PrimeXM has reported mixed trading volumes for December, in line with other institutional and retail platforms that saw the activity of their clients mostly unstable, compared to earlier last year when the coronavirus pandemic stocked unprecedented Volatility across varying asset classes.

The provider of FX Bridge aggregation and institutional hosting solutions today revealed an average daily volume (ADV) of $39.38 billion, down 10 percent month-on-month from $43.76 billion, reported back in November.

Having hit the $1.15 trillion milestone in March and $918.9 billion in November, total turnover at PrimeXM took another step back in December, coming in at $866.46 billion, or 6 percent less than it was the previous month.

The highest daily trading volume of the month was recorded on 21 December with a $56.26 billion turnover. The total number of trades in December was 25.17 million, slightly higher from 25.07 million for November.

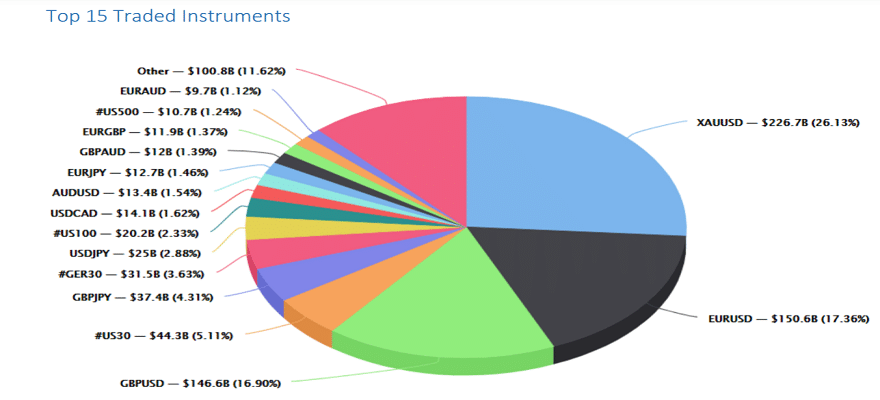

Other business highlights show that PrimeXM’s Gold instrument, XAU/USD, saw a lower monthly turnover at $226.7 billion last month, which is a decrease of 11 percent from a month earlier. The bullion activity saw a record $288.7 billion in monthly volumes back in August.

London Keeps Grip on Trading Volumes

XAU/USD accounted for 26 percent of the overall traded volume, followed by major FX pairs EUR/USD and GBP/USD whose turnover jumped to $150 billion and $146 billion, respectively, in December.

EUR/USD took the top position among FX pairs in December (17 percent of all volume), and major US indices also picked up in volume due to volatility in stock markets.

In line with previous months’ metrics, LD4 was the strongest across its three major data center locations, with $645.3 billion worth of trades exchanging hands there, or 77 percent of the total monthly trading volume. This compares to $118 billion in New York and $103 billion in Tokyo.

PrimeXM appointed last month a new Chief Technology Officer (CTO) to drive its evolving product portfolio and software development roadmap, having promoted its current executive Constantinos Orphanides to take on the new role.

Following a career in the gambling industry, PrimeXM originally hired Constantinos Orphanides back in April 2019 to lead its product development affairs. He was elevated to his expanded role as CTO to head the company’s overall technology strategy and provide guidance to engineering team members across branch offices in Limassol, Dubai and Shanghai.