The UK's Financial Conduct Authority (FCA) has proposed a set of reforms aimed at strengthening the resilience of money market funds (MMFs) operating in the country. The watchdog wants to increase the minimum proportion of highly liquid assets in MMFs’ hands and remove some of the existing regulatory requirements.

FCA Proposes Reforms to Strengthen Money Market Funds

In a consultation paper published today (Wednesday), the FCA has outlined several measures to reduce vulnerabilities in MMFs and bring regulations more in line with international standards. The proposed changes reflect the FCA's support for ongoing work by the Financial Stability Board to address issues with MMFs globally.

The FCA noted these proposals “will further enhance MMF resilience, as set out in the consultation paper. Overall, all of our proposals prioritize strengthening the existing regulatory regime for MMFs.”

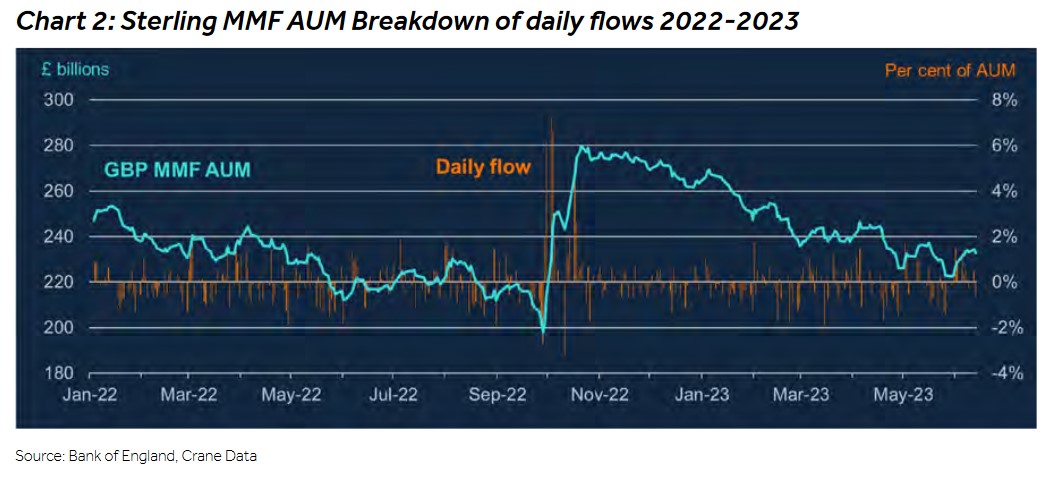

The first change suggests a considerable enhancement in the minimum quota of highly liquid assets that all types of MMFs are required to maintain. This measure is designed to ensure that MMFs possess sufficient liquid assets to manage substantial withdrawals over a brief duration during severe but plausible market stress.

The second proposal involves removing existing requirements that tie liquid asset minimums to imposing controls on investor redemptions for important MMF types. Delinking these policies will reduce the incentive for preemptive runs driven by concerns over the future ability to access funds.

The consultation is open to response until March 2024. Based on feedback, the FCA will finalize rules strengthening protections for investors in MMFs. The reforms would apply to UK-authorized MMFs, including those domiciled overseas but sold into the UK market.

ESMA Presented Its Own Changes

The FCA’s recent measures are a response to the early-year proposals by the European Securities and Markets Authority (ESMA) regarding MMFs. ESMA 's consultation paper underscored two primary revisions to the existing approach. Firstly, it introduced updated liquidity scenarios reflecting the intense stress experienced during the Covid-induced market shock. Secondly, it focused on refining the macro strategy to more accurately assess its macroprudential impact, taking into account market dynamics and participant behavior.

ESMA, in its first comprehensive market report on European Union MMFs, revealed that the total assets under European managers’ control in MMFs amounted to €1.44 trillion in 2021. The report highlighted that a significant majority, about 89%, of these funds are based in France, Luxembourg, and Ireland.

ESMA's report further indicated that over 90% of the investors in these money market funds across Europe are professional investors, pointing to a high level of expertise and understanding among the fund's clientele.

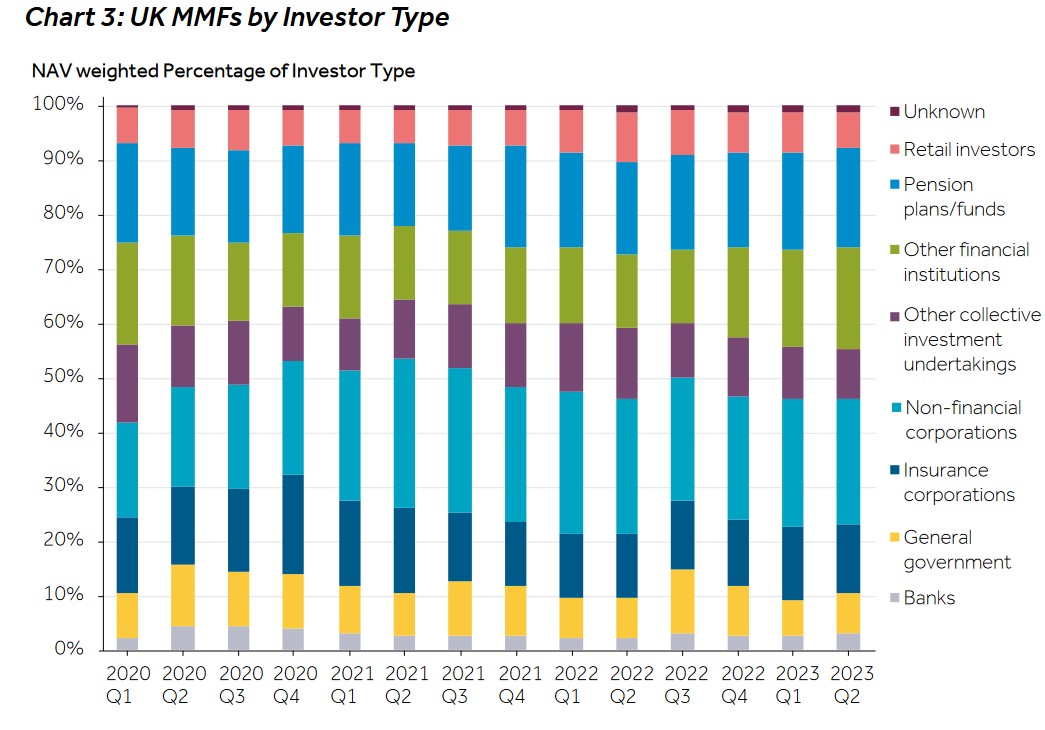

As shown in the chart below, this data is also confirmed by the latest consultation paper from the FCA:

“Among UK investors, MMFs are predominantly used by financial services firms – investment funds, pension funds and other non-bank financial institutions,” the FCA commented.