The Bank for International Settlements (BIS), the Switzerland-based organization that has over 90 of the world’s central banks as its members, today released a new report with global OTC derivatives statistics through the end of December 2015, and showed a broad-based decline in market activity during the second half (H2) of last year.

During H2 last year, the notional amount of outstanding contracts in the global derivatives markets fell by 11% by the end of the year, from $552 trillion in the prior half to $493 trillion for the last six months of 2015, according to the BIS press release.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Trade compression decreased totals

A key driver of the trend was attributed to trade compression, which was employed to eliminate redundant contracts, as per the BIS update, and the fall in notional values was paralleled by a sharp drop in the gross market value of outstanding derivatives contracts, which BIS described as having helped to provide a better measure of the overall amounts at risk.

More specifically, the gross market values decreased by 6% through H2 2015, from $15.5 trillion to $14.5 trillion, reaching their lowest level since 2007, with the bulk of the decline concentrated in interest rate Swaps .

Central clearing still key focus

In addition, central clearing continued to make progress and remains high on the list of global regulators' agenda with regard to reforms that are aimed at reducing systemic risks in the OTC derivatives markets, also cited in the BIS update.

During H2 last year, the percentage of credit default swaps booked with central counterparties rose to 34% by the end of the period, up from 31% reached during the end of the first half (H1) in 2015.

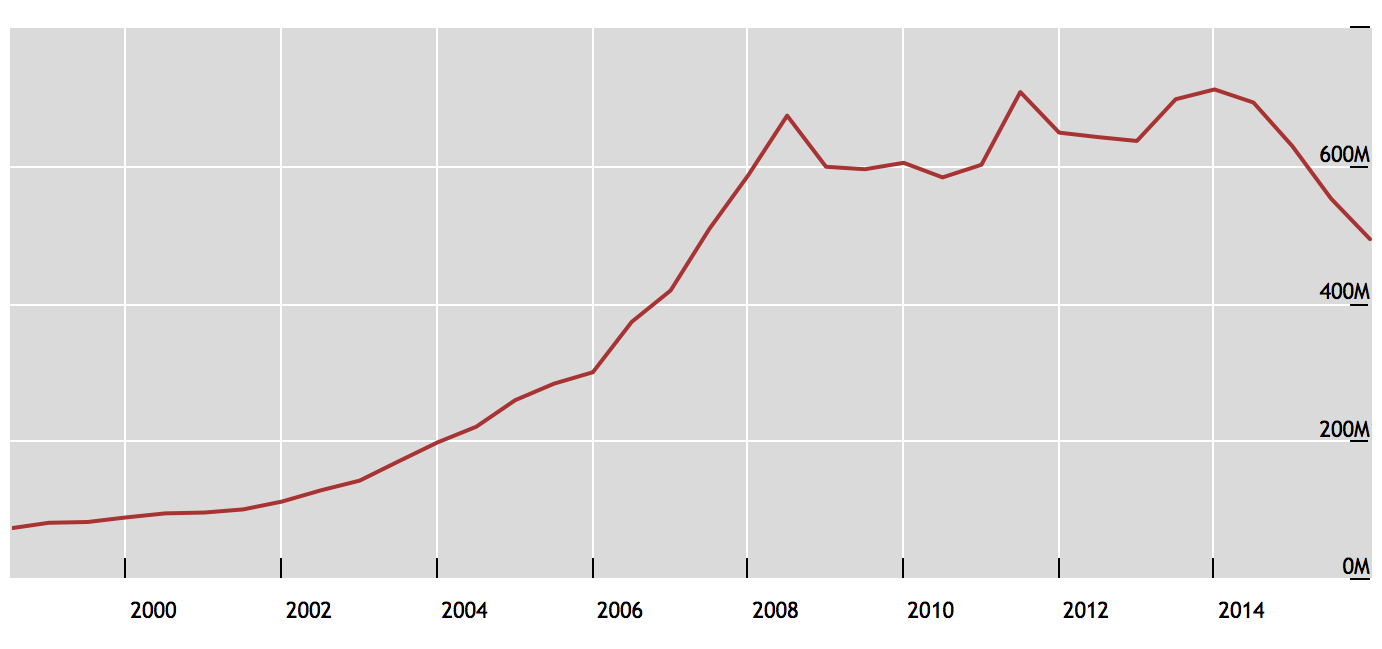

BIS included the 2015 H2 data in its statistics explorer and a screen shot of that data - including over the last nearly twenty years worth of data - can be seen in the following excerpt showing the pullback in volumes in recent years from its December 2013 high, as trades continue to become compressed including in interest rate swaps.

Triennial FX survey

BIS just completed its Triennial survey for the foreign exchange market last month, which will be published later this year as the organization has to prepare the multitude of data gathered from reporting banks, including trillions of dollars worth of average daily trading volumes during the month. That report will be widely referenced - as have prior triennial reports - and will be hotly awaited by market participants following the last release from 2013 that Finance Magnates wrote about.

Source: BIS Explorer