After the completion of the acceptance process of its new Universal Trading Platform, (UTP) in February this year, the Warsaw Stock Exchange completed its first trading session on the platform on April 15.

Entirely on schedule, the NYSE Technologies platform went into service successfully, with trading having proceeded correctly according to the new session schedule and the session opening and closing was uninterrupted. The session started on 15 April 2013 at 9:00 for the cash market and at 8:45 for the derivatives market, and closed at 17:05 on both markets.

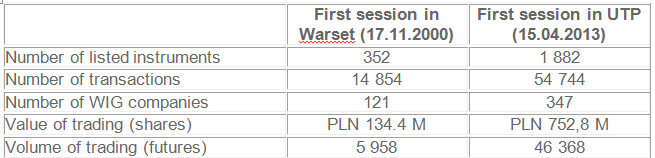

During the first session, the total value of trading in shares was PLN 752.8 million and investors made 54,744 transactions in total.

“The first session without interruptions proves that more than two years of joint efforts of the Exchange, brokerage houses and all other institutions present on the Polish capital market have brought very good results. Now we have to retain high efficiency of the system and focus our efforts on its business opportunities. I wish to thank everyone involved in the project, both at the Exchange and among the market participants,” said Adam Maciejewski, President and CEO of the Warsaw Stock Exchange.

“I would like to congratulate WSE on their first day of trading on NYSE Euronext’s UTP. Their effort and cooperation in working with the NYSE Technologies team was crucial to yesterday’s success in delivering a platform that supports the domestic and international strategy of WSE,” said Dominique Cerutti, President and Deputy CEO of NYSE Euronext.

“Having made a significant investment in the UTP and the Secure Financial Transactions Infrastructure (SFTI®), WSE will benefit from our leading Trading Platform and global network that meets the complex demands of today’s and tomorrow’s markets. Following our successful technology collaborations, we look forward to exploring future opportunities premised on our exchange partnership to further benefit the capital markets community.”

At the end of the session, 1,882 instruments were listed on the WSE and WIG covered 347 companies. Total value of trading on the first day’s session was PLN 752.8 million.

The new system UTP has replaced Warset which was in operation on the Warsaw Stock Exchange since 17 November 2000. At the end of the first session using the previous trading system, the WSE listed 352 financial instruments and WIG covered 121 companies. Total value of trading was PLN 134.4 million.

The implementation of the new trading system engaged over 100 partners including the WSE, 58 brokerage houses – Exchange Members, the Polish Financial Supervision Authority (KNF), the Central Securities Depository of Poland (KDPW), KDPW_CCP, BondSpot and several dozen exchange data vendors.