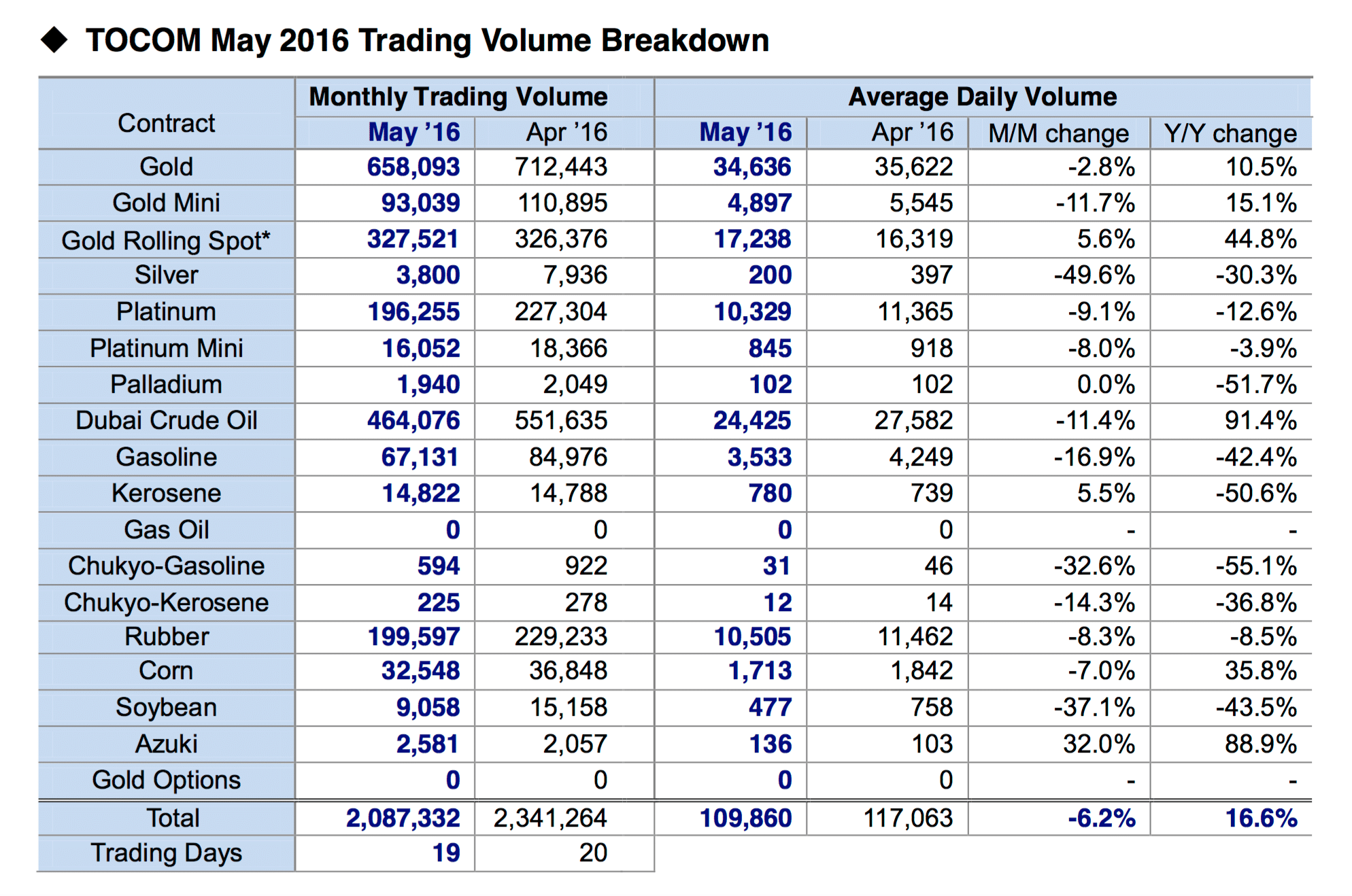

The Tokyo Commodity Exchange (TOCOM) today reported its May 2016 trading volumes with the average daily volume (ADV) reaching 109,860 contracts across the venue's products and lower by 6.2% compared to 117,063 reported in April.

May ADV was higher by 16.6% compared Year-over-Year (YoY) to May 2015, and the 6.2% decline was also reflected in overall volumes which totaled 2,087,332 in May, lower from 2,341,264 in April.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Gold volumes inch lower

Standard gold contracts, the exchange’s most traded product, saw its ADV decline by 2.8% to 34,636 contracts on a month-over-month (MoM) basis, followed by gold mini contracts falling 11.7% over the same period and totaling 4,897 contracts for May. Compared YoY, gold standard and mini contracts were higher by 10.5% and 15.1% respectively.

The gold standard contracts totaled 658,093 contracts overall in May, and the gold mini had 93,039 contracts traded during the month. Gold rolling spot contracts managed to accumulated higher volumes for the month, up to 327,521 in May, higher by 5.6% MoM, and up 44.8% YoY.

Crude oil volumes dip

TOCOM's next largest traded contract, the Dubai crude oil contract, had its May volumes lowered by 11.4% to 24,425 from 27,582 reported in April, yet was higher by a whopping 91.4% YoY. Within related energy contract, gasoline contracts also declined MoM to 67,131 contracts and lower by 16.9% from April.

In addition, rubber contracts dipped by 8.3% to 10,505 in May, both on a MoM basis and by nearly the same degree YoY. The remaining metals, energy and commodity instruments can be seen in the table below comparing volumes to the prior month and YoY.

Note: The below table was updated by TOCOM shortly after publication and has since been updated here below to reflect the values in the total row under the two monthly trading volumes columns and related number of trading days for May and April.

Source: TOCOM