The Switzerland-headquartered multi-asset interdealer broker Compagnie Financière Tradition SA, listed on the Swiss SIX under ticker CFT, and known under the Tradition brand, today reported 2015 results which included an increase in operating profit by 45% year-over-year, after the company reported certain figures for 2015 this January.

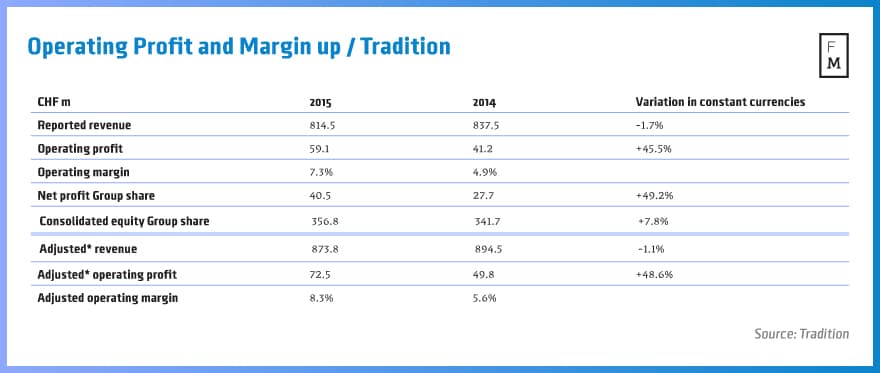

Despite revenues dipping to CHF 814.5 million for 2015, down 1.7% from CHF 837.5 million in the previous year (on a constant currency basis), the company managed to realize a 45.5% higher operating profit of CHF 59.1 million when compared to CHF 41.2 million in the previous period, thanks to cost management and savings on organizational expenses. Net profit on a consolidated basis was also within that range and up to CHF 45.2 million for 2015. While adjusting proportionally for the consolidation method for joint ventures, adjusted revenues dipped 1.1% on a constant currency basis.

Tradition said adjusted revenue from its interdealer broking business (IDB) dropped 2.3% on a constant currency basis while its retail Forex trading business in Japan (non-IDB) was up 57.3% from 2014’s totals.

The company’s Japanese FX brokerage business Gaitame.com contributed CHF 8.4 million in operating profit in 2015, higher from CHF 2.1 million YoY thanks to increased operating margins of 33% versus 12% in the prior year.

At the end of last year, Tradition held consolidated equity of CHF 370 million with CHF 356.8 million attributable to shareholders of the parent company, and total adjusted cash including financial assets stood at CHF 154.5 million as of December 31st 2015.

A meeting on May 19th this year will be held where it’s believed that the firm’s Board will propose an increase of the dividend from CHF 3.0 per share to CHF 3.50 per share, a nearly +5% yield and based on shareholder approval.

The company employs nearly 2200 people across almost every range of asset classes and markets including bonds, interest rate, currency and credit derivatives, equities, equity derivatives, interest rate futures and index futures, and non-financial products (energy and environmental products, and precious metals).

The company noted industry consolidation in its outlook and how it is well positioned as a leader in the space and will focus on both organic growth opportunities as well as external possibilities (such as acquisitions), and noted that the evolving regulatory environment was squeezing smaller operators along with the effects of consolidation felt by smaller firms. Tradition said it will also continue optimize its investments in technology and while focus on cost saving measures. Below is an excerpt from the company's results comparing year-over-year changes: