BestX Ltd. has strengthened its core product suite with the launch of its Pre-Trade execution analysis functionality. The new development strengthens the group’s end-to-end offering, supporting improved pre-trade analysis and netting capabilities, among other benefits.

The London Summit 2017 is coming, get involved!

The rollout comes less than eight months after the launch of its post-trade analysis solution. Founded in March 2016, the trading technology provider focuses on execution management with its products. The group caters to clients via comprehensive Analytics solutions to help them navigate an increasingly complex and challenging environment, especially with regard to the execution process.

The trading community faces no shortage of challenges, ranging from fragmented Liquidity and high variance across execution products to shifting regulations. Amidst these challenges, BestX has opted to streamline trading costs prior to execution – the focus is one of the twin pillars of its product suite, together with its post-trade functionality.

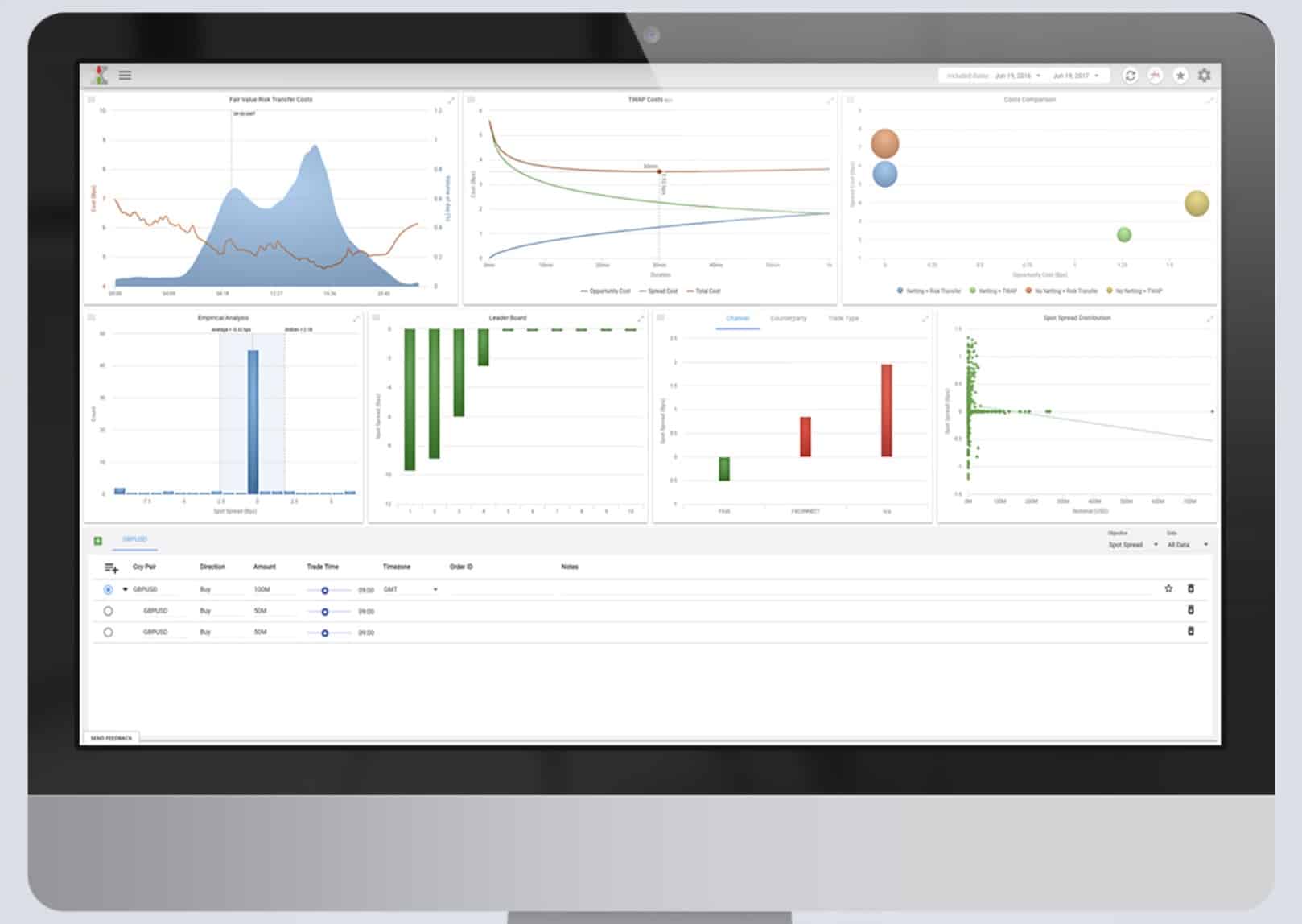

Pre-Trade software interface

BestX

The Pre-Trade software package provides a multitude of tools for clients, none more important than cost-analysis prior to execution. This permits the use of what-if analysis, optimizing a trade in terms of timing, size, and its ultimate method of execution. Moreover, a more robust netting analysis framework for currency pairs is supported under the new product, enabling quantifiable opportunity cost analysis vs. spread costs across multiple trading periods.

Pete Eggleston

Furthermore, the Pre-Trade interface lets clients tap into previous transactions, providing a summary of attributes and the empirical performance of similar transactions, all linked with BestX’s Post-Trade application. Subsequently, all pre-trade analysis conducted can be saved for future use, as well as exported as a report in full compliance with upcoming regulations, including MiFID II.

Pete Eggleston, co-founder of BestX, commented exclusively to Finance Magnates: "We are very excited with the launch of our pre-trade module, which is another key component of our suite of execution analytics. Linking the pre and post-trade components together provides users with the ability to manage the execution lifecycle of the trade, a core element of delivering best execution."