Last month, the foreign exchange (Forex or FX) market saw no shortage of volatility, particularly in the Japanese yen and the declining US dollar. As a result, the average daily volumes (ADV) of the largest institutional players in the industry recorded increases both monthly and annually.

Institutional Spot FX Volumes Up in Asia and the US

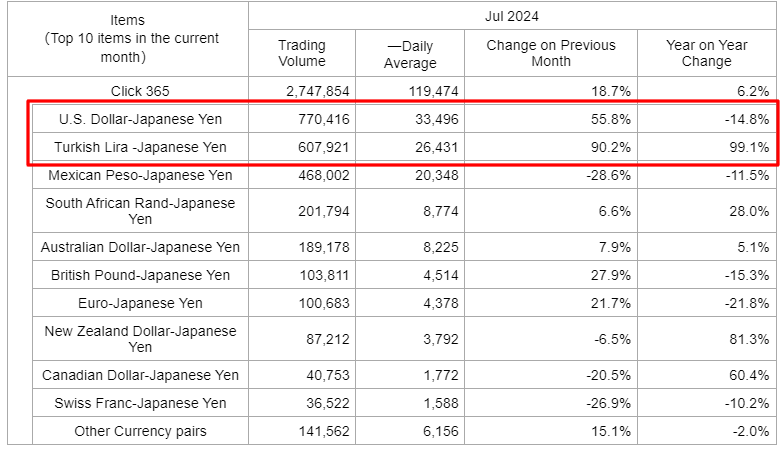

At the Japanese platform Click 365, owned by Tokyo Financial Exchange (TFX), currency volumes in July reached 2,747,854 contracts, increasing by 19% compared to June and 6.2% compared to the same period last year. The average daily volumes stood at 119,474.

The highest activity, similar to previous months, was observed on the USD/JPY pair, generating an ADV of 33,496 contracts, which was a 56% jump compared to June, but a 15% decrease compared to July 2023.

It's also worth noting that the second most popular pair became TRY/JPY with an ADV of 26,431 contracts and a jump of over 90% both on a monthly and annual basis.

In the US market, FX volumes also grew. Cboe spot volumes in July were $1 trillion, rising from $950 billion reported a month earlier. Due to a higher number of trading days, the ADV indicator declined. In June, trading occurred for 20 days, and in July, it occurred for 23, resulting in an average daily volume of $44.5 billion compared to $47.5 billion from the previous month.

Europe Also on the Rise

How does the situation look in the Old Continent? For Euronext FX, total volumes grew to $583 billion, and the ADV indicator was $25 billion. This result is better than June's when Forex's volume stood at $558 billion. However, similar to Cboe, a higher number of trading days caused the ADV to slide from over $28 billion.

On the German stock exchange -owned 360T, July FX volumes exceeded $707 billion, rising from $634 billion reported a month earlier. ADV also recorded a modest jump, from $30.2 billion to $30.8 billion in July.

It's worth noting that these results are higher than last year. At that time, 360T's ADV was $29.6 billion, while CBOE's was $43.9 billion.