The start of the new year saw a significant rebound in spot foreign exchange trading volumes reported by FXSpotStream. According to data for January 2024, the total average daily volume (ADV) increased 10% both month-on-month and year-on-year, reaching $73.6 billion.

FXSpotStream Volumes Rise in January

The number of trading days in January was one more than in December for the FX electronic liquidity distribution provider, totaling 22 days. As a result, the total monthly volumes rose to $1,619 billion last month.

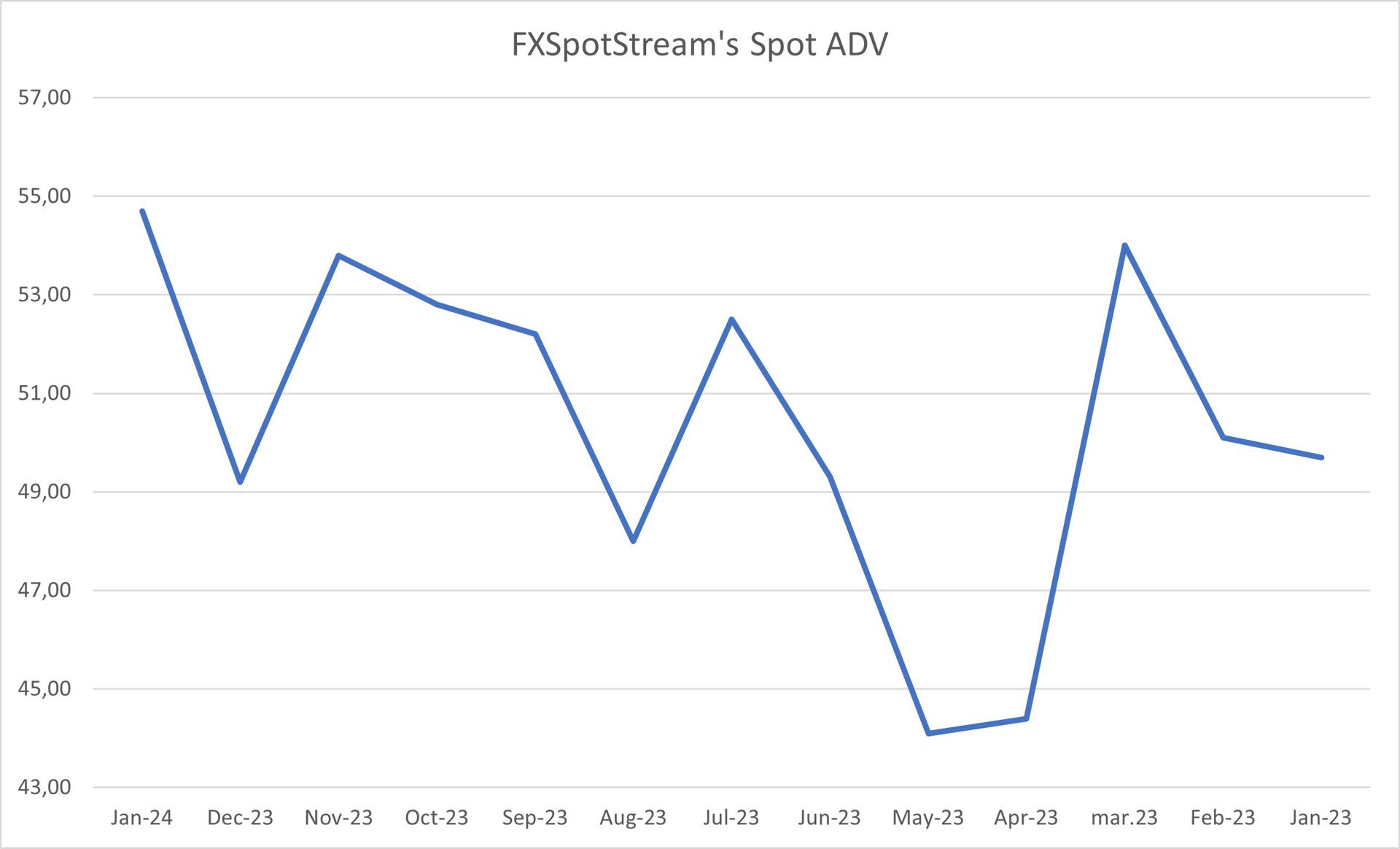

Looking at the spot market data, the ADV reached $57.7 billion in January, improving 10% compared to December, when this figure was $49.2 billion. The year-on-year change was very similar, at 9%, compared to $49.7 billion reported for spot ADV in the same period a year earlier.

Notably, the spot ADV and total ADV values reported by FXSpotStream are the highest since at least 2019. FXSpotStream does not provide data for earlier years on its website.

The high January performance aligns with the strong results achieved throughout 2023, especially towards the end. As Finance Magnates reported, FXSpotStream reported a total ADV of $70 billion in November.

FXSpotStream's New Liquidity Pool and New CEO

Last month, the company announced that Wells Fargo has joined as the 16th liquidity provider on its foreign exchange price streaming service. This is the first new liquidity provider added since NatWest joined over a year ago in 2023. Prior to NatWest, no new entities had joined FXSpotStream's liquidity pool since 2020.

FXSpotStream's Chief Technology Officer, Tom San Pietro, stated that the addition of Wells Fargo demonstrates the high interest from banks to join as liquidity providers . He said that FXSpotStream's growth, client service, performance and reliability have made it an appealing platform.

In related news, Jeff Ward took over as FXSpotStream's new Chief Executive Officer on January 1st, 2024. His appointment was announced last August to permanently replace Alan Schwarz, the former CEO and a Co-Founder who stepped down in 2023 after 11 years leading the company.

Following Schwarz's departure, San Pietro temporarily filled the CEO role until Ward's official appointment, which was confirmed via a LinkedIn post. The transition comes as FXSpotStream, an electronic FX liquidity distribution provider, looks to continue expanding its liquidity pool and client base under new permanent leadership.