The Singapore Exchange (SGX) has just reported its monthly statistics and volumes measures across its derivatives and commodities business for the month ending April 2016, which took a step back, paring the majority of its gains seen in March, according to an SGX statement.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

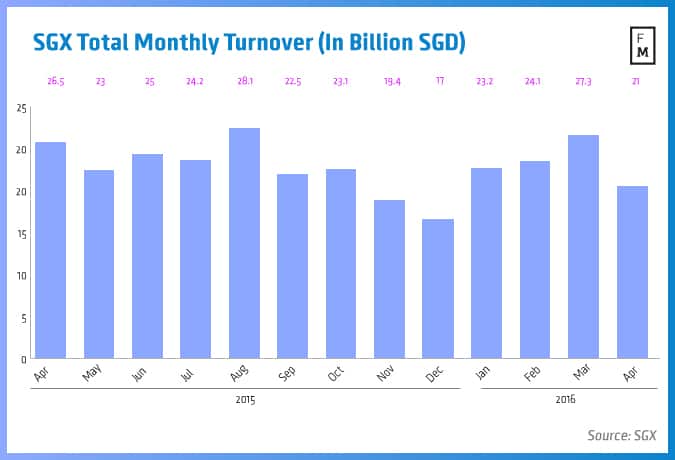

Looking at the SGX’s latest turnover figures, the securities volumes during April 2016 came in at $15.4 billion (S$21.0 billion), down -23.1% MoM from $20.0 billion (S$27.3 billion) in March 2016 – this weakness was also extended over a yearly timeframe, with April 2016’s figures justifying a fall of -21.0% YoY from April 2015.

Moreover, the SGX’s daily average value of trading in the month of April 2016, comprised of a total of 21 trading days, yielded $730 million (S$1.0 billion), falling by a margin of -16.7% MoM from $880 million (S$1.2 billion) in March 2016 – by extension, average daily values of trading were also lower by a full -21.0% YoY since April 2015.

One slight improvement was recorded across the SGX’s total market capitalization, which during April 2016 climbed to $657.0 billion (S$897.4 billion), inching higher by less than 1.0% MoM from $654.3 billion (S$894.3 billion) in March 2016. This figure took into account the total market cap for all 768 listed companies on the SGX.

Derivatives and FX Fall by Double Digits

SGX’s derivatives business followed the same path in April 2016, failing to build on last month’s momentum. April 2016’s volumes took a tumble to 14.9 million contracts traded, vs. 17.1 million contracts in March 2016, or -12.9% MoM. The narrative was similar across a yearly interval, with the latest tranche of volumes coming up short by -8.0% from April 2015.

Moving to equity index futures, this area of volumes at the SGX was also lower than the month prior, falling to 12.0 million contracts in April 2016, good for a decline of -12.4% MoM from 13.7 million contracts in March 2016, as well as a fall of -18.0% YoY from April 2015.

Finally, April continued to see high volumes of FTSE China A50 futures, which during the month notched a total volume of 6.1 million, down -17.6% MoM from 7.4 million in March 2016. The SGX’s total foreign exchange (FX) futures volume was 378,640, constituting a pullback of -20.5% MoM from 476,068 in March 2016.