LMAX Exchange, a multilateral trade facility that provides foreign exchange (FX) trading to retail and institutional clients, has launched a new global infrastructure expansion, linking up with Equinix’s NY4 Data Center, Finance Magnates has learned.

Take the lead from today’s leaders. FM London Summit. Register here!

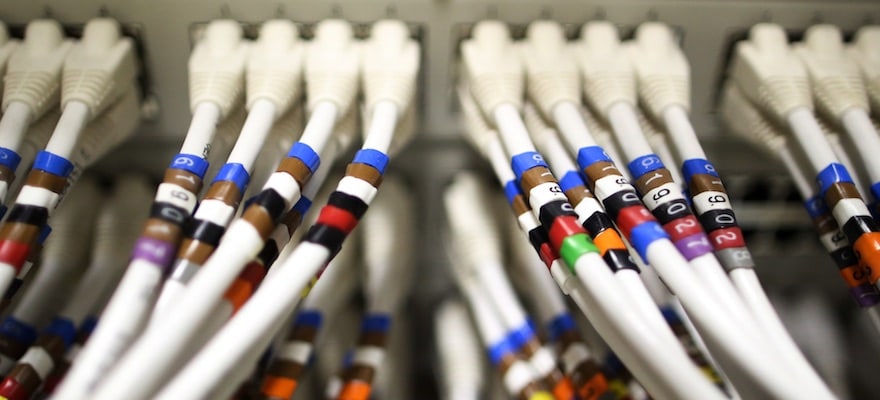

The initiative helps cap off a series of assimilations with other matching engines worldwide, including LD4 and TY3. NY4 is a virtual hub, constituting a total of 49 sovereign exchanges that lease space. Collectively, the data center completes upwards of 9.6 million messages per second through its fiber-optic cables, which provides the infrastructure for electronic trades representing trillions of dollars’ worth of equities, derivatives, currencies, fixed-income, and FX assets.

LMAX’s decision to set up a matching engine into Equinix's NY4 Data Center also is reflective of the strategic importance of the US FX market. The move will also help LMAX better provide its clients aiming to instill proper Liquidity sourcing as well as matching in less than 100μs.

The group has opted to lower a number of pricing requirements for clients with the move, which is fast becoming a trend amongst financial service providers. The move to NY4 will also aim to capture more business from funds, banks, and proprietary firms, brokers, and asset managers.

According to LMAX Exchange's Chief Executive Officer (CEO), David Mercer in a recent statement on the linkage, “Through the global proliferation of exchange style execution for traditionally OTC-traded FX products, such as spot FX, LMAX Exchange is leading the charge towards greater transparency. We are committed to re-establishing trust in global FX markets by delivering precise, consistent execution to all participants, regardless of status, size or activity levels. By using robust and scalable technology we are able to deliver internal exchange latency of less than 100 micro-seconds - this is critical for the demands of institutional traders and Liquidity Providers worldwide and our extensive client base in over 90 countries."

"Equinix's NY4 data centre is the ideal location for our high performance matching engine which is capable of delivering over 100,000 orders/second. Being in NY4 will provide us with close proximity to major financial institutions in North America to the benefit of our customers and LMAX Exchange," noted Andrew Phillips, Director of Technical Operations at LMAX Exchange, in an accompanying statement.