One of the largest Chinese companies on the Hang Seng Index, CITIC limited, which represents a diverse range of businesses including its financial services division that handles banking, securities, trust and prudential business for the brand, has reported its 2014 annual report, signed by the company’s chairman today.

The company is a leading provider of financial services in China, including through its significant Citic Securities division, and saw its group revenues across all business lines total just over $402.12 billion Hong Kong dollars (HKD) for 2014 (which is roughly equivalent to almost $52 billion USD at today's rate), and was lower than the 2013 restated totals of $409.74 billion HKD that CITIC had previously reported.

Group revenues dip 1.8%

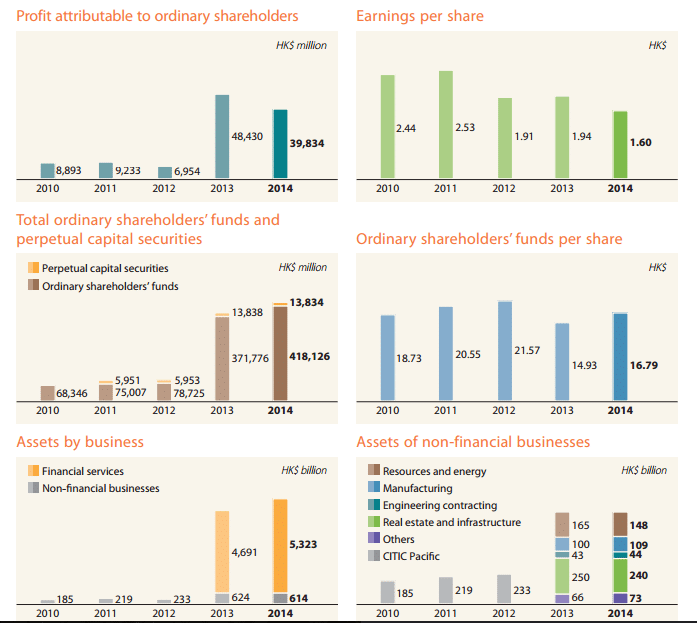

The year-over-year decrease of over $7.6 billion HKD represents a 1.8% decline, and as the group’s profit before tax fell by $13.6 billion to $77.8 billion HKD over the same period. Earnings per share reflected a 17.5% change by decreasing from 1.94 HKD per share in 2013, to 1.60 HKD per share for the company’s 2014 calendar year.

Despite the lower revenue and profit year-over-year, total assets at CITIC rose to almost $6 trillion HKD for its 2014 reported year (roughly $773 billion USD), up by $626.12 billion HKD from the $5.32 trillion HKD reported for 2013. The company’s staff count tripled to over 125,000 from 36,512 people employed in the prior year period, following a number of acquisitions including in Thailand.

Source: CITIC 2014 annual report released March 24th 2016

Financial services revenue up 20%

The bulk of the increase in assets was attributable to CITIC financial services segment which trumped all other segments by far in terms of increase, revenue, and profit attributable to shareholders, while losses from other segments helped offset some of those gains. Revenue from financial services was up 20% by $27.76 billion YoY, whereas the company’s resources and energy segment revenues fell by $33.69 billion over the same period.

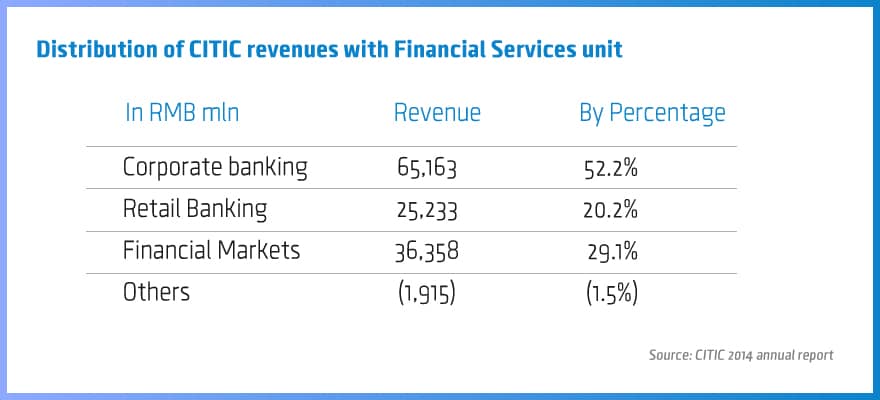

CITIC reported that the number of its retail customers in mainland China increased by 16% year-over-year and its retail business represented 20% of the bank’s revenue, also up 23% of the same period. CITIC's financial services segment offers foreign currency, wealth management, precious metals and derivatives, as well as Risk Management , investment and financing services, to both retail and institutional clients. The company noted an increase in non-performing loans, a potential tell-tale sign that China could be facing challenges in the housing market.

The company's Chairman Chang Zhenming highlighted the report with a letter and excerpt where he said: "The fundamental concept is that when people come from one culture and live and work in another, especially early in life or their careers, an amalgamation of cultures is created — a third culture — that does not match either their origin or destination. My objective is to develop a third way, a CITIC way that is neither designed by an individual nor created by edict or a mission statement, but shaped over time by the actions, behaviours, and ideas of our diverse group of employees."

An excerpt of data the CITIC annual report for 2014, seen below, shows the distribution of revenues across the company's Financial services division:

Source: CITIC