The first group of institutional FX platforms to report their monthly volumes indicate that February was a busier month all round, with FXSpotStream setting its second-highest ADV on record.

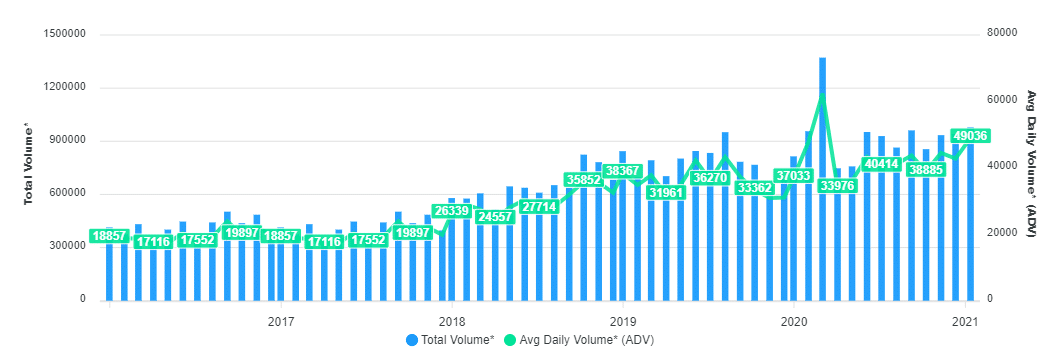

Total trading volumes on FXSpotStream’s trading venue, the aggregator service of LiquidityMatch LLC, ticked higher last month, helped by a rise in politically driven Volatility . Specifically, February’s figure came in at $992 billion, which was slightly higher from $980 billion in the previous month and also rose by 4 percent on a yearly basis.

February’s average daily volume (ADV) of $49.6 billion is the highest monthly reading for this metric since it hit an all-time high at $62.3 billion back in March 2020. Additionally, this figure is higher from $49.0 billion in January 2021 and increased 3.7 percent year-over-year when compared with $47.8 billion in February 2020.

Cboe FX, CLS and Thomson Reuters to Follow Suit

February 2020 saw a total of 20 trading days, the same as it had been in the month prior.

Activity on FXSpotStream’s trading venue has been consolidating over the last few months, namely since the aggregator service of LiquidityMatch LLC reported a record $1.37 trillion in total volumes for March. The monthly turnover has bottomed out at $855 billion back in October.

Other institutional FX platforms including Cboe FX, CLS and Thomson Reuters are expected to report a rise in volumes for last month as volatility picked up and the secular trend of rising FX volumes comes into play again.

We last reported on FXSpotStream LLC last month when it hired Matthew K. Fic to be its Senior Vice President and Head of Sales in the Americas.

The appointment came little more than two years after Matthew left UBS, where he had been Executive Director and Head of eFX Sales for the Americas at the Swiss bank.