The global operator of several industry and professional facing information and trading services, under the Thomson Reuters brand, today announced its 2015 annual report, which it also filed with the SEC ahead of the market open this Wednesday. The company employs over 55,000 people through its numerous subsidiaries and main business lines, including Financial & Risk, Legal, and Tax & Accounting segments.

Using IFRS Financial reporting measures in its results Thomson Reuters said its 2015 revenues were $12.2 billion and lower by 3% from $12.6 billion during 2014, and had lower operating profit of $1.73 billion for 2015, a 30% decrease from 2014’s total. This resulted in a 32% drop in its diluted earnings per share down to $1.60 per share for 2015 from $2.35 for the previous year.

Its 2017 forecast still remains $2.80 per share, as announced in February, and the company’s cash flow at the end of last year had strengthened, up 414 million to nearly $2.84 billion in terms of its balance sheet. Total assets were $29.1 billion at the end of 2015 although lower by $1.5 billion year-over-year.

Thomson Reuters said that the Financial & Risk segment achieved its EBITDA margin target of 30% (before currency) in Q4 2015, yet the division's revenues were essentially unchanged. Overall for 2015 that segment saw a 3% decline in revenues to $1.527 billion from $1.597 billion in 2014, but excluding the decline in price adjustments from consolidated legacy products and lower recovery revenues, the segment's revenues grew by 2% year-over-year.

Net earnings for the three months ending December 31st 2015 (Q4) were down 64% to 417 million, blamed on the lower operating profits that had been partly offset by lower net financing costs.

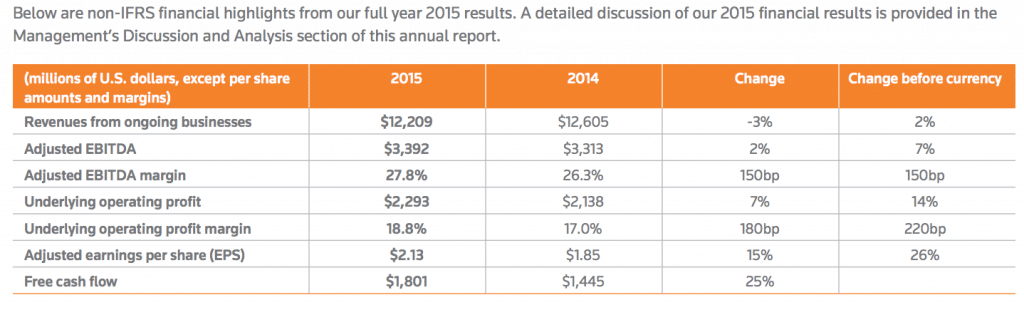

The company said that the reason for the drop in operating profit was mainly due to a 2014 gain that it had recorded in connection with the loss of control of a subsidiary that involved the settlement of an intercompany loan that was considered permanent (that it has to book at as gain). Excluding that item, on a non-IFRS basis, the underlying operating profit was $2.29 billion, up 7% from $2.13 billion for the prior year on an underlying profit basis. Adjusted EBITDA also rose 2% to $3.39 billion from $3.31billion.

Acquisition Spending Cut

The company has cut down considerably on acquisition spending in an effort to grow the business organically as opposed to the accretive revenues it could obtain from buying other companies. It only spent $37 million on such deals in 2015 compared to nearly $950 million between 2009 and 2013.

According to a reference about Thomson Reuters Foreign Exchange (FX) businesses, it said that it reached a key milestone after it consolidated its FX venues and post-trade services into its new FX Trading Platform .

Transactions revenues rose 1% as contributions from the FXall and BETA businesses were partly offset by lower revenues from FX matching. In addition, the company noted that revenues for its recovery efforts, which are low-margin revenues that Thomson Reuters collects and largely passes through to a third party information provider, such as with Stock Exchange fees, had decreased 5% in 2015.

Forecasts for the year ahead were in low single digit figures, at 2-3% for the Financial & Risk segment, where the company said that material risks included uneven economic growth globally, recession or volatile currency movements across the markets that it served. These could result in reduced spending levels by its clients, and global market conditions could depress transaction volumes in its key trading segment. Below is an excerpt from the 2015 report.

Source: Thomson Reuters 2015 Annual Report