Leading global Exchange operator, Bats Global Markets, Inc., listed on its Bats exchange under ticker symbol BATS, and which provides services for financial markets, today reported its June 2016 trading statistics showing improvements across many key segments compared to May.

The company highlighted a number of improvements across its global businesses including its U.S. Options market share among other areas recorded in June and compared to prior periods.

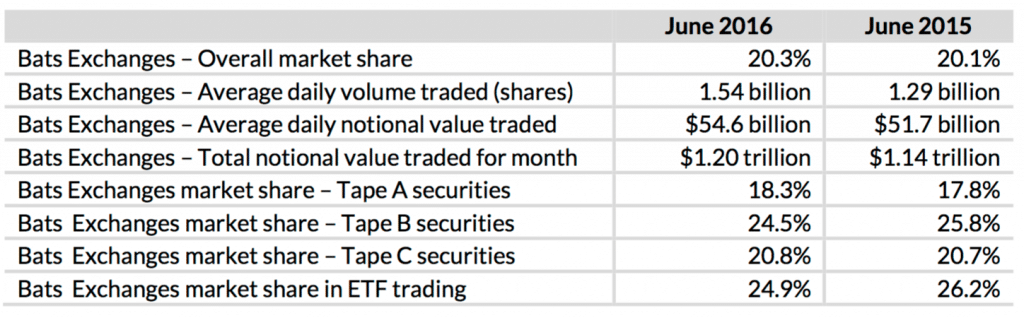

Bats reported its average daily volume of shares traded across all exchanges grew to 1.54 billion in June, up by 100 million shares or nearly 7% from the 1.44 billion reported in May. From these totals, $54.6 billion worth of securities were traded per day and added up to $1.2 trillion worth of notional value recorded for the whole month of June.

Share of options' volumes climbing

The share of U.S. Options that Bats attributed to its volumes grew to 11.7% in June, up from 9.7% YoY, and the company said that its market share for single-leg equity options trades reached 19% - indicating that it had achieved a new record.

Nearly a third of all new ETF listings are choosing Bats, as the company said it won 29% of all listing for ETFs in the U.S., and as it retained its market share lead of ETF trading volumes by executing 24.9% of all June volume.

At the end of June, Finance Magnates reported that the Winklevoss twins had changed their desired venue for listing their Bitcoin trust away from Nasdaq to Bats BZX Exchange, Inc. (BATS) under the ticker symbol COIN.

Market share in U.S. and Europe

Bats noted in its June report that it maintained its position as the second-largest U.S. equities markets’ operator with just over a 1/5 market share at 20.3%, and in Europe Bats continued to hold first place as the largest European Stock Exchange commanding 22.9% market share and as the largest trade reporting facility with €428.8 billion reported in June to BXTR.

An excerpt from the company's June 2016 report compares totals on a year-over-year basis with June 2015:

BATS June 2016 Data

New products and FX developments

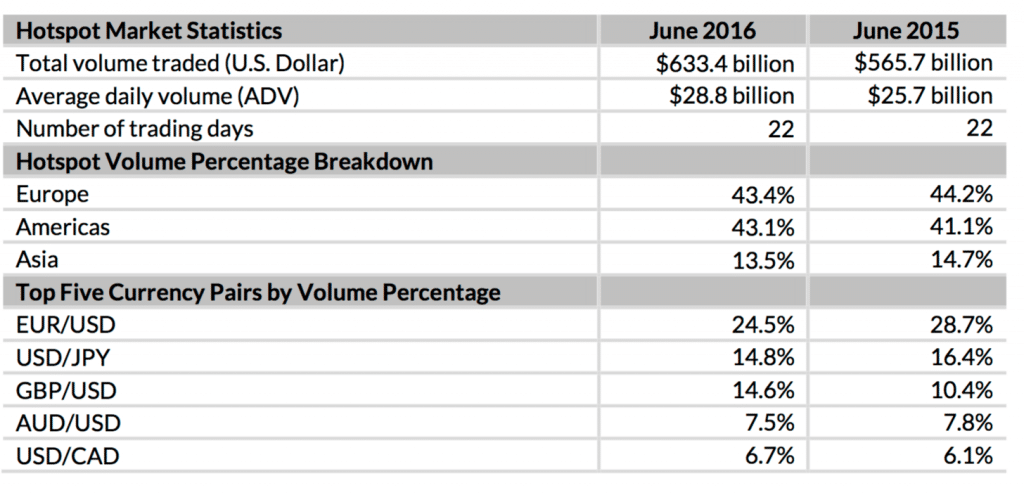

Finance Magnates reported in June when Bats unveiled a series of new benchmark indexes as the company further aimed to compete with other venues and build its market share further, after announcing plans to add FX forwards to its suite of foreign exchange products. In addition, the company provided volumes data showing a surge in trading after Brexit on June 24th, including in its FX venue.

Bats also noted in the update for June that its institutional spot foreign exchange market, Hotspot, had recorded average daily volume of $28.8 billion during the month.

BATS June 2016