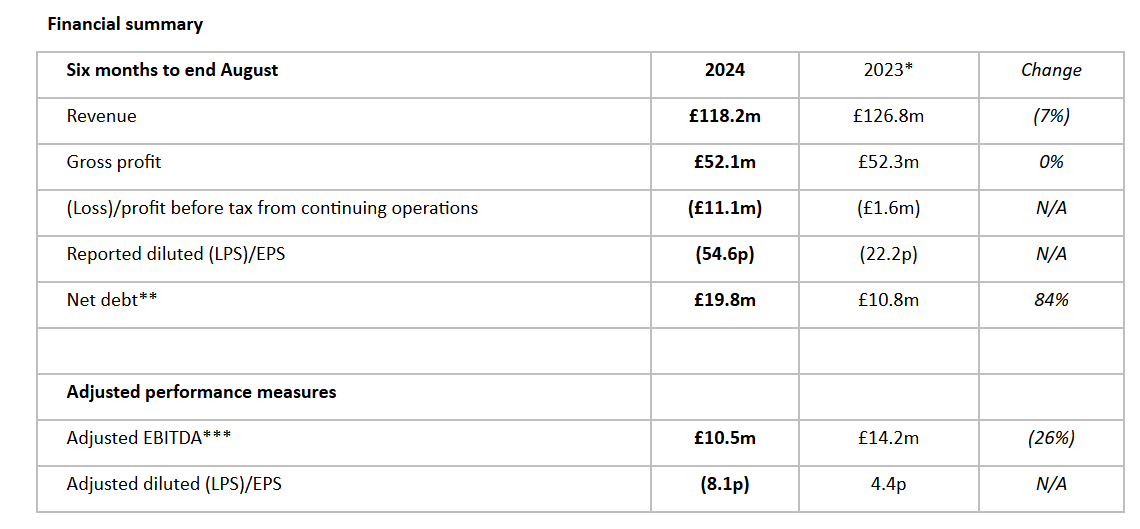

FD Technologies (LSE: FDP) reported today (Tuesday) a 7% decline in revenue to £118.2 million for the first half of fiscal year 2025 (H1 FY25), highlighting ongoing challenges in its business transformation journey. The company's financial results revealed mounting pressures on profitability despite stable gross margins.

FD Technologies Reports Revenue Decline amid Transformation Efforts

The technology firm's adjusted EBITDA dropped 26% to £10.5 million, while net debt increased significantly to £19.8 million, up 84% from the previous year's £10.8 million. The company's bottom line showed a widening loss before tax from continuing operations of £11.1 million, compared to a £1.6 million loss in the same period last year.

Despite the revenue headwinds, FD Technologies maintained its gross profit relatively stable at £52.1 million, demonstrating resilience in its core business margins. The company acknowledged an expected churn rate of 8–10% in the current fiscal year, with improvements anticipated in FY26 and beyond.

The financial results reflect the company's ongoing strategic repositioning, with reported diluted loss per share increasing to 54.6 pence, compared to 22.2 pence in the previous year. Adjusted earnings metrics also showed pressure, with adjusted diluted loss per share at 8.1 pence, down from a positive 4.4 pence in the comparative period.

Revenue of the Sold First Derivative Also Declines

FD Technologies recently announced a plan to sell its First Derivative business to EPAM Systems for £230 million. The transaction, expected to close before year-end, is part of the company's strategic move to concentrate on its high-growth KX division, which specializes in real-time analytics and AI-driven solutions.

First Derivative's revenue declined 2% year-over-year to £78.8 million during the reporting period.

“We have made significant strategic and operational progress in the first half, with the divestment of First Derivative and strong execution in KX,” commented Seamus Keating, the CEO of FD Technologies. “Following the completion of the sale of First Derivative, we expect to return cash to shareholders, in line with our disciplined approach to capital allocation, and KX will be a pure-play, high-growth software.”

Meanwhile, the KX division saw a 5% revenue growth, reaching £39.5 million. Its annual contract value (ACV) also increased to £7.4 million, aligning with the company's forecasted range of £6–8 million.

Regarding the fiscal year 2024, FD Technologies reported a total revenue of £248.9 million. The KX division showcased robust performance, with revenue increasing by 12% in constant currencies to £79 million. Recurring revenue emerged as a key growth driver for KX, rising 19% year-over-year. This recurring component now represents 86% of the division’s total revenue, up from 81% in the previous fiscal period, underscoring the division's growing reliance on stable, long-term revenue streams.