FXSpotStream, a provider of FX electronic liquidity distribution, has published its monthly volumes report for February 2024, revealing robust trading activity despite prevailing market volatility. The company's latest data underscores the resilience of FX markets amid turbulent economic conditions.

FXSpotStream's February Volumes Revealed

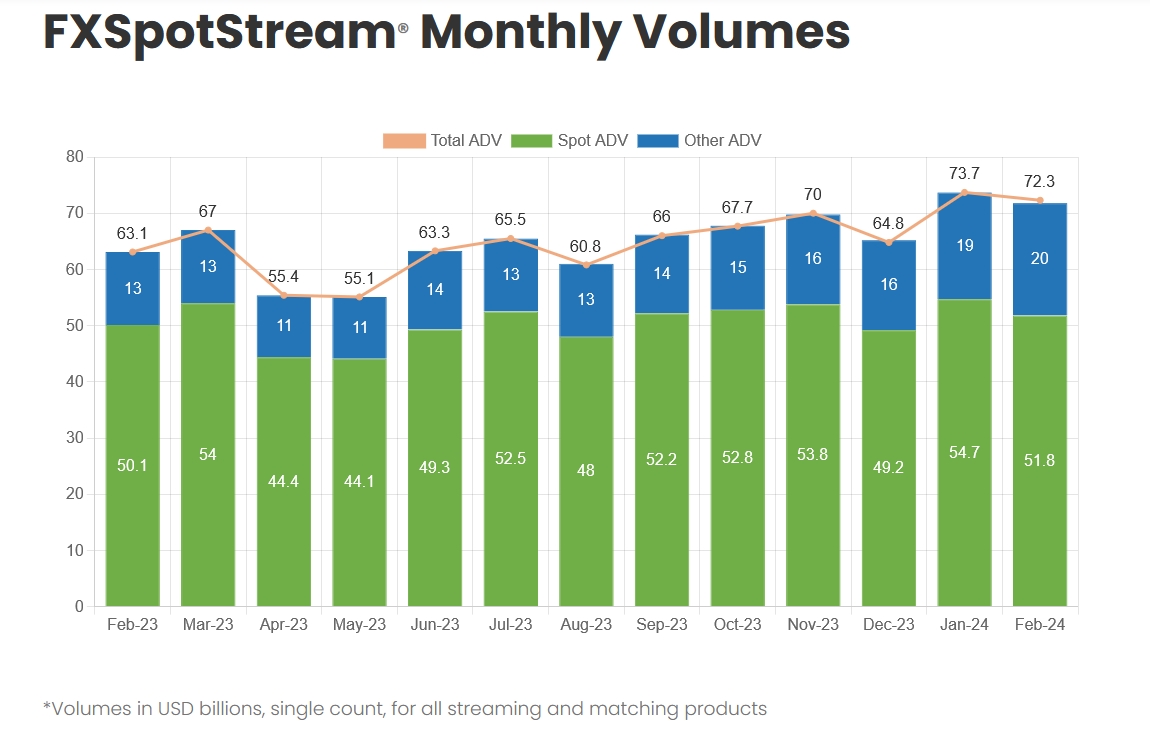

According to FXSpotStream's report, the average daily volume (ADV) for spot transactions in February stood at $51.8 billion, with an additional $20.5 billion traded in other FX products, resulting in a total ADV of $72.3 billion. Despite a slight decrease from January's total ADV of $73.6 billion, the figures demonstrate sustained market engagement amidst ongoing global uncertainties.

Throughout February, FXSpotStream facilitated trading activities across 21 trading days, one day less than in January. Despite the reduced number of trading days, market participants remained active, contributing to the overall trading volumes during the month.

Leadership Transition and Integration of Horizon

Jeff Ward became the Chief Executive Officer at FXSpotStream, which started on January 1, 2024, succeeding Alan Schwarz, the Co-Founder who resigned in the previous year. Tom San Pietro, the Chief Technology Officer, had temporarily filled the CEO position after Schwarz's departure until Ward officially assumed the role.

Moreover, FXSpotStream recently integrated Horizon, FairXchange's data analytics platform, into its operations, improving real-time analytics for more accurate trading execution and analysis. The integration allows FXSpotStream's liquidity management team to better manage relationships with both price-takers and liquidity-providing banks. Clients of FXSpotStream will gain insights into their execution, optimizing trading and bolstering relationships with liquidity providers.

"We are always looking for ways to enhance our offering for both clients and LPs, and FairXchange's Horizon platform will allow our clients to make informed decisions regarding their liquidity," said Antony Brocksom, the Head of Sales at FXSpotStream.

Established in 2011 as a bank-owned consortium, FXSpotStream has expanded its services beyond the institutional spot forex market to include the derivatives market. In addition, it has launched support for FX Algos and allocations over its API, broadening its service offerings.