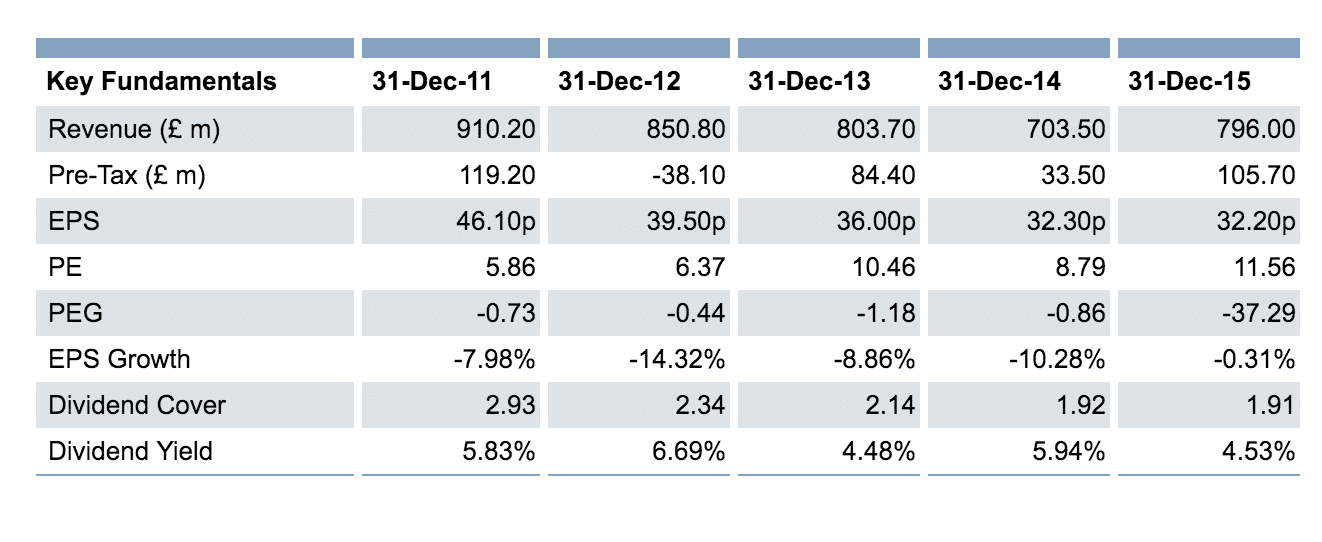

Preliminary results for Tullett Prebon's year ending December 31, 2015, highlighted revenue up 13% across every region, and operating profit higher by 7%, but with operating margins decreased when excluding exceptional items and acquisition costs - as the company invested in expanding its business, and which resulted in basic earnings per share being little-changed to the downside by 1 tenth of a pence to 32.2 pence year-over-year.

Financial highlights for 2015 on a preliminary basis, excluding exceptional items and acquisition costs, included revenue of £796.0 million, up from £703.5 million reported in the previous year, thus helping to buck a multi-year downtrend in topline revenue.

Operating profit totaled £107.9 million for 2015 for Tullett Prebon, and was up from £100.7 million when compared year-over-year. The decrease in operating margin fell from 14.3% in the prior year to 13.6% for 2015, whereas profit before tax was £93.7 million, up from £86.6 million reported for 2014.

Revenues Lifted from Energy

When including the exceptional and acquisitions items, the basic EPS was 34 pence, up from 11.2 pence YoY, and the expected proposed dividend for May was anticipated to be unchanged at 11.25 per share in the upcoming board vote in April, in line with the total dividend of 16.85 pence per share that was paid in the prior year.

The bulk of revenues were driven by the company's energy and commodities business lines, including from the PVM acquired business, which together helped to deliver £204.3 million during 2015, up over 100% according to the presentation shown during the company's online webcast of the results.

With regard to the challenges and market environment during 2015, during the online presentation the company's CEO said: “Overall trading volumes in the banks - which are still our main customer - were way down due to balance sheet constraints borne of post-financial crisis regulation.”

Tullett Prebon Results

Source: London Stock Exchange

The company had taken up a cost reduction initiative that including lowering the number of staff across key segments in Europe and the Middle East, which are Tullett Prebon's higher revenue earning regions. Cost reduction efforts were also undertaken within the Americas, and included restructuring broker contracts in North America, and as revenues from the company’s broking segment was 3% lower YoY.

Revenue from the traditional interdealer broker product areas including treasury products, interest rate derivatives, and fixed income fell 6% year-over-year. The drop was described as having been partly offset by growth in Tullet Prebon's energy and equities divisions, whereas, revenue from information sales and Risk Management services was 14% higher in 2015, when compared to the prior year.

Commenting in the preliminary report, John Phizackerley, Chief Executive of Tullett Prebon plc, said: “We achieved a good overall financial performance in 2015 against the backdrop of a challenging trading environment and subdued client demand.”

Continued Investment in Growth

Mr. Phizackerley also highlighted the ICAP deal: "We took a number of initiatives during 2015 in pursuit of our goal to become the world’s most trusted source of Liquidity in hybrid OTC markets and the best operator in global hybrid voice broking. The agreement for the acquisition of ICAP’s global hybrid voice broking and information business provides a unique opportunity to accelerate the delivery of our strategy, and we are in the process of planning the integration of the two businesses to be implemented after completion of the transaction which we expect will be during 2016.”

“We will continue to look for opportunities to deliver our objectives to build revenue and raise the quality and quantity of earnings through further diversification of the client base, continued expansion into Energy and commodities, and building scale in the Americas and Asia Pacific, whilst preserving the business’s core franchises,” he added.