Broadridge Financial Solutions, Inc. (NYSE:BR), a provider of investor communications and technology solutions, has reported its mutual fund performance versus Exchange -traded-fund (ETF) data for Q2 2015, according to a Broadridge statement.

Broadridge Financial utilizes a Fund Distribution Intelligence (FDI) tool - the utility helps aggregate a variety of information into a unified sales and asset data collection, tracking performance of both mutual funds and ETF assets. The FDI tool collects data on a monthly basis, which is then analyzed by respective channel, geography, etc.

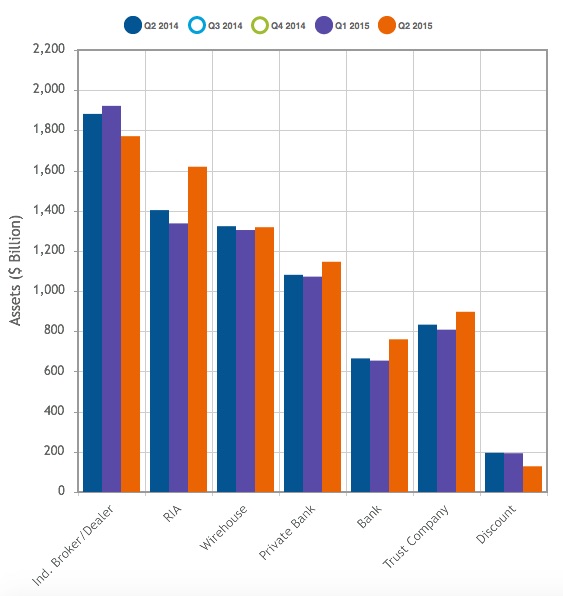

Highlighting the quarterly figures were a standout performance across Broadridge’s retail channels, which continued to fuel (ETF) growth through Q2 2015. In particular, ETFs helped increase assets (in absolute US dollars) by $265 billion YoY since Q2 2014, vastly outpacing the $200 billion in long-term mutual fund (LTMF) assets distributed by other retail channels.

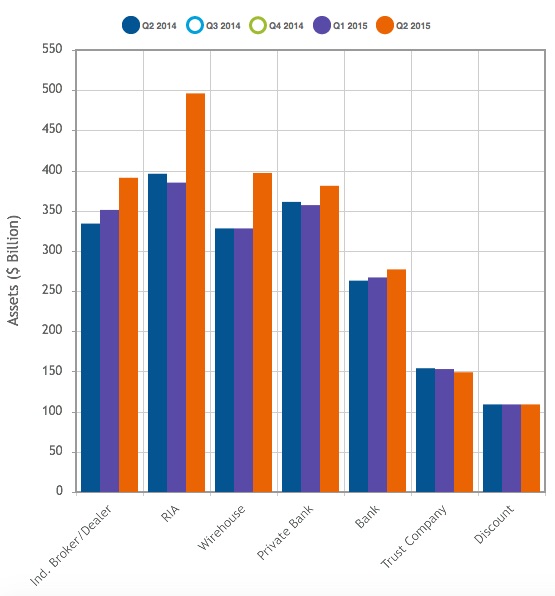

Source: ETF Market, Fund Distribution Intelligence, Broadridge Financial

ETFs in the Driver’s Seat

Roughly 87% of ETF asset growth during the year ending June 30, 2015 were attributed to retail distribution channels having been led by registered investment advisors (RIAs) with total ETF assets of $496 billion. This corresponds to an increase of 18.2% YoY from just $418 billion over the same period a year before. Moreover, Broadridge’s wirehouse channel moved into second place behind RIAs with total ETF assets climbing to $397 billion, notching a 21.4% YoY increase from $327 billion over last year. Collectively, ETF assets are up $116 billion YTD 2015 across all retail channels at Broadridge.

Amongst the largest holders of ETFs during Q2 2015 were RIAs with $500 billion of ETF assets - overall, the growth of ETFs across the RIA channel has continued to overtake all other distribution channels. The best example of growth in quantifiable terms were equity products, which constituted 88% of the net increase in ETF assets over this period.

Additionally, Fixed income ETFs represented 15% of the overall net increase during the same period, with commodity ETF assets incurring a 4% net decline in assets. By extension, mutual funds could not capture the same growth margin as its ETF counterpart - long-term mutual fund (LTMF) asset growth came in at only $200 billion in Q2 2015.

Source: Mutual Fund Market, Fund Distribution Intelligence, Broadridge Financial

According to said Frank Polefrone, Senior Vice President (SVP) of Broadridge’s Access Data product suite, in a recent statement on the performances, “The retail channels drove the growth of ETF assets with a 20 percent increase over last year ending June 30, and almost all of the increase came from retail channels – RIAs, independent broker-dealers, wirehouses and discount broker-dealers. Retail channels’ dominance for ETF asset growth was even more pronounced on a year-over-year basis, with all of the $116 billion of increased ETF assets coming from retail distribution channels.”

During Q2 2015, Broadridge Financial signed and entered into an agreement with Thomson Reuters (NYSE: TRI), whereby acquiring its Fiduciary Services and Competitive Intelligence unit.

Back in May, Broadridge released its first tranche of financial metrics for the 2015 calendar year – during Q3 2015, the group reported strong fee revenues of $406 million, jumping 5% YoY from just $387 million during Q3 2014. In addition, total revenues swelled to $634 million during Q3 2015, up 5% YoY from $606 million in Q3 2014.