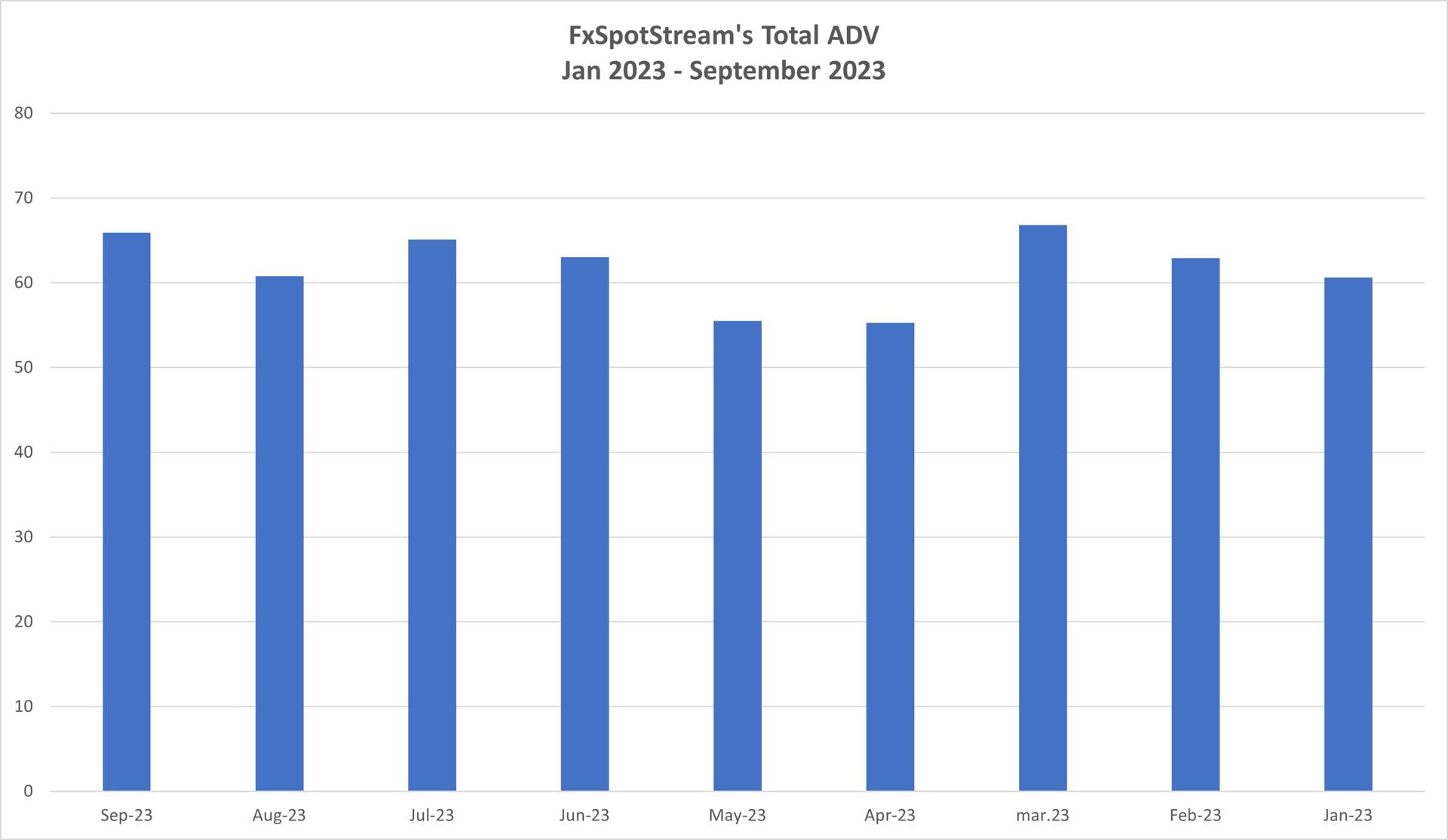

Spot foreign exchange transactions for institutional investors have continued to show mixed results for another consecutive month. The latest data from FxSpotStream, a New Jersey-based provider of multibank price streaming services for FX spot and swaps , confirms this trend. While the total average daily volume (ADV) was higher in September compared to August, it showed a decline on a year-over-year (YoY) basis.

FxSpotStream Announces September 2023 Volumes and Introduces New Reporting Guidelines

In a message sent to Finance Magnates, FxSpotStream announced that it now provides more detailed information about its monthly volumes, breaking them down into more categories. Tom San Pietro, the Chief Technology Officer and Interim CEO of FxSpotStream explained that this move aims to align with market standards and enhance transparency. As a result, spot FX volumes have been separated to better showcase where trading is taking place.

"Our core product is, and always has been spot, and we see that reflected in our volumes. We feel that the move helps to improve transparency in the FX market and highlights the excellent work that is being done on a daily basis at FxSpotStream," added Pietro.

However, moving on to the actual results, the total ADV in September was $95.99 billion, increasing 8.63% compared to August's figure of $60.8 billion. However, when comparing this result with the figures from the same period last year, the indicator recorded a decline of 10.03%.

This also applies to spot ADV volumes, which grew 8.7% to $52.2 billion in September but fell by almost 12% YoY. A similar dynamic was also observed in the "other ADV" category where the monthly result improved 8.4% to $13.8 billion, but the YoY result declined 2.6%.

FxSpotStream additionally noted that the number of trading days in September was 21 instead of 23 trading days.

Other Centers Also Report Mixed Results

As reported by Finance Magnates yesterday, other major trading centers showed mixed spot volumes in the FX market for September 2023. While Cboe FX and Deutsche Börse's 360T saw a rebound after a weak August, Euronext FX and Click365 reported a decline in trading activity.

For Cboe FX, September values were $952.01 billion, compared to $944.44 billion reported a month earlier. 360T saw an increase of over $80 billion, reaching $585.77 billion. Euronext FX, however, recorded a decline in volume from $518 billion to $503 billion, and Japan's Click365 dropped 16.7% to a level of 1,917,266 contracts.