Two UK-registered entities of the Finalto Group, Finalto Trading Limited (previously Tradetech Alpha Limited) and Finalto Financial Services Limited (formerly CFH Clearing Limited), ended 2023 with a combined turnover of more than $74.1 million, a decline of about 7.9 percent. However, combined profits soared to $13 million from 2022’s $6 million, a year-on-year jump of 116 percent.

Migration from One Unit to the Other

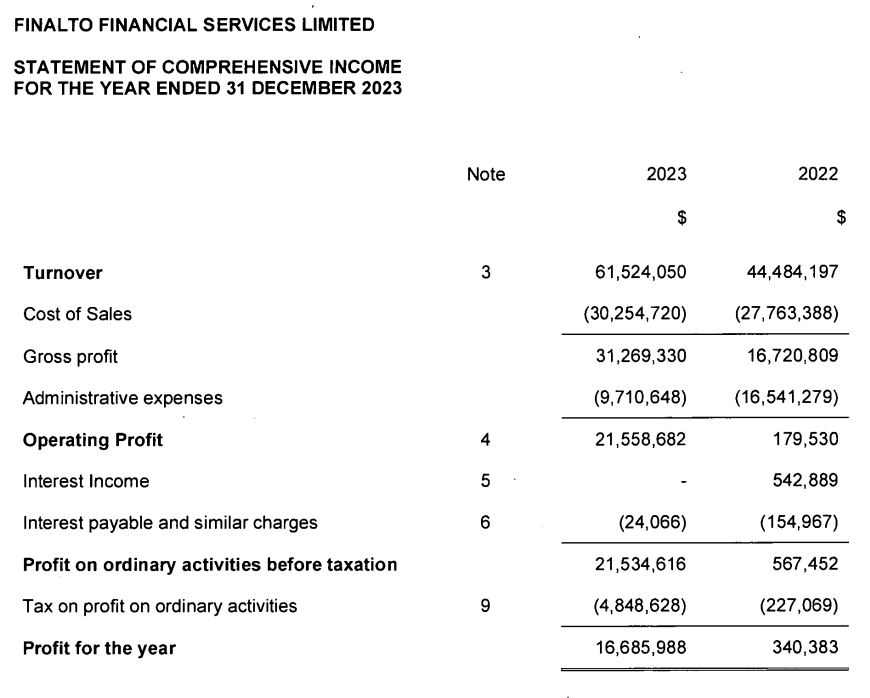

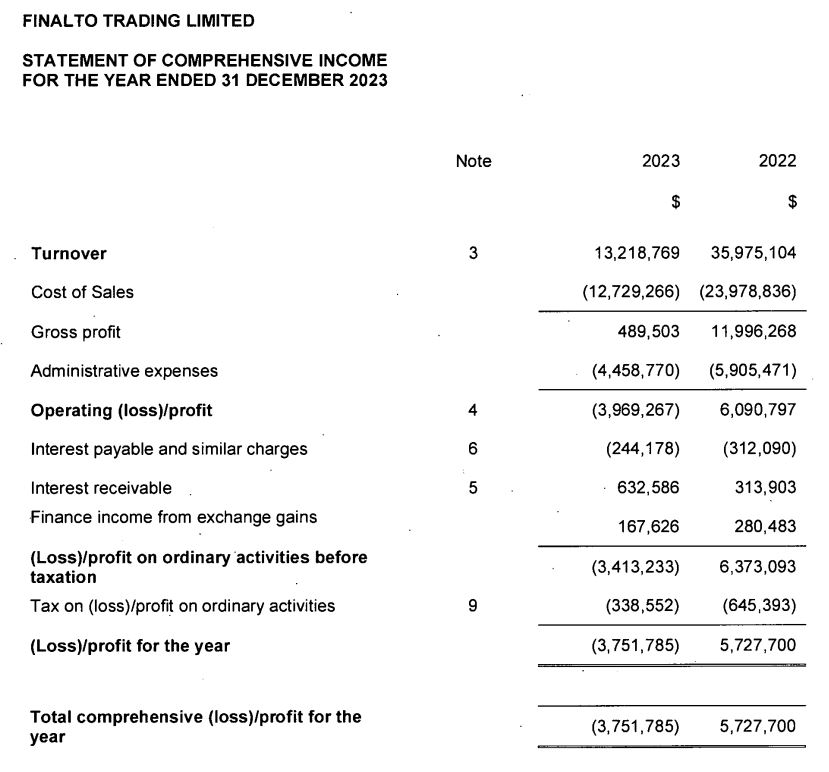

The annual revenue of Finalto Financial Services jumped to $61.5 million from the previous year’s $44.5 million, while Finalto Trading’s revenue dropped to $13.2 million from almost $36 million. The decline in Finalto Trading’s revenue was due to the migration of clients to its sister entity, Finalto Financial Services.

The latest Companies House filings revealed that the migration of clients started in 2023 and was expected to be completed by the end of the first half of 2024.

Finalto Financial Services provides brokerage services for leveraged products. Its sister company, Finalto Trading, operates as a forex, CFDs, and spread bets broker, offering services to retail and professional traders. Hong Kong-based Gopher took control of both companies last year through the sale of the Finalto Group for $250 million.

“Whilst the ultimate strategic plan for the company is still being finalised, the company remains a going concern and of strategic value to the Group,” the filing of Finalto Trading stated. Meanwhile, the migration benefited Finalto Financial Services, resulting in its “improved performance.”

Profit Soars

The increased revenue of Finalto Financial Services also resulted in a profit windfall: it netted almost $16.7 million, significantly higher compared to $340,383 in 2022. However, the migration pushed Finalto Trading into a loss of over $3.7 million from the previous year’s $5.7 million in profit.

The trading volume on Finalto Financial Services jumped 17 percent to $1.4 trillion, which, according to the Companies House filing, was due to the roll-out of new products and services, the enhancement of its income diversity, and functionality additions.

However, the client trading volume on Finalto Trading declined to $312 billion from 2022’s $485 billion, which was a direct result of the migration. The company highlighted that its other performance metrics, including yield, cash availability, solvency, and regulatory capital, remained strong.

Meanwhile, the South African unit of Finalto recently launched a new White Label solution designed to help market participants quickly establish their brokerages by offering liquidity, along with a customizable back office, client portal, CRM, and multi-asset trading platforms.