For years, mutual funds have been synonymous among retail investors as the long-term investment of choice. But, that trend is ending with Exchange -Traded Funds (ETFs) grabbing a larger market share of new retail investor funds. This development was on display as data from Broadridge’s Fund Distribution Intelligence tool showed that ETF assets increased by $265 billion on a year-over-year basis and the end of Q2 2015, compared to $200 billion growth in long-term mutual funds. According to the research, the ETF growth was primarily led by retail customer flows.

But how do ETFs work? Taking a closer look, Finance Magnates explored the process of creating an ETF, from conception to open trading.

An increasingly popular security for investors, ETFs are funds that own a variety of assets, such as equities, bonds or commodities, usually tracking an index. ETFs are broken into shares and traded on exchanges, much like stocks. The indices tracked by ETFs can range from the entire Nasdaq exchange (QQQ) to a small niche group of Cybersecurity companies (HACK). The ease of exchange and variety of index types strongly contribute to the growing popularity of ETFs.

Creation

First, the idea and planning for the ETF is conceived by the prospective ETF manager, known officially as the sponsor, like Invesco or PDR Services LLC. The manager then submits the plans to an organization responsible for regulating securities and exchanges, such as the Securities and Exchange Commission (SEC) for the United States.

After the plan has been approved, the sponsor arranges with an authorized participant to create the ETF. The authorized participant, usually a large institutional organization, like Blackrock or Vanguard Group, is then responsible for obtaining the underlying assets and place them in a trust in order to form ETF creation units. Those units usually comprise a large amount of shares of the ETF, generally 50,000 shares. Shares are then traded in the open market.

Large amounts of ETF shares formed into creation units can also be redeemed for the underlying securities. This means that the total number of ETF shares can change whenever creation units are redeemed or formed.

ETF providers are incentivized to create ETFs for a variety of reasons. For one, the ETF manager receives a small portion of the ETF’s assets as a management fee. Additionally, the ETF manager can lend out the component securities of the ETF.

Redeeming ETFs

Investors holding individual shares of the ETF can trade them with other investors on an exchange. Alternatively, a large institutional investor can redeem large quantities of ETF shares for a creation unit, and then exchange that creation unit with the trust in order to obtain the underlying assets.

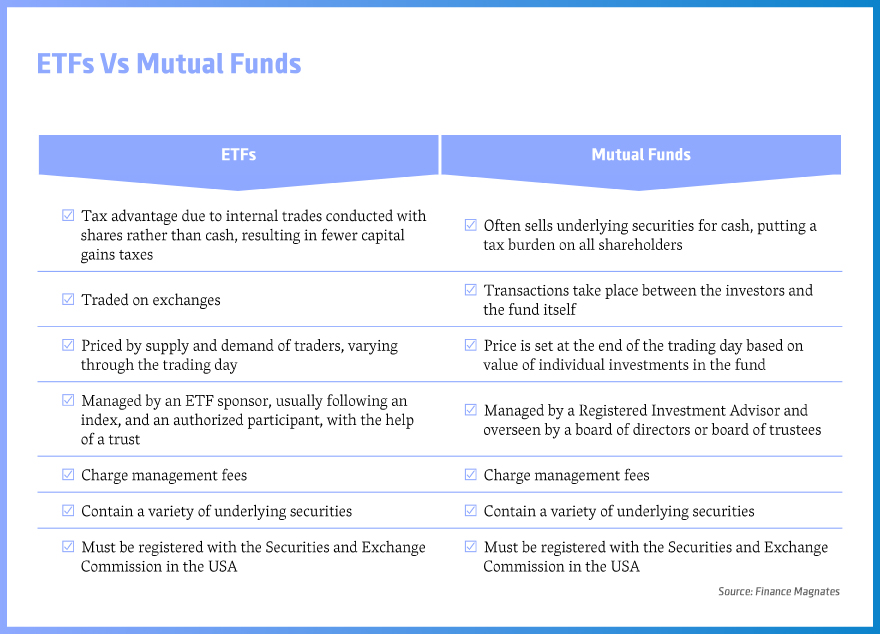

Because securities are traded for other securities, no taxes are involved in the redemption process. This gives the ETF its main advantage over the mutual fund, which generally sells its underlying securities to be redeemed, putting a tax burden on all shareholders.

Additionally, since it is traded like a regular stock, ETFs do not incur additional fees. ETFs can also be used as an easy way to short large amounts of securities, as some ETFs are inverse ETFs, that gain value proportional to how much the underlying securities lose value.

Leveraged ETFs

Growing in popularity are leveraged ETFs. The product follows an index or commodity such as oil, but adds Leverage in order to provide higher multiples of return when compared to the underlying securities (typically 2-4X). Leverage is achieved by investing in futures contracts or using borrowed capital. However, the higher potential multiple of profits, also results in greater risk.

These possibilities, along with the tax benefits and variety of index choices, make ETFs a popular method of investing in a basket of securities.