Eurex Clearing, part of German-headquartered Deutsche Borse Group which operates major exchanges and clearinghouses, today provided an update on enhancements to its marketplace, as per an official statement.

Serving 176 clearing members across 17 countries and managing a collateral pool of roughly 50 billion euros and processing 16 trillion euros worth of gross risks, Eurex Clearing is a leading central counterparty (CCP) globally.

New CEO on July 1st

Erik Muller, an executive board member at Eurex, who will be taking over responsibility as CEO for Eurex Clearing at the start of next month, provided an update on recent activity within the company's clearing of securities lending.

The impact of Regulation and the increasing cost of capital, combined with the drive for operational efficiency, support central clearing for the securities lending marketplace.

The new world of Online Trading , fintech and marketing – register now – for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Lending CCP Shift

Mr. Muller said in a recent statement regarding the update: “The impact of regulation and the increasing cost of capital, combined with the drive for operational efficiency, support central clearing for the securities lending marketplace.”

At the end of 2014 Morgan Stanley partnered with Eurex Clearing to revise and expand its original securities lending clearing offering and since April 2016 has actively been using its Lending CCP.

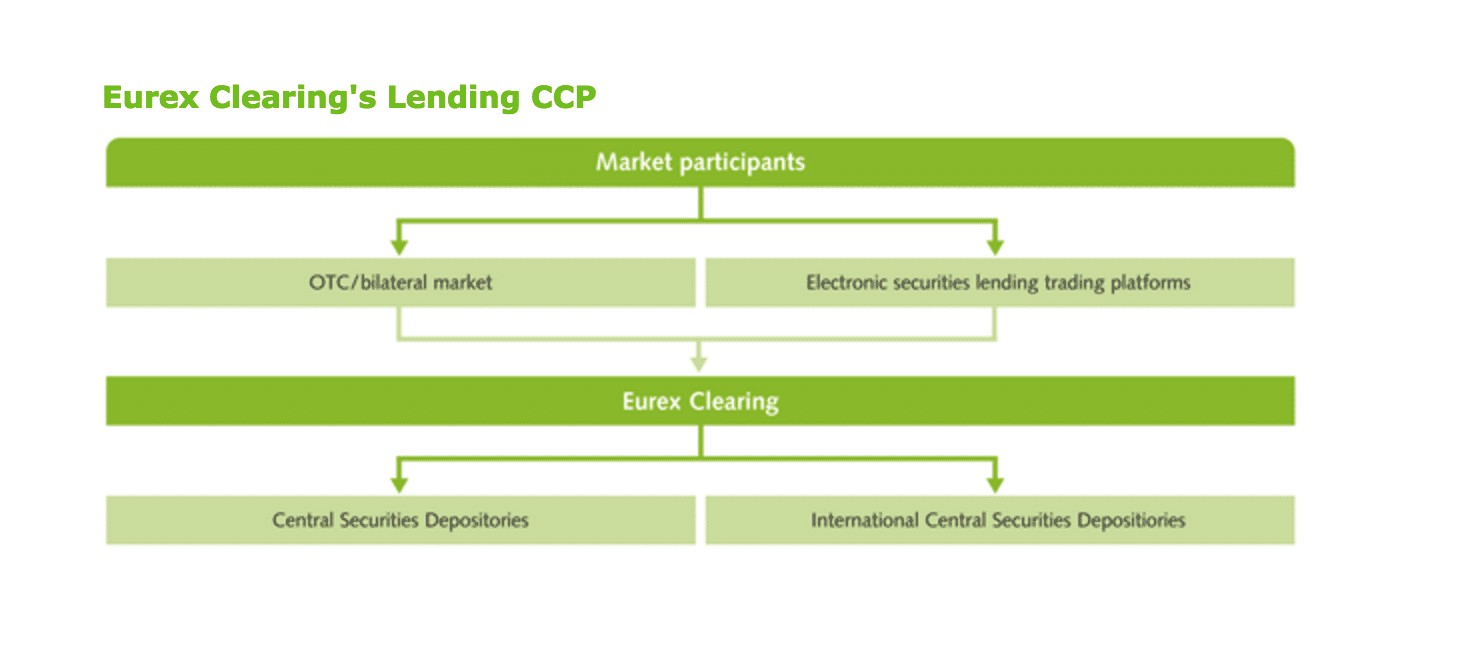

Source: Eurex Clearing

Morgan Stanley Active Since April

Susan O’Flynn

Source: LinkedIn

Commenting on the developments, Susan O’Flynn, Global Head of CCP Strategy, Governance and Optimization at Morgan Stanley, explained: “Morgan Stanley and Eurex Clearing combined efforts to identify the remaining barriers to broader take-up of central clearing securities lending transactions.”

“This has been a key strategic development in creating a centrally cleared model that is resource-efficient for all participants and allows us to create additional capacity for our clients.”

Mrs. O’Flynn added: “Following extensive collaboration with our clients, we are now actively trading in a new centrally cleared model that is much closer to bilateral market execution, particularly in post-trade activity.”