Switzerland’s main investment bourse, the SIX Swiss Exchange, a user-owned company group backed by around 140 banks, published today its first quarter 2016 trading results. The company has reported an exchange-trading-fund (ETF) trading turnover of CHF 25.3 billion (USD 25.9 billion), equating to an increase of CHF 5.6 billion (USD 5.7 billion) compared with the previous quarter. Finance Magnates previously reported its February 2016 trading metrics in March.

There were 256,378 ETF transactions carried out on SIX Swiss Exchange in the first quarter averaging CHF 98,603 (USD 101,118), corresponding to a slight increase quarter-on-quarter. The number of transactions below CHF 10,000 (USD 10,255) increased by over 3,200 to 113,236, indicating a growing interest for ETFs among private investors.

Most Traded Products

In the first quarter, the iShares SMI were once again the most-traded ETF with CHF 1,387.9 million (USD 1,423 million) in turnover. The UBS ETF MSCI EMU hdg to USD was in second place in the previous quarter with trading turnover of CHF 782.2 million (USD 802 million). iSHARES S&P 500 UCITS, which recorded the highest trading turnover in the previous quarter, ranked third at CHF 711.5 million (USD 729.4 million).

Nine out of 20 track European equities are supplemented by, among others, PowerShares EQQQ Nasdaq 100 UCITS ETF, a replication of the NASDAQ 100 Index, which ranks 13th and has a turnover of CHF 363.8 million (USD 372.9 million).

Two ZKB Gold ETFs in CHF and USD are also among the top 20, with turnover of CHF 312.0 million (USD 320 million) and CHF 316.1 million (USD 324 million) respectively.

High Market Volatility

High volatility continued on the markets in the first quarter due to increased nervousness and fluctuations, especially in terms of commodities prices which have in some cases seen a dramatic fall. In addition, a weakening economy in several emerging countries and increased political challenges in the Middle East have caused many investors to turn more to investments in precious metals. This was reflected in increased trading turnover for both ZKB Gold ETFs in CHF and USD, which closed the first quarter with a turnover increase of 12.5% and 16.1% respectively.

Increase in Listed ETFs

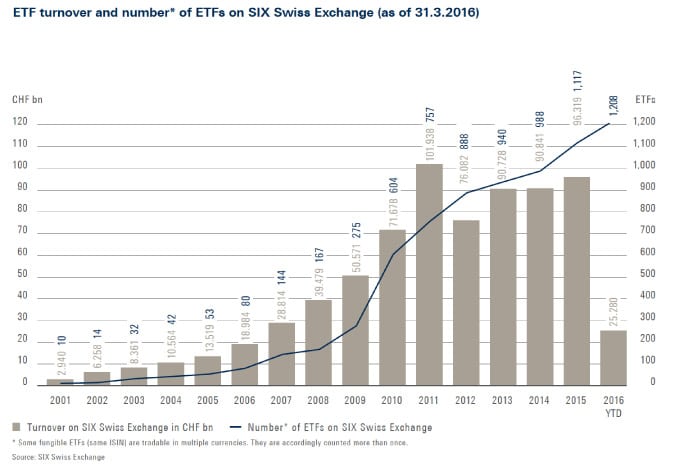

During the first quarter of 2016, a total of 93 new ETFs were listed on SIX Swiss Exchange, encompassing 1,208 products which included 16 actively managed ETFs.

The products are listed on the stock exchange by 21 providers, with Liquidity provided by 23 official market makers. In March, the Swiss Exchange welcomed new ETF issuer, Nomura NEXT FUNDS Ireland plc. The asset manager from Japan has four proprietary ETFs listed in various currencies on the Nikkei 225 and JPX Nikkei 400 and is also responsible for market making for the products. The four tradeable ETFs offer investors the opportunity to invest in the Japanese equity market with a currency hedge.