Tradition recently announced a new venture called traFXpure, an open access Trading Platform for participants that have access to CLS settlement. Its aim is to facilitate a fair market environment, driving price discovery and Liquidity while leveling the technological playing ground. We had a chance to catch up with Daniel Marcus, Managing Director, Strategy and Business Development, at Tradition.

Daniel Marcus, Managing Director, Strategy and Business Development, at Tradition

traFXpure - what does the name mean?

The FX Pure group of banks who had been working on the market design and protocol for over a year came to Tradition back in March and asked us to prove our capability to deliver a market in line with their requirements. By May they were convinced of our capabilities and hence we announced. The name is simply Tradition – Tra… combing with the FXPure name. It’s pronounced trafexpure.

Please tell us a bit about the platform.

The key features are transparency, symmetric disclosure; innovative trading logic designed to increase liquidity; and greatly reduced market data costs by providing the same data for all at the same time. Additionally we will reduce IT costs by providing industry standard connectivity (API) – we’re very mindful of the industry’s IT cost constraints and want to keep these to a minimum. An important aim of the platform is to keep peripheral trading costs down by democratically concentrating these costs into the transaction. It is designed to take out the technological advantage and give a level playing field for all participants. It’s a complementary offering to what there is already in the FX market and will also provide valuable regulatory transparency.

As mentioned earlier Tradition was approached by a group of banks who wanted a new technological offering and additional liquidity and we agreed in May to start developing this platform. A number of banks have already signed up with several more agreeing to support. We look forward to launching by the end of the year.

What currencies do you offer? Do you offer Yuan, Ruble and Rupee?

We offer trading in all CLS eligible currencies with all trades settled in CLS. On CLS there are 17 currencies in total. At this point, Ruble, Rupee and Yuan are not offered.

Who can join your platform?

Any participant that has access to CLS settlement is welcomed to join our network. CLS has 61 direct and more than 15,000 third party members including banks, brokers, high-frequency funds, corporates and others.

How will you deal with small orders (IDB's usually trade larger tickets)?

Minimum order size will be set at a level consistent with the needs of the platform participants and general wholesale market considerations. We are also working with the market to establish the appropriate order types that are consistent with the principles of a fair market.

How do you deal with toxic flow?

The system is designed to promote positive trading behaviour. In no way shape or form do all HFTs trade in a toxic manner and as previously mentioned the platform is open to all CLS participants and HFTs are welcome to join. The qualification is simply that their behavior on the platform will be restricted by the market protocol that is designed to ensure fair play.

You mentioned that you will go live by the end of this year - if so, are you still developing/testing the platform?

Yes. As stated the banks originally approached us in March and we have been designing the platform since May, although as you can imagine we have done a fair amount of work. We are building and testing this platform now for readiness by the end of the year. A key requirement was for a flexible trading product that will continue to be relevant and consistent as the FX market evolves.

CME tried to set up a fx executing venue backed by banks a while back but failed, what makes you different?

I can’t comment on the CME venture, but the key points of traFXpure is that market demand wants a platform that operates like this. At Tradition we respond to market desires – the market has witnessed this from the success of our interest rate swap offering Trad-X – and we have done the same here. We have significant interest from much of the market to both provide liquidity and trade on this platform and we believe liquidity begets liquidity and results in trades. Our initiative has many factors that we believe are compelling in the search for true firm liquidity.

- Transparency – symmetric disclosure fair for all

- Pro– competitive and complimentary

- Innovative trading logic designed to suit those with intention to trade – firming liquidity

- Significant reduction in market data costs – lowers barriers to entry for all

- Significant reduction in IT costs –

- industry standard API;

- single matching engine hosted in existing data centre

- Democratic concentration of trading costs into actual transaction – minimal peripheral costs

- Regulatory transparency – positive feedback from Fed, BOE and SNB

- Equal trading fees for all

- Flexible platform to evolve with the market – consistent efficiency

- A proactive relevant initiative that will invigorate market - NOT reactive

- Significantly more efficient broker/vendor model – TraFXpure revenue derived from transaction fees.

Do Dodd-Frank rules have any effect on traFXpure and the way it operates?

No, but we are providing a feed to the regulators so they have a complete insight in to the activity on the market, such as order/ fill ratios.

When talking about a spot FX trading platform used by banks EBS obviously comes to mind - How does traFXpure compete/compare with EBS? Is it mainly on the new technological features and on being a level field for everybody removing any advantages?

The FX market is a vast global, yet fragmented market and having diversity of trading models and competition in this market is a good thing. We have seen this with the proliferation of multiple FX trading platforms over the years not just EBS and Reuters. The market has requested a platform that facilitates open and fair trading and traFXpure is our response.

Are you going to enter retail forex market directly at all or do you prefer to approach this market indirectly through investments in the likes of Gaitame and FXDD?

Correct – traFXpure is a wholesale initiative.

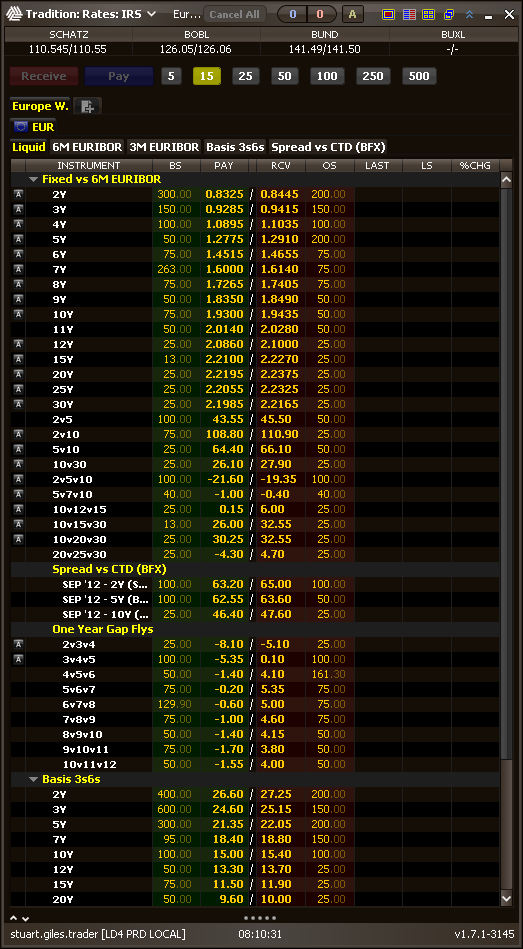

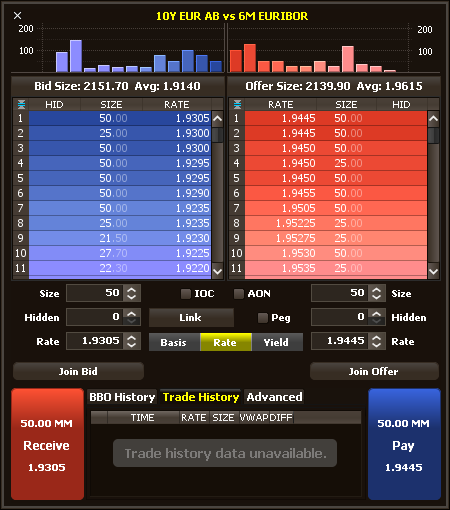

Trad-X interest rate swaps platform is operated by Tradition and the underlying technology is being used and adapted for traFXpure. The screenshots are of Trad-X.