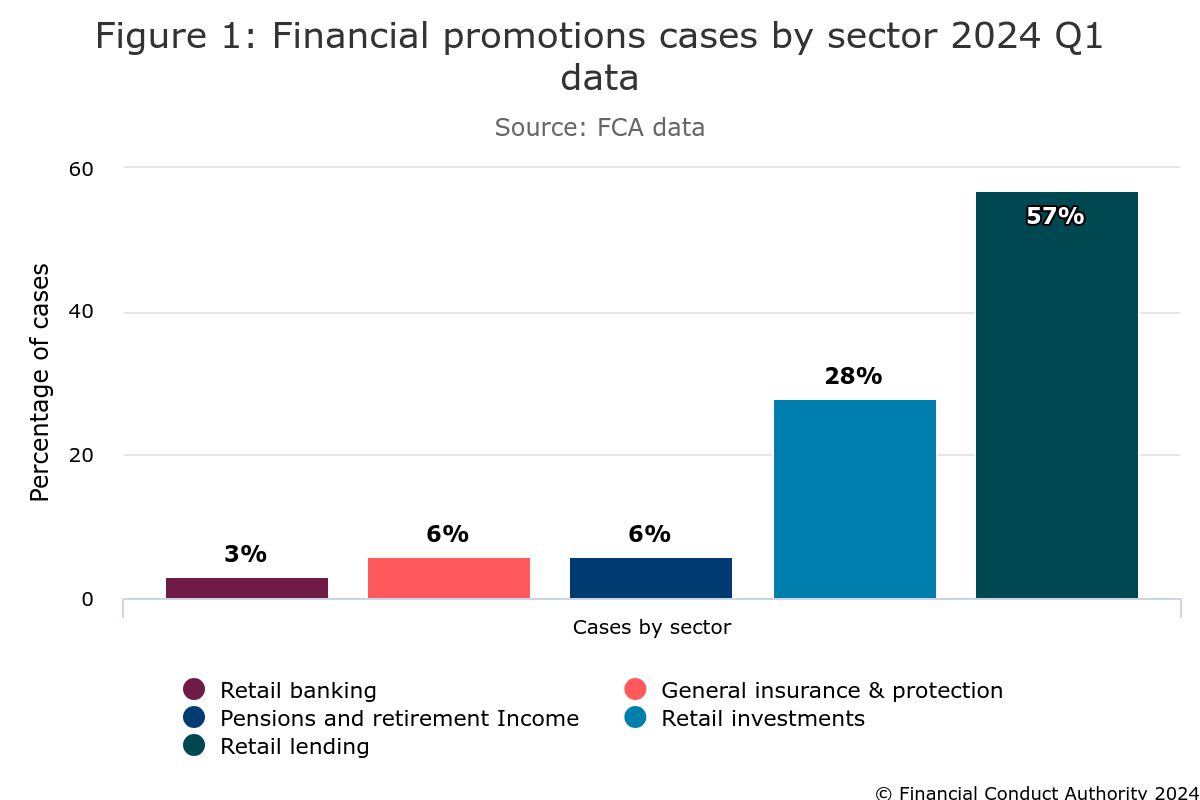

The Financial Conduct Authority (FCA) ordered the amendment or withdrawal of 2,211 financial promotions in the first quarter of 2024. According to the FCA, the most affected sectors are retail investment and retail lending. The data for the period between January 1 and March 31, 2024, highlighted actions taken against firms breaching financial promotion rules and investigations of unregulated activities.

Enforcing Financial Promotion Rules

The retail investments and retail lending sectors experienced the highest rate of orders to amend or withdraw promotions, accounting for 85% of the FCA's interventions. Additionally, in the first quarter, the FCA received 5,722 reports about potential unauthorized business activities. Responding to these reports, the watchdog issued 597 alerts regarding unauthorized firms and individuals.

Notably, 11% of these alerts were related to clone scams, where fraudsters impersonate authorized firms to deceive consumers. These scams often involve online breaches of financial promotion restrictions.

Oversight and Compliance

During the first quarter of 2024, the FCA implemented several regulatory measures to enhance oversight and compliance in the financial promotions space. Notably, initiatives include the introduction of the financial promotions approval gateway, which requires firms to obtain approval from the FCA before endorsing financial promotions on behalf of unauthorized firms.

Additionally, the FCA conducted reviews to assess compliance with Direct Offer Financial Promotion rules and took proactive steps to address breaches where necessary. The regulator has expressed commitment to safeguarding consumers from misleading financial promotions.

In 2023, the FCA canceled 1,266 unauthorized firms and imposed record fines. Additionally, the agency removed over 10,000 potentially misleading adverts and issued 2,243 warnings about unauthorized firms and individuals.

Besides that, the FCA imposed fines totaling £52,802,900 against entities throughout the year, signaling a robust response to misconduct and sending a clear deterrent message to the industry. The number of canceled entities was double that of the previous year.

Nikhil Rathi, the Chief Executive of the FCA, mentioned: “We know at the FCA our role is not just about regulating financial services, it's about safeguarding futures, supporting innovation and informed risk-taking and maintaining a resilient financial ecosystem.”