April was one of the worst months for the U.S. dollar across the board. With the euro, the Japanese yen, the British pound, the Canadian dollar and the antipodean currencies (Australian and New Zealand dollars), all rallying, Volatility on the markets has been stable when compared to previous months.

Looking at volume metrics reports that have been published by major ECNs however, we are hardly seeing volumes rebounding from a seasonally weak March (Easter Holidays). April was as benign as March (probably a touch more disappointing) despite the U.S. dollar’s weakness and the Japanese yen’s strength across the board.

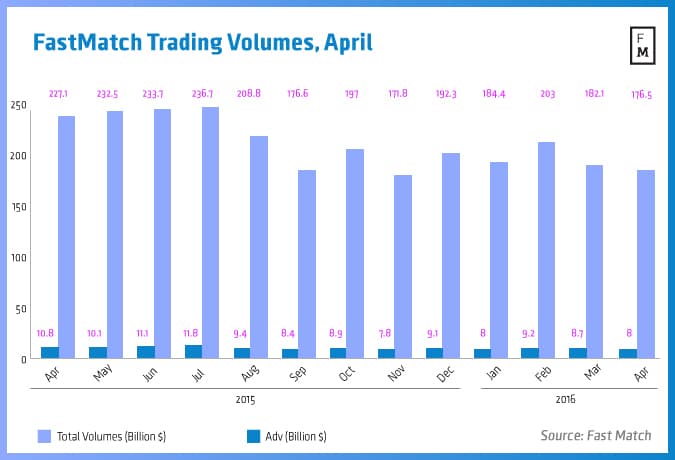

Fastmatch

One of the ECNs that has been gaining impressively in recent months, Fastmatch, has reported a positive month in April in terms of ADV. The venue partially owned by FXCM has announced that ADV increased by 7 per cent when compared to March and by a massive 35 per cent when compared to last year, marking $10.8 billion per day.

Looking at the total numbers the trend is not materially different from the other ECNs in the industry, with the nominal trading volumes figure standing at $227.1 billion. This number is higher by 28.6 per cent when compared to the previous year but lower by 2.3 per cent when compared to the month of March.

Fastmatch is the only venue that reported a nominal year-on-year increase, albeit from a low base, Data source: Fastmatch

Fastmatch has impressively rebounded from last year’s decline caused by the Swiss National Bank crisis that affected a number of the foreign Exchange industry’s market players. At the time one of the company’s parents FXCM had to negotiate a bailout from Leucadia National - a move that greatly affected trading volumes at Fastmatch.

A year later the firm looks to have completely recovered and has recently introduced some substantial changes to its offering reflecting the long term plans of the company to expand its market share amongst major ECNs.

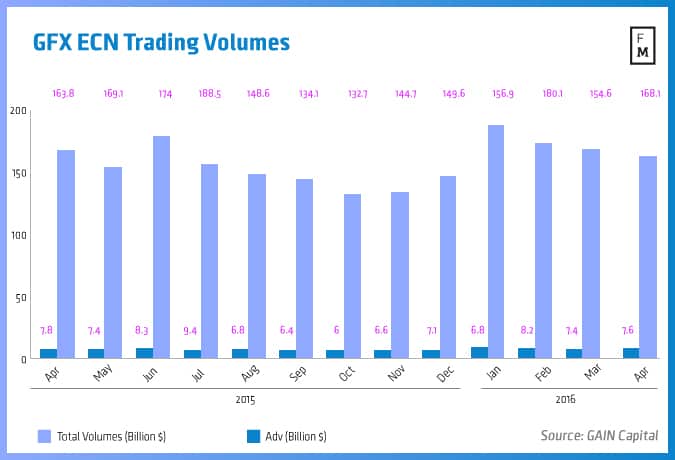

GAIN Capital GTX

The volumes transacted across GAIN Capital’s GTX ECN have increased substantially in the first quarter of 2016 when compared to the final one of 2015. The move is mainly due to increased volatility across foreign exchange markets. Looking at the first month of the second quarter the figures are rather consistent.

Trading volumes at GTX have been solid throughout Q1 and remained close in April, Data source: GAIN Capital

The average daily volumes at the ECN ticked higher by 5.4 per cent month-on-month and by 2.6 per cent year-on-year to $7.8 billion. Looking at the nominal number for April, GAIN Capital’s GTX ECN trading volumes decreased when compared to a year ago and to March with a total of $163.8 billion, which is lower by 3.1 per cent month-on-month and by 2.5 per cent year-on-year.

After the inclusion of the broker’s swap dealer facility, which is an agency voice service that executes trades in all FX products however, the ADV for GTX increased by 8.8 per cent when compared to last month and was higher year-on-year by 1.8 per cent at $11.1 billion daily.

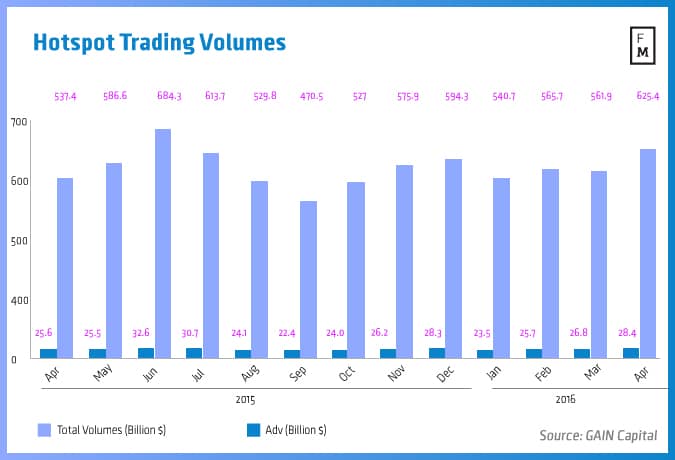

Hotspot

The electronic foreign exchange trading venue of BATS Global Markets, Hotspot, has had a similar month. Monthly ADV figures have notched a tiny increase by $100 million to total $25.6 million per day in April. Looking at a year-on-year comparison however the venue lost some market - the decline year on year amounted to 9.8 per cent.

Trading volumes at Hotspot remained at levels consistent with Q1, however declined somewhat year-on-year, Data source: Hotspot

The total amount of trading volumes transacted through Hotspot’s ECN in April totaled $537.4 billion, a figure that is lower by 8.3 per cent when compared to last month and by 14 per cent when compared to the same month last year.

BATS Global Markets’ ECN has registered a substantial rebound in the first quarter of 2016 when compared to the final quarter of 2015 in a similar way to the whole industry.