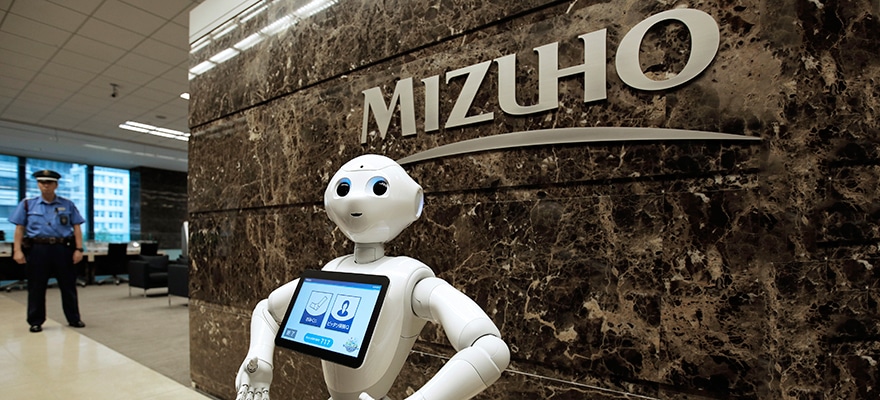

One of the leading foreign exchange electronic communications networks, Thomson Reuters, announced today that Japanese bank Mizuho has integrated the company’s next generation FX desktop, FX Trading (FXT), into its trading workflows.

FX Trading brings together all Thomson Reuters FX transaction venues onto a comprehensive end-to-end platform to streamline workflows and create a single point of access to the industry’s largest collective independent pool of FX Liquidity .

To unlock the Asian market, register now to the iFX EXPO in Hong Kong

Increasing Asian Demand

The announcement follows the increasing demand from FX professionals in Japan and across Asia to improve the efficiency and effectiveness of Execution , as well as the need for a platform to trade diversified instruments.

In 2015 Thomson Reuters brought together all of its FX transaction venues onto one platform to create a single point of access to unrivalled liquidity in hundreds of currency pairs. FXT delivers multiple venues for spot, FX swaps, Options and NDFs via a single, integrated platform. Users also gain access to new order types such as Peg, TWAP and Icebergs, thus providing greater flexibility and choice in execution.

Moreover, FXT enables market participants to streamline their trading workflow by including compliance tools, straight-through processing, confirmations as well as settlement and trade history reports. It helps market participants comply with regulatory trade requirements by providing access to regulated trading venues and a global trade reporting service.

Michael Go, Head of FX Market Development, Asia Pacific at Thomson Reuters, said: “We are proud of Mizuho’s selection of FXT, which highlights Thomson Reuters achievements and progress in the foreign exchange space. As a highly effective and comprehensive ecosystem of Thomson Reuters FX solutions, FXT allows market participants to access superior FX liquidity, manage trading risks and connect seamlessly with the global FX community.”

World’s Largest FX Community

Users are also able to connect with the world’s largest professional FX community, with over 14,000 dealing counterparties, 1,500 FXall buy-side liquidity takers and over 300,000 Eikon Messenger contacts.

Yosuke Takahashi, Foreign Markets Team 1, International Foreign Exchange Department, Mizuho Bank, added: “The biggest advantage of FXT for dealers is the availability of more ordering methods. FXT is not only a system that executes matching, but it also offers conversation functions where transfers can communicate with the external parties and information gathering function. Only FXT combines these functions on one single platform. These functions are helpful in developing transactions strategy and informing decision making.”