Today UBS released its 2015 annual report where the banking conglomerate cited how the absence of credible improvements in the eurozone and geopolitical uncertainty added to overall financial market uncertainty during 2015. This included the Swiss franc anomaly that occurred last January, and weakness in the Chinese economy towards the end of the year, both having had an impact on its business, among other external market developments.

Yet, against these market conditions the company was able to achieve a net profit of CHF 6.2 billion attributable to shareholders, and which represents an increase of 79% when compared to 2014's total. The firm's management highlighted in the opening statement that UBS surpassed its 10% target for the adjusted return on tangible equity as it hit 13.7% on a full-year basis, and how the net profit was the best in the last eight years for the Swiss company.

Profit before tax on an adjusted basis for UBS Wealth Management’s division was up 13% to CHF 2.8 billion in 2015 when compared to CHF 2.7 billion in the prior year.

Robust Recovery

Through the company's Personal & Corporate Banking division, the adjusted profit before tax was CHF 1.7 billion and up by CHF 100 million reported from 2014's total of CHF 1.6 billion. The company said that it had attracted a record number of new customers, and this increase was the best it had had since 2010, for that division. UBS was ordered by the SEC to pay a fine last October in connection with an offering to US investors regarding a product structured against a forex trading strategy.

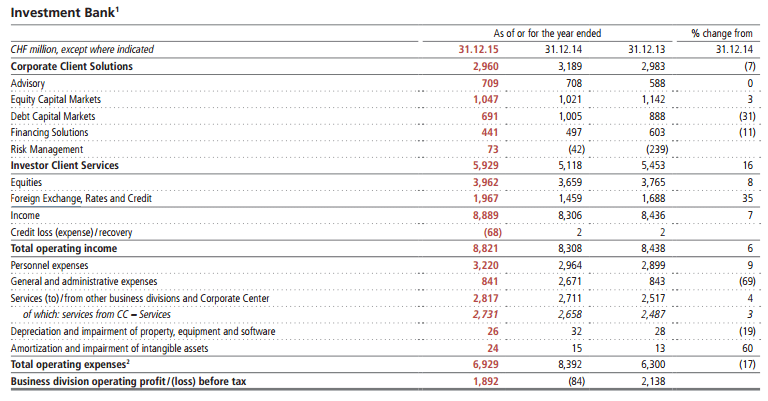

UBS Investment Bank division saw net interest and trading income rise by CHF 669 million to nearly CHF 5.19 billion, driven largely by higher revenues in its forex and rates segments within the Investor Client Services division. The company said this mirrored higher client activity and elevated volatility, and noted the Swiss National Bank’s actions of 15 January 2015 as well.

An excerpt from the report shows the Foreign Exchange division alongside other parts of the company's investment bank unit:

Source: UBS 2015 Annual Report

Despite the geopolitical risks also noted in the report regarding a potential Brexit scenario, an excerpt of UBS' 2016 outlook for Europe noted: "In the eurozone, we observe persistent support from loose monetary policy and expect a rise in real disposable spending power, more readily available credit, and mildly expansionary fiscal policy. Together, these factors should support a moderate improvement in growth prospects."

Competition

Also noted by UBS were some of the company's competitors including BlackRock, JP Morgan Asset Management, BNP Paribas Investment Partners, Amundi, Goldman Sachs Asset Management, AllianceBernstein Investments, Schroders and Morgan Stanley Investment Management, and other firms with a specific market or asset class focus. For UBS's equities and foreign exchange and corporate advisory businesses, it said competitors included the major global investment banks, such as Bank of America Merrill Lynch, Barclays, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, JP Morgan Chase and Morgan Stanley.

The company said technology innovation remained a top priority during 2015 as it launched its Swiss peer-to-peer mobile Payments application Paymit, and the global trading platform Wealth Management Online as well as upgrading its UBS Neo product for the company's investment bank division. Shares of UBS Group on the Swiss SIX Exchange were up 1.2% around time of the news, and follows Finance Magnates' recent coverage of the changes the company made to its FX prime brokerage division after it made a new appointment to the marketing division at its investment bank.