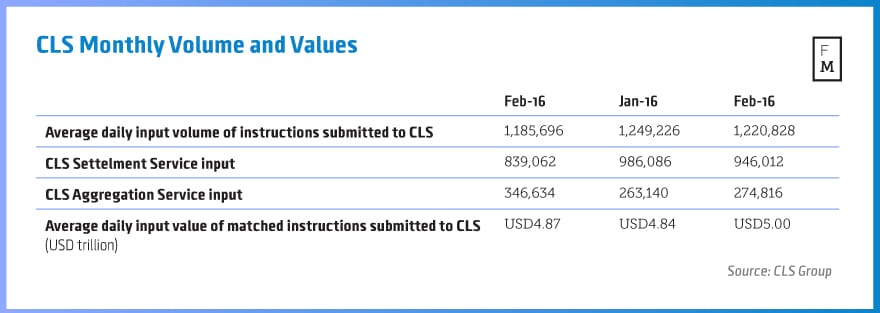

The leading provider of risk mitigation and operational services for foreign Exchange dealers and institutions, CLS Group, today reported February trading metrics showing mixed results when compared month-over-month.

Average daily input value submitted to CLS during February was up by 3% month-over-month to USD $5 trillion, higher by $160 billion from January’s total of $4.84 trillion, and also higher when compared year-over-year yet to a lesser degree that last month's increase.

The figures are reported based on both sides of FX transactions and in line with BIS standards and Foreign Exchange Committee market reports, and thus, should be divided by two to obtain the nominal trade amount (to avoid double-counting).

Source: CLS

Larger Amounts, Fewer Trades

Despite the rise in input values in February, average daily input volume submitted to CLS that combines the Settlement and aggregation services totals resulted in a combined 1,220,828 instructions for February, down 2.3% from January’s total of 1,249,226 instructions in the prior month.

That segment total consisted of 946,012 instructions per day for the CLS Settlement services and 274,816 instructions per day for the aggregation service. In addition to the month-over-month changes, the settlement's total was higher year-over-year, while the aggregation total was lower when compared to the same month in 2015. It's not clear if the year-over-year divergences were largely affected by leap year which resulted in an extra trading day in February or if that was merely incidental.

CLS also noted that while the instructions are received on a given day for future settlement, the settlement doesn’t always occur within the same month, which means monthly overlap could be a factor, as well as a potential error of margin in the totals.