The Zurich-headquartered Swiss banking institution, with more than 50 locations worldwide, operated by The Julius Baer Group Ltd., today released its 2015 annual report, as assets held by the Swiss bank reached a record high of 300 billion Swiss francs at the end of last year, up by 3% from 2014.

Operating income rose 5.8% to nearly 2.7 billion CHF (2694.4 million), up by CHF 147.7 million from CHF 2546.7 million during 2014. However, operating expenses climbed 23.1% during the same period from roughly CHF 2.07 billion to over 2.55 billion, an increase of CHF 479.1 million year-over-year (YoY). Accordingly, net profit declined to CHF 122.5 million, down 66.7% from CHF 367.4 million YoY, while on an adjusted basis was CHF 22.3 million, down from 173.7 million for 2014, according to the income statement filed with the report.

FX Division Income Higher

Following a challenging year that saw the Swiss National Bank’s abrupt policy change that prompted the country’s currency to strengthen, the bank had introduced a number of measures to protect against the strength of the Swiss franc.

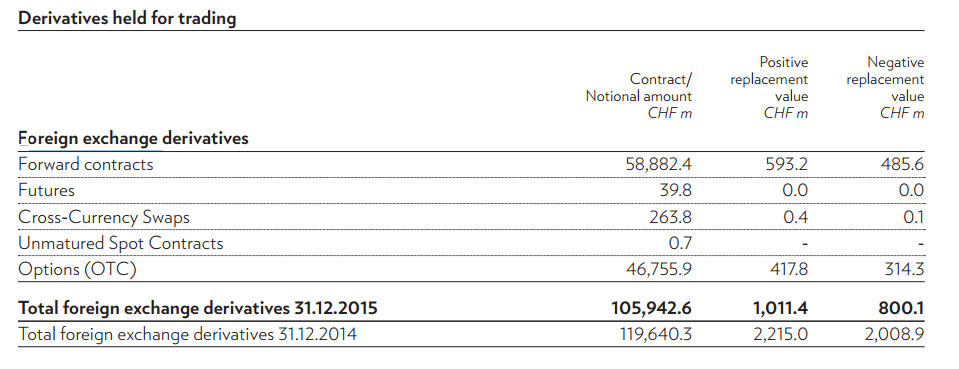

For the company’s FX division, net trading income rose by 38.8% from 367.3 million in 2014 to CHF 509.8 million for 2015, higher by CHF 142.5 million YoY. Meanwhile, Julius Baer’s net trading income from equity instruments totaled a loss of 104 million CHF, worse by 77.6% from the nearly 59 million CHF loss reported for 2014. A breakdown of the company's Forex derivatives segments shows options and forwards made up the majority of volumes, as seen in the excerpt below from the 2105 annual report.

Litigation and Settlements

Ongoing litigation across a number of cases against the company included a claim from a former client for the amount of CHF 1 million plus accrued interest from 2008, and with a partial claim that could reach CHF 121 million, in relation to CHF 441 million lost in connection with foreign Exchange transactions. The bank said it is contesting the claim, while defending its interests.

In addition, during 2015, a nearly $550 million USD settlement was reached that Julius Baer had to pay to the US Department of Justice (DoJ) in connection with company’s cross-border legacy business. This took out a chunk of the aforementioned operating income and thus squeezed its subsequent margins.

Acquisitions Activity

Despite the costs and ongoing litigation, Julius Baer made a number of acquisitions including of Leumi Private AG, Frasad Gentian SA, and Commerzbank International SA, and increased in its current stakes in other strategic investments during the year.

The company said it was well capitalized, and expects to increase its dividend to CHF 1.10 per share during the Annual General Meeting on April 13 next month. Shares of Julius Baer were up nearly forth-tenths of a percent around the time of the news.