Leading interdealer broker ICAP Plc has today released its annual report for its financial year ending March 31st 2016, with group revenues declining by 6% to £1.20 billion and lower by 3% when excluding closed trading desks and on a constant currency basis, amid challenging market conditions that the company noted in its report.

Trading profit before tax was £203m, and lower from £229m in the prior year and was impacted by a £7m foreign exchange trading loss, according to ICAPs 2016 annual report highlights.

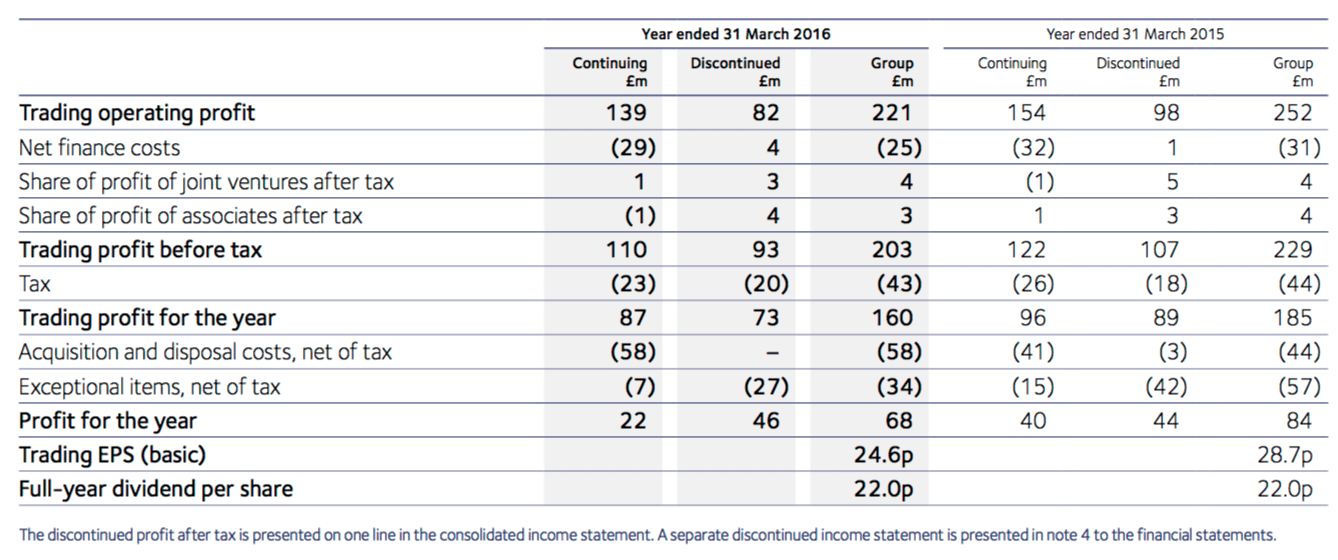

An exceprt from the report, seen below, compares continuing revenues with revenues from discontinued operations and along with group revenue totals - for its most recent reported year that ended March 31st, 2016 and the prior year period.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Source: ICAP 2016 annual report

Group revenues dip by 6% YoY

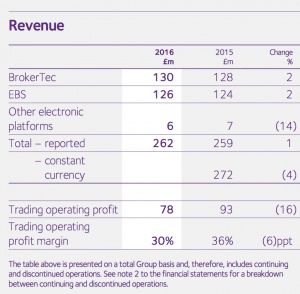

Revenue from Post Trade Risk and Information segment was up 5%, yet was offset by decreases of 4% in Electronic Markets and 5% in Global Broking, excluding closed desks and on a constant currency basis.

Despite the decline in group profit which fell to £68m from £84m in the prior year period, the company invested £96 million in new product initiatives - including in forwards on its related platforms - and had made strategic investments during its year that ended March 31st 2016.

ICAP noted that it was able to maintain its full-year dividend at 22 pence per share as its final dividend payment of 15.4 pence per share will be proposed for approval to be paid in July. The company had acquired the buy-side data Analytics platform provider ENSO Financial Analytics, and noted that the Tullett Prebon deal was on-track - and amid developments that emerged today regarding that transaction.

Investments and priorities

As part of ICAP’s priorities and plans to expand its addressable market, it noted that Spot FX average daily volume on EBS Direct had consisted of a range of currencies which helped it achieve an average of $20 billion during the final quarter of the 2016 financial year, and was higher by 37% year-on-year.

Excerpts from comments made in the report by Michael Spencer, Group CEO of ICAP, highlighted the challenging market conditions the company observed, “During the course of the year, the Group’s trading performance was impacted by the ongoing combination of structural and cyclical factors including historically low and negative interest rates, low levels of volatility and bank deleveraging resulting in reduced risk appetite from bank customers."

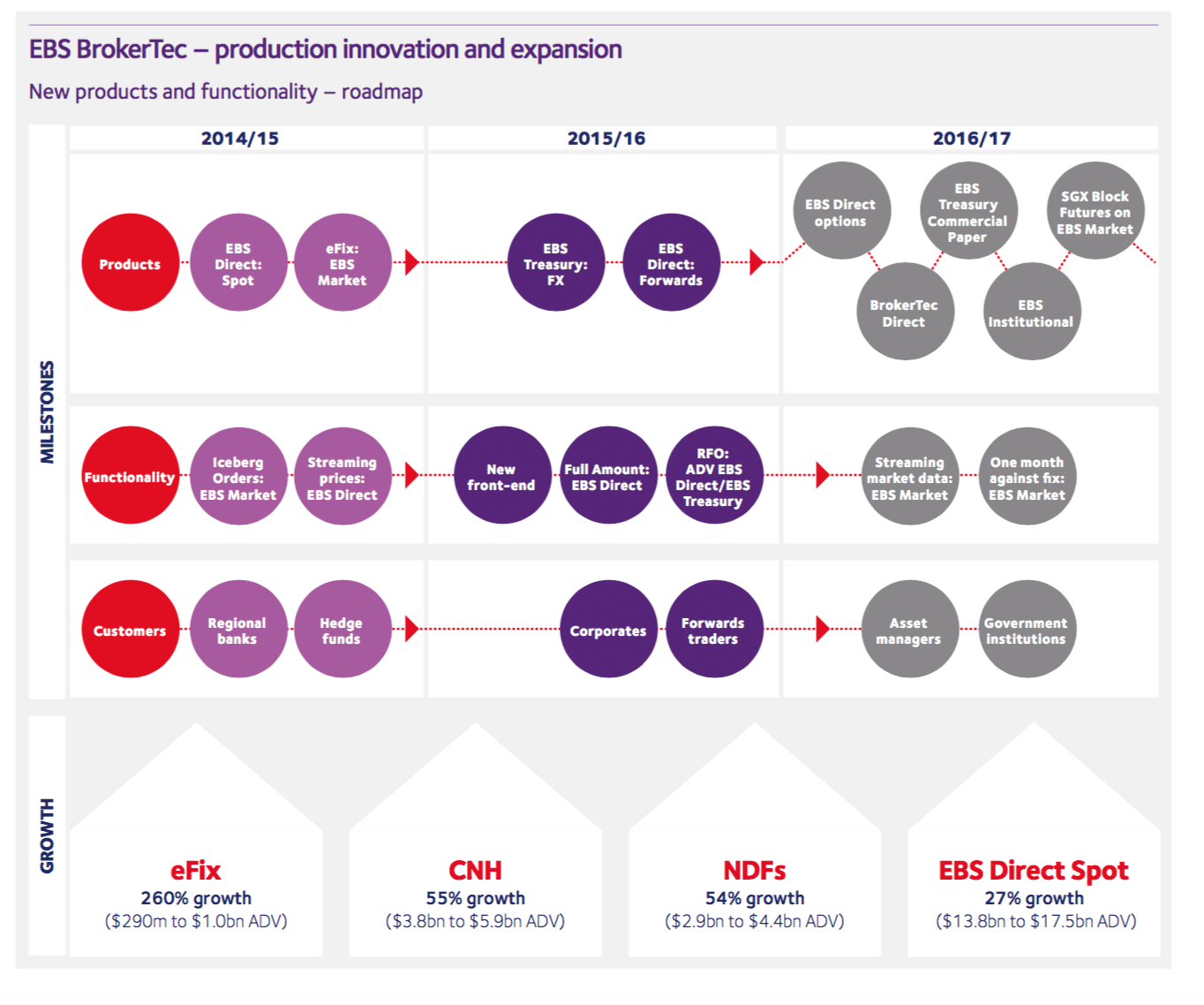

An excerpt below from ICAP's 2016 annual report highlights progress made within its EBS BrokerTec product lines, compared to recent years and the year head:

Source: ICAP 2016 annual report

Challenging market conditions

"This was partly offset by the increase in trading activity in emerging market currency pairs on EBS Market, and greater demand for risk mitigation products such as triReduce and triResolve,” Mr. Spencer added.

Mr. Spender further explained: ”Despite ongoing subdued market conditions this has been a year of good progress and positive strategic change for ICAP. Trading activity since the start of the new financial year, however, continues to be challenging. The ICAP board is confident that the transformation of the Group and the continued investment in new products and technology will result in long-term growth and improvement in profitability driving sustained shareholder value creation.”

ICAP noted that the share of operating profit in recent years had shifted towards post-trade which accounted for 44% of revenues for its year ending March 31st 2015, compared to 38% in the prior year report, and up from 33% in 2014.

Conversely, operating profit for Global broking accounted for 21% in the 2016 report, and down from 25% in the 2015 report, and lower from 30% in ICAP's 2014 year report, even though group revenues from this segment were £694m and more than double the revenue totals from post trade risk and information (which was £245m) and electronic markets (reported at £262m).

Operating profit from ICAP's electronic markets was unchanged from 2014 to 2015 at 37%, yet declined by 2 percentage points to make up 35% of operating profit totals for the companies year ending March 31st 2016.

FX revenues dipped 7%

The company’s FX and money markets business which is made up of spot, forwards and cash related FX products, had reported a 7% decrease in revenue, noted in ICAP’s 2016 annual report.

Factors such as Illiquid FX markets that were due to a persistent low-interest rate environment and coupled with low-risk appetite had negatively impacted trading activity.

Meanwhile, the company's Asia Pacific (APAC) FX division benefited from a restructuring across its Singapore and Australia operations. In addition, the company noted that cash trading in the Americas remained robust and driven by its strong position as the the go-to choice in the market for short-term funding.

ICAP 2016 annual report