New flows from algorithmic traders may be coming to exchange operator OTC Markets Group, thanks to a deal where market data provider Redline Trading Solutions Inc. will stream the exchanges real-time prices to its clients, including level 1 and level 2 quotes, as well as reference data for securities traded on the OTCQX, OTCQB and Pink markets under OTC Markets' Alternative Trading Systems (ATSs).

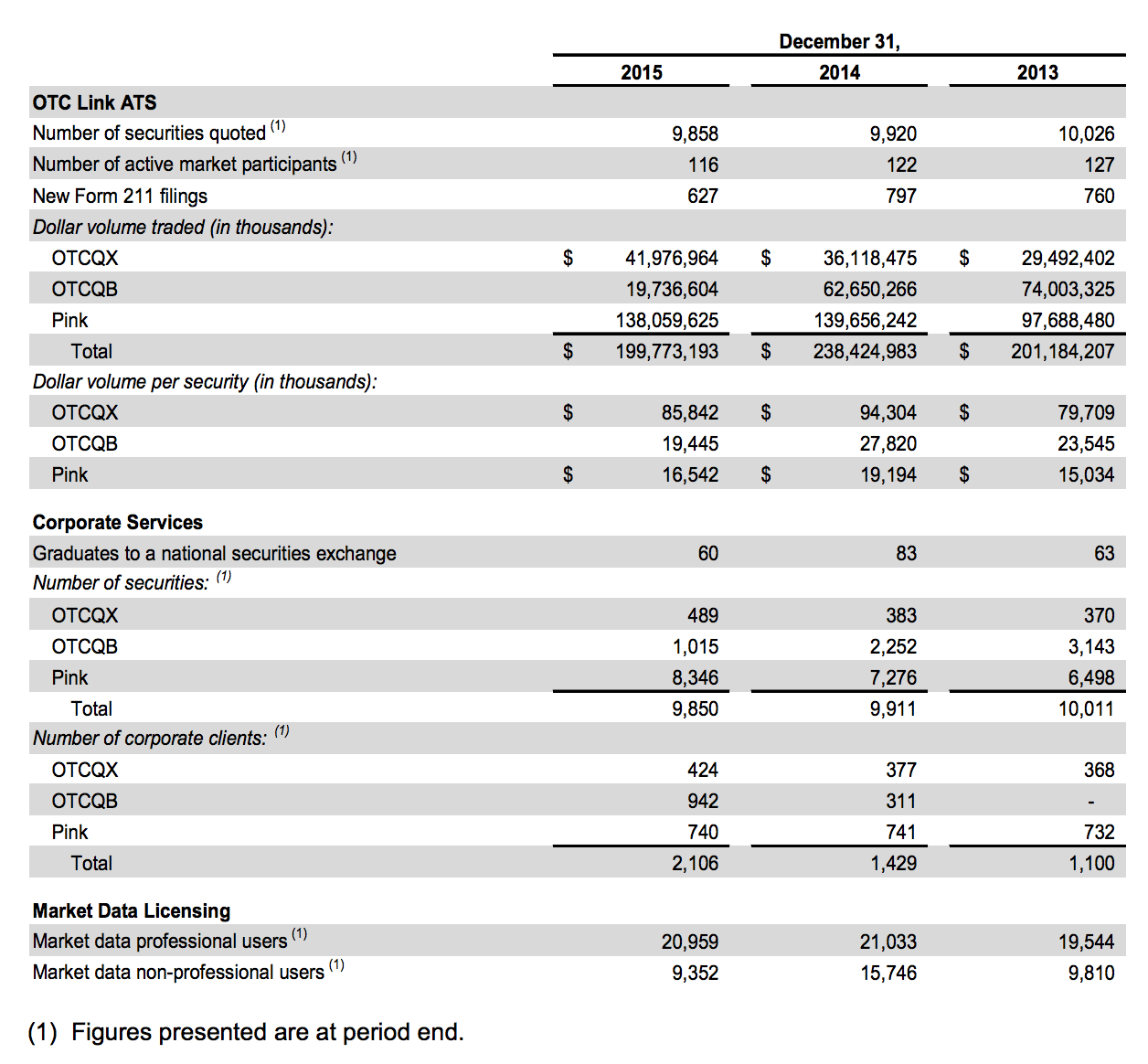

OTC Markets Group's FINRA regulated subsidiary OTC Link LLC operates the OTC Link ATS covering the three venues, with combined volumes of over $199 billion across nearly 10,000 securities, according to data in the company's annual report. Redline provides order Execution systems for automated trading, and high-performance market data, and the new data integration with OTC Markets provides data across the symbols from its three venues including OTCQX, OTCQB and Pink securities that will be streamed to Redline's clients.

The data from the three venues could enable an influx of volumes from algorithmic traders, thus helping to add Liquidity 'takers' and/or 'givers' as well as provide Redline's clients with additional venue trading capability, or potentially faster price-discovery to clients already accessing the venues' data through other methods.

Redline CEO Mark Skalabrin added in the announcement: “Adding support for OTC Markets in our InRush Ticker Plant enables our customers to easily access OTC Markets Group’s data within the Redline application programming environment,” and concluded, “our customers using this interface to trade OTCQX, OTCQB and Pink securities today are seeing immediate benefits in faster price discovery.”

The Search for Flows

The bulk of volumes and securities are on the OTC Pink market at nearly $138 billion in volumes across 8363 symbols, followed by its OTC QX market with nearly $41 billion across 452 securities, and the rest on its OTC QB representing just over 1000 securities and almost $19 billion in volume. The OTC QB venue is referred to as its venture market and also open to international firms to become listed based on an exemption under rule 12g3-2(b) under the exchange act. The company had just filed its 2015 annual report earlier this month, showing both higher revenue (nearly $50 million) and income when compared to its 2014 year ending December 31st.

Commenting in the press release regarding the Redline deal, OTC Markets Group Executive VP of Market Data and Strategy said: "We are pleased to be added to Redline’s list of supported markets, which will help deliver timely, reliable data on OTCQX, OTCQB and Pink securities to buy- and sell-side investors.” Key financial metrics can be seen below from OTC Markets 2015 annual report, showing its three most recent reported years.

Source: OTC Markets Annual Report