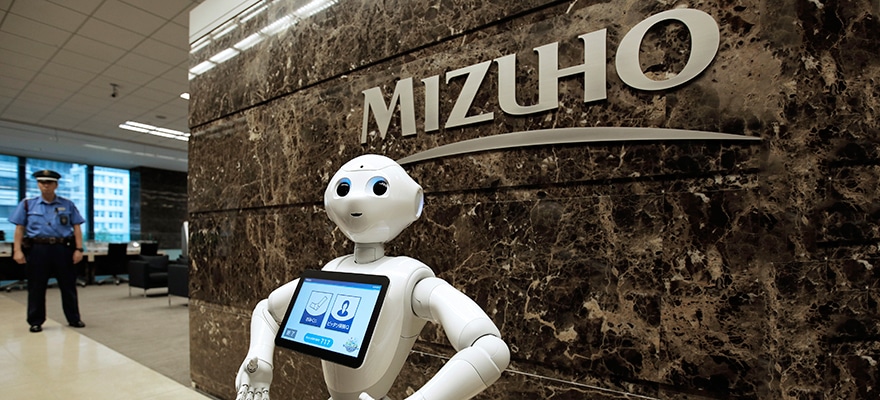

Global clearing house LCH announced this Monday that it has provided access to its Euro debt clearing services to its first Japanese financial institution, Mizuho Securities Co., Ltd, as a member of RepoClear.

LCH SA’s debt clearing services is the largest European pool of cleared debt, according to the statement released by the company today. By joining the service, Mizuho can now access this netting pool as well as the benefits of central clearing.

Central clearing, or central counterparty clearing, is a financial institution that reduces the counterparty, operational, settlement, market, legal, and default risk for traders. This is because the entity becomes the counterpart to the buyer and seller, guaranteeing the terms of a trade even if one party pulls out of the agreement.

Commenting on the development, Corentine Poilvet-Clèdiere, Head of RepoClear and Collateral, LCH SA, said: “I’m delighted to welcome Mizuho as LCH SA’s first Japanese clearing member.

“This is an important step in the international development of RepoClear’s service, building on the consolidation of Euro debt clearing into LCH SA earlier this year. We look forward to continuing to expand our membership base and our service offering over the coming months.”

Mizuho continues to expand offering

So far this year, Mizuho has been expanding its capabilities through a number of partnerships. As Finance Magnates reported, the Japanese bank partnered with smartTrade technologies to deliver its electronic foreign exchange (Forex ) platform.

Through the partnership, Mizuho Bank is able to centralize the aggregation process and optimize, as well as internalize, the management of their FX flows. In addition, the partnership allowed the bank to cut down on costs, as well as create new investment opportunities for its clients.

“Becoming a member of LCH SA means that Mizuho is now able to benefit from the largest pool of Euro debt clearing in Europe,” added Nozomi Kishimoto and Amandine Triadu, Head of Repo in Tokyo and London respectively at Mizuho Securities.

“Clearing through LCH SA enables us to maintain access to this important Liquidity pool while managing our counterparty risk effectively.”