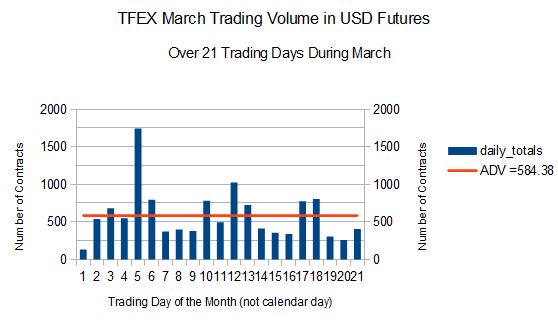

According to data released by the Thailand Futures Exchange (TFEX), part of the Stock Exchange of Thailand (SET) group, for the month of March, Average Daily Volume (ADV) of USD futures trading totaled 584 contracts, up 63 from 521 in February, reflecting an increase of 12% month-over-month, and back near the ADV of 582 contracts the exchange reported in January as covered by Forex Magnates.

Total USD Futures volume for March was 12,727 contracts over 21 trading days, as can be seen in the table below, which averaged to 584.38 contracts during the month. The contract is priced against the Thai Boht, and calculated from the exchange rate announced by Thomson Reuters at 11:00 hrs (BKK time) on the last trading day, according to the exchange's contract specification for the USD Futures product.

Each contract is for $1,000, therefore the total volume barely amounts to $12,272,000 worth of currency. However, open interest during march accounted for 132,378 contracts on TFEX, which represent a less meager nominal value of over $132M.

TFEX USD Futures Daily Totals, and Average Over 21 trading days in March 2014

As part of the update, dated April 9th 2014, TFEX reported totals for Q1 of this year, which showed that average daily trading volume was at 56,415 contracts per day, and similar to the last quarter of 2013, mainly driven up by stock futures as the product was used to help boost returns when the market was increasing, as well as to manage risk amid domestic political uncertainties.

Super-Margin To be Imposed for Long National Holiday Period

![USD Futures at the Thailand Futures Exchange [Source TFEX]](https://www.financemagnates.com/wp-content/uploads/fxmag/2014/04/usd-futures-300x95.jpg)

USD Futures at the Thailand Futures Exchange [Source TFEX]

Given the upcoming long national holidays this month, Thailand Clearing House Co. Ltd., (TCH) will temporarily impose additional margins, described as"Super Margin," for 50 Baht gold futures, 10 Baht gold futures, oil, silver, and USD futures ahead of the Songkarn holidays, effective on April 10.

These increased margin requirements, are designed to help investors buffer the risks from price volatility that may occur when TFEX closed for a holiday during April 12-15, while the global financial markets remain open. However, the margins will be back to normal on April 16, according to the official press release.

![Kesara Manchusree, Executive Vice President, Head of Markets Division, The Stock Exchange of Thailand [Source: SET]](https://www.financemagnates.com/wp-content/uploads/fxmag/2014/04/KM.jpg)

Kesara Manchusree, Executive Vice President, Head of Markets Division, SET

TFEX Managing Director Kesara Manchusree said in the announcement regarding the Q1 results, “trading volume in the January-March period remained strong with a total of 3,497,752 contracts, or 56,415 contracts per day, close to the fourth quarter of 2013. The average trading value was THB 18.93 billion baht per day. Most of the volume came from single stock futures with an average daily trading volume of 30,744 contracts, or 54 percent of the total volume. It has been popular among investors especially during the uptrend market as this instrument helps boost returns and at the same time be used for Risk Management during times of domestic political uncertainties.”

While the SET50 futures's average daily trading volume was up 3.73 percent from the previous quarter, at 18,630 contracts, gold futures were down 1.34 percent at 6,139, when compared to Q4 2013. On March 28, TFEX made its one-day highest trading volume at 174,804 contracts, reflecting ample demand of Thai stocks. Most derivatives trading investors were retail investors, accounting for 54.9 percent, while institutional investors represented 37.3 percent and foreign investors 7.8 percent.

A chart below from Bloomberg shows the price history of the USD/THB over the last year, which has steadily depreciated yet lacked a high degree of volatility. This could make it more prone to longer-term trades as the lack of major price movements could be less appealing to short-term speculators.

![Trailing 12 month Price History of US Dollar Against the Thai Boht (USD/THB) [Source: Bloomberg]](https://www.financemagnates.com/wp-content/uploads/fxmag/2014/04/USDTHB.jpg)

Trailing 12 month Price History of US Dollar Against the Thai Boht (USD/THB) [Source: Bloomberg]

New Developments Coming as the Exchange Focuses on Investor Education

TFEX continues to arrange workshops and add more training for investors with a TV program called "TFEX station," available on SET's Money Channel under the concept "Easy-Happy-Study." A more intensive training program continuing from last year called TFEX Challenge Academy will also be held throughout the year, as per the update. In addition, TFEX Open House, a joint program between TFEX and many leading brokers aiming at educating investors of all levels will also continue to take place during the year.

![TFEX March 2014 Trading Volumes [Source TFEX]](https://www.financemagnates.com/wp-content/uploads/fxmag/2014/04/TFEX-March.jpg)

TFEX March 2014 Trading Volumes [Source TFEX]

The exchange also appears to be accommodating to retail traders with the upcoming change of the contract size for its SET50 futures contract which is scheduled to be revised on May 6th and be named "Mini SET50 futures." This change of the contract size for the lot amount, reduces the existing SET50 futures to be one-fifth and all open positions prior to the launch date will be automatically increased by five times to compensate for the change (for open trades during that time). Margins and exchange fees will also be reduced proportionally to one-fifth as well, per each new contract (which will then be 1/5th smaller compared to the current specification).

With regards to the first quarter that just concluded, Forex Magnates has today released its highly anticipated Quarterly Industry Report (QIR) for Q1 2014, containing extensive research into Foreign Exchange developments during that period and of relevance to participants, and which is now available for purchase on ForexMagnates.com.