February was not a good period for major FX trading centers, as average daily volumes (ADV) declined across all continents. The drops were most acute in the USA, extending a negative streak to four months. Lower volumes were also observed in Asia, with negative sentiment affecting European centers.

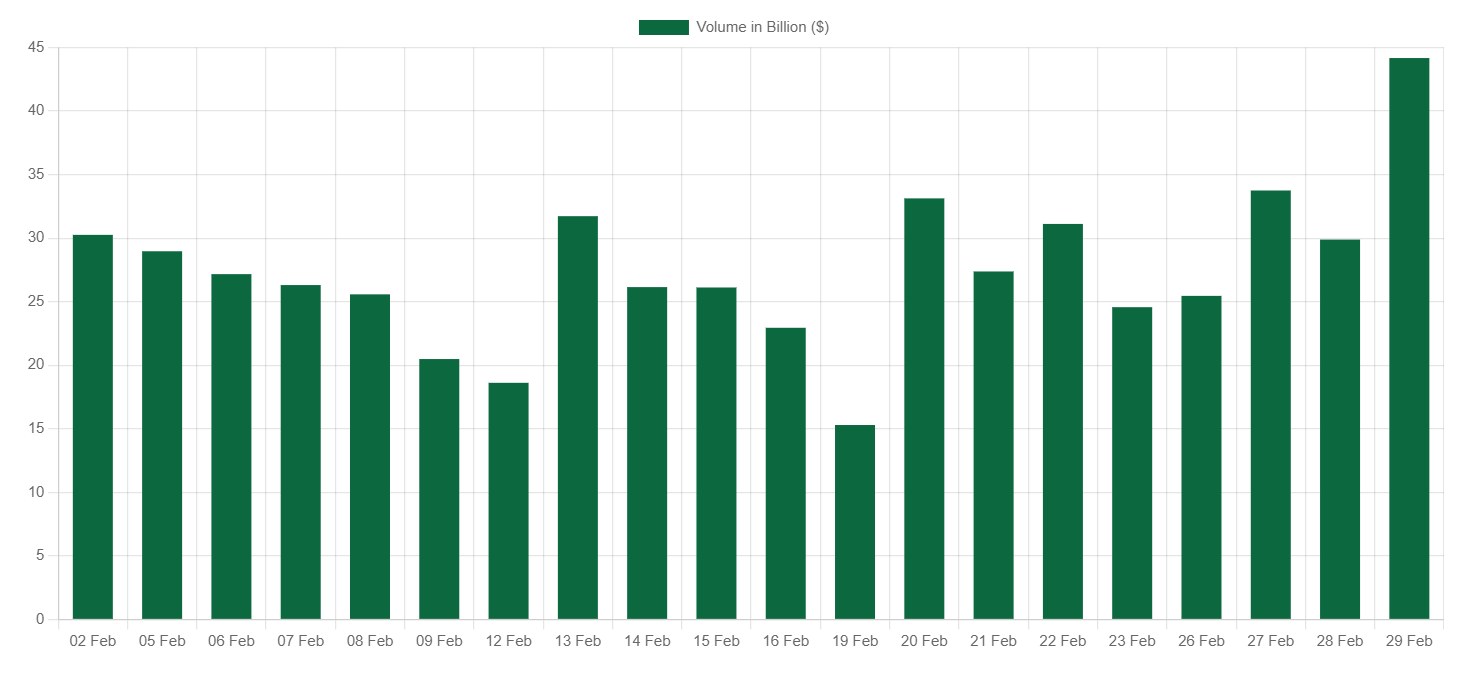

FX Spot Volumes at Cboe Decline since October

February marked the fourth consecutive month of decline in ADV for Cboe FX Markets, dropping to $42.6 billion. This marked a decrease from the previous month's figure of $1 billion, and October 2023's record high of $46.7 billion. The total volume for February was $895.2 billion, compared to $959.8 billion reported in January.

It's worth noting that the past month had one fewer trading day (21) than the first of 2024. Total volumes have been falling from the record values above $1 trillion observed in November and October.

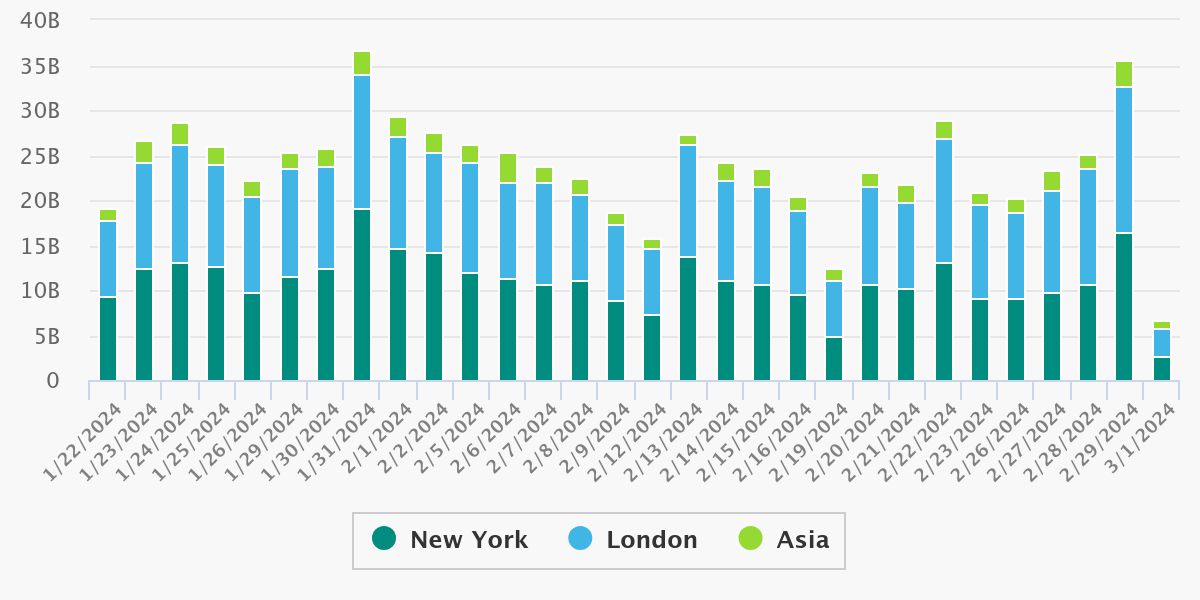

Europe Joins the Negative Trend in FX Volumes

In Europe, Deutsche Börse's 360T reported a drop in ADV to a two-month low of $27.6 billion, compared to $29 billion reported a month earlier. The total volume was just under $580 billion, sliding on a monthly basis. Like Cboe FX Markets, 360T had one fewer trading sessions in February than in January.

In the competing Euronext FX's Fastmatch, a depreciation in both main volume indicators was observed. The total volume at 21 trading sessions fell to $495.8 billion from January's $576 billion, and ADV dropped from $29 billion to $23.6 billion.

Whereas the previous month saw America and Europe as tales of two continents, with volumes falling in the USA and rising in the EU, February saw declines everywhere.

Click365 Experiences Another Monthly Volume Decline

Click365, the FX platform of the Tokyo Stock Exchange , reported a turnover decrease compared to January, amounting to a drop of 13.1%. The total volume of 1,783,795 contracts fell by nearly 25% compared to February 2023.

ADV was at 84,942 contracts, compared to 93,303 in January and 111,661 in December. As in previous months, the most substantial volume depreciation was observed in USD/JPY contracts where the monthly drop was 36%, and the annual nearly 50%.