A number of foreign exchange trading venues have reported their numbers for the month of June with Fastmatch, Hotspot and GAIN Capital’s GTX venues all marking double digit growth month-on-month. With the Brexit event triggering massive moves in the foreign exchange market this doesn’t come as a surprise. Finance Magnates has also obtained some information about the performance at EBS and FXSpotStream.

What will be more interesting in the coming months is whether the FX volatility that we have seen throughout the past week can be sustained throughout the typically slower summer period. In our monthly report we are taking a look at the trading volumes across all major venues that have been reported so far.

EBS Post-Brexit Boost

Sources close to the company with knowledge of the matter have shared with Finance Magnates that ICAP’s EBS registered over $200 billion last Friday across all platforms. To put this figure into perspective, the average daily trading volumes for EBS in May 2016 were $75.7 billion.

An ICAP spokesperson shared with Finance Magnates: “During major events such as what we’ve seen last Friday, as well as unforeseen events, the highly liquid spot foreign exchange and US and European fixed income markets typically retreat to public central limit order books as a safe haven.”

“Certainty of execution, continuous flow and two way prices enable customers to get their business done in times of significant stress. The EBS and BrokerTec platforms have experienced substantial volumes and have demonstrated continuous, deep and reliable Liquidity throughout a period of extreme volatility,” the spokesperson added.

Fastmatch Grows 43% in June

Fastmatch has reported an increase of 40 per cent on a monthly basis in yet another testament to the strength of the company’s business. The trading volumes have been reported at $358.4 billion for the month of June with the Average Daily figures at $16.3 billion. The total number and the average daily values were higher by over 76.5 per cent when compared to June 2015.

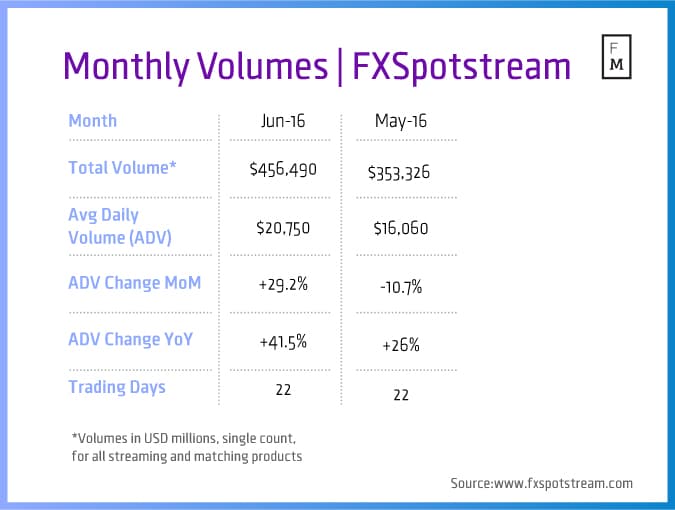

FXSpotStream Registers Record Growth

June was an excellent month for the firm with FXSpotStream announcing upbeat results for June after disclosing it was its busiest month to date. Total FX volumes of over $456 billion for the month exceeded May's figures of 353 billion and its previous record of $441 billion in February this year.

In terms of average daily volume, June’s $21 billion ADV represented a 29 percent MoM over May’s $16 billion and a YoY increase of 41.5 percent. June was the second best month to date - the second highest ADV supported by FXSpotStream – $20.750 billion vs $20.977 billion in February.

Finance Magnates

GAIN Capital GTX Spikes Higher 40%

GAIN Capital’s GTX trading venue has also reported an increase of 40 per cent throughout the month of June. Looking at the nominal figures, the volumes of the Electronic Communications Network and the Swap Execution Facility of GTX totaled $212.3 billion in June with an average daily volume of $9.6 billion. The figures are higher when compared to a year ago by 18 per cent.

Looking at the total figures for GAIN Capital’s GTX, which include its swap dealing facility, the company’s volumes total $265.6 billion, which totals to an ADV of $12.1 billion.

BATS Global Markets Hotspot Registers 12% YoY Increase

In June the foreign exchange trading venue of BATS Global Markets has marked an increase of 23 per cent when compared to May 2016. The total numbers reported by the venue were $633.8 billion of total volumes and $28.8 billion in average daily volumes. The year-on-year growth figures on both counts were about 12 per cent higher.

During the period of heightened volatility at the end of the month the three most popular pairs for traders were GBP/USD, EUR/USD, and USD/JPY. ECNs have been the institutional investor’s safe heaven during the massive volatility spike, which widened FX spreads across brokerages worldwide.