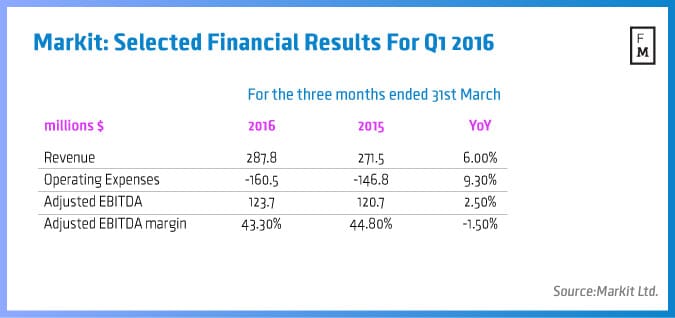

Markit Ltd. (Nasdaq:MRKT), a provider of financial information services, has announced its financial metrics for Q1 2016. The group reported mainly solid operating results, including a rise in revenues, helping the company secure QoQ growth in spite of challenging market conditions.

Revenue

For Q1 2016, Markit saw its revenues increase by $16.3 million to $287.8 million, up 6 percent QoQ from $271.5 million in Q1 2015. Organic revenue growth was $2.7 million, or 1 percent from Q1 2015. This was driven by new business wins across the company’s solutions and information segments, partially offset by a decrease in its processing segment.

Operating Expenses

Operating expenses increased by $13.7 million, or 9.3 percent, to $160.5 million for Q1 2016, from $146.8 million for Q1 2015, mainly due to increases in personnel costs and acquisitions.

Adjusted EBITDA and Adjusted EBITDA Margin

Adjusted EBITDA of $123.7 million for Q1 2016 increased by $3.0 million, or 2.5 percent, from $120.7 million for Q1 2015. This increase reflects the operating performance described above. Adjusted EBITDA includes a $3.0 million loss in Q1 2016 associated with the company’s share of the KYC joint venture included in its solutions segment.

Adjusted EBITDA margin decreased to 43.3 percent for Q1 2016, compared to 44.8 percent for Q1 2015 mainly due to the reduced revenue in the processing segment and the dilutive impact of acquisitions completed in 2015.

Markit has been an active participant in the Acquisition space over the past few months. In its latest bid to bolster its Multi-Asset capabilities, Markit last week acquired an interest in commodity markets research and price reporting PRIMA.

Commenting on the results, Lance Uggla, chairman and chief executive officer of Markit, said: "In the first quarter, Information produced solid operating results and we saw steady performance in Processing. Despite expected slower growth in Solutions this quarter, and challenging market conditions, our long term financial objectives for Markit’s businesses have not changed. We remain focused on helping our customers manage regulatory change and reduce costs while delivering strong results for our shareholders”.