Japan’s Government Pension Investment Fund (GPIF), the world’s largest pension fund, has just announced its investment results for the first quarter of fiscal year 2016, which showed its worst performance since the global financial crisis, with losses exacerbated by unfavourable currency moves and a foray into equity markets.

Take the lead from today’s leaders. FM London Summit, 14-15 November, 2016. Register here!

Portfolio losses for Japan's $1.3 trillion GPIF in the three months ending June 30, 2016, amounting to 5.2 trillion yen ($52 billion), or 3.9 percent, which effectively wiped out all the gains that the fund made since it revised its investment strategy to place a heavier weighting on equities.

Government Pension Investment Fund decided in October 2014 to take a more aggressive investment stance, shifting towards stocks and away from low-yielding Japanese government bonds, in line with a surge in Japanese equities and a weaker yen earlier in Prime Minister Shinzo Abe’s term. Opponents accused Abe’s government of favoring the stock market and their own approval ratings over pension security.

The Q1 FY 2016's loss follows a 5.3 trillion-yen drop ($68 billion) in the year ended March 31, 2016, the worst annual performance since the global financial crisis when the fund lost 7.6 percent in the 12 months ending March 2009.

In a press briefing in Tokyo after the results were announced, Norihiro Takahashi, the president of GPIF, blamed the quarterly investment loss on the surging yen following the Brexit event. He said: “We invest with a long-term view. Even if market prices fluctuate in the short term, it won’t damage pension beneficiaries. We are also strengthening Risk Management and continuing to hire experts.”

“The results of the UK’s referendum turned out to be different from what the market expected. And US unemployment data in May was much worse than forecast,” he added.

Asset weightings

While GPIF's losses can be mostly attributed to rocky markets and an index-hugging investment approach, the second reason, the Brexit, could be the main contributor as the vote results, which were announced less than a week before the end of the quarter, produced a 7 per cent plunge in the main Japanese stock benchmark, Topix. Furthermore, Topix was already broadly in the red before the UK’s referendum, falling 8 per cent in the first quarter before clawing back 3 per cent by the end of June.

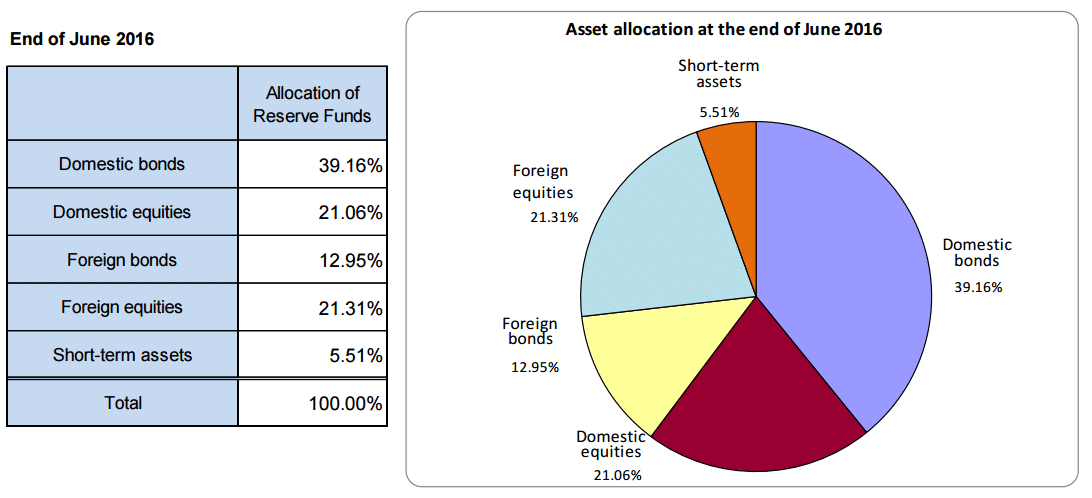

Investment assets and portfolio allocation. Source: GPIF

As of June 30, 2016, the GPIF had 42 percent of its 129.7 trillion-yen ($1.3 trillion) portfolio in Japanese and global stocks while foreign and domestic bonds accounted for 52 percent of its assets. However, the fund targets allocations of 25 per cent each for Japanese and overseas stocks, 35 per cent for local bonds and 15 per cent for offshore debt.

During the reported quarter, the fund lost 9.6 percent on foreign shares and 3.3 percent on overseas debt, while Japanese bonds handed the fund a 4.1 per cent gain.

Further losses expected

The fund's mega-losses are likely to continue in the current quarter if Japanese stocks resumes their current slide. The Nikkei Stock Average has shed more than 13 percent since the beginning of the year, and fell 1.18 percent Friday.

The biggest risk would also be coming from the stronger yen which benefited from major central banks’ recent decisions to hold off easing policy. The USD/JPY is currently hovering around the 100.0 psych level, bringing its gain this year to about 17 percent, with further risks to the downside.

Strength of the yen helped amplify losses to the GPIF’s portfolio in the April-June quarter. And while Abenomics are not expected to change anytime soon, this fact may bring the idea of hedging the fund’s currency exposure to the table. In practice, this would involve taking positions to at least offset declines in the value of the currencies in which investments are held.