This morning in London, Thomson Reuters issued an announcement highlighting the growing turnover of FX options throughout 2015. However according to the broader data that the Bank of International Settlements is collecting, this is not an isolated case. With the first half of the year being mundane in terms of growth in the space, the final quarter has seen a big increase in activity.

Thomson Reuters published its own data, showing that electronic FX options trading accelerated by 166 per cent throughout 2015. With more than 36 active options price-makers and more than 225 active options price-takers, the Thomson Reuters FX dealer-to-client platform has registered FX options as the fastest growing product of the year.

While the final figures for 2015 have not been published, the over-the-counter (OTC) FX options line of business has been growing globally according to Bank of International Settlements data. The final figures for last year are expected to be published by the institution in the coming weeks.

Commenting on the announcement by Thomson Reuters, the Global Head of FX at the company, Phil Weisberg, stated: “Due to their inherent complexity, FX options have been the last FX instrument to move from OTC markets to electronic platforms, but best Execution requirements are seeing options volumes and participants on our platforms really flourish.”

“We are finding that in today’s highly fragmented and increasingly scrutinized FX market, price-takers - Buy-Side firms and smaller banks - want to use platforms that offer optimal transparency and help them prove effectiveness of execution whether it is mandated or not. They also want the efficiency and flexibility that comes with the feature-rich workflow tools that electronic platforms can provide,” the former Chairman and CEO of FXAll added.

According to industry insiders, the rapid growth in the foreign exchange options market throughout 2015 has been largely ongoing in the final quarter of the year, when the big event risks from the European Central Bank policy actions and the Federal Reserve’s first interest hike in 9 years have led to increased appetite from investors to protect their investments.

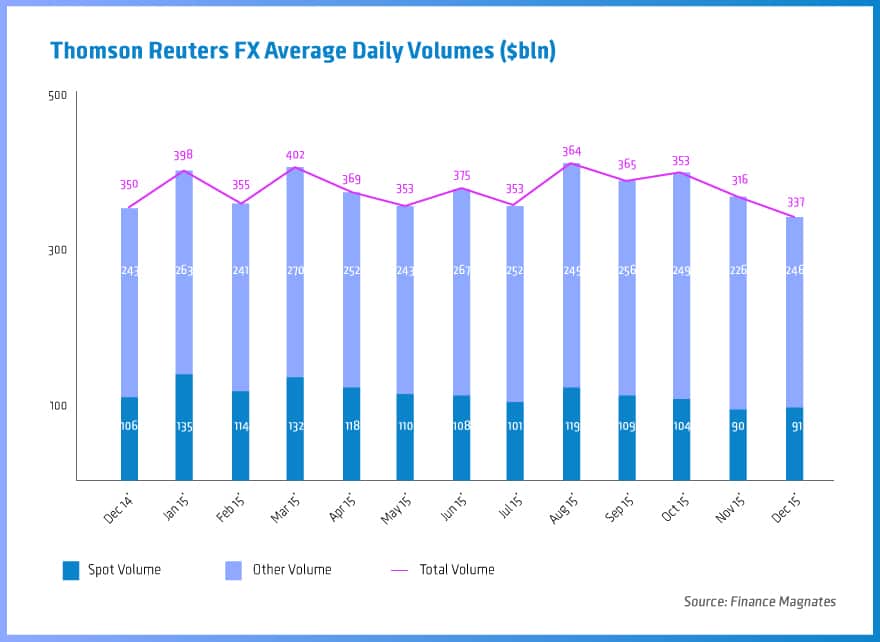

Looking at the final monthly report for 2015 from Thomson Reuters, we have observed that the total FX average daily volumes have increased by 6.6 per cent to $337 billion. However the total volumes were largely boosted by an 8.8 per cent increase to $246 billion in the ‘Other Volume’ section which includes FX swaps, forwards, NDFs and options.