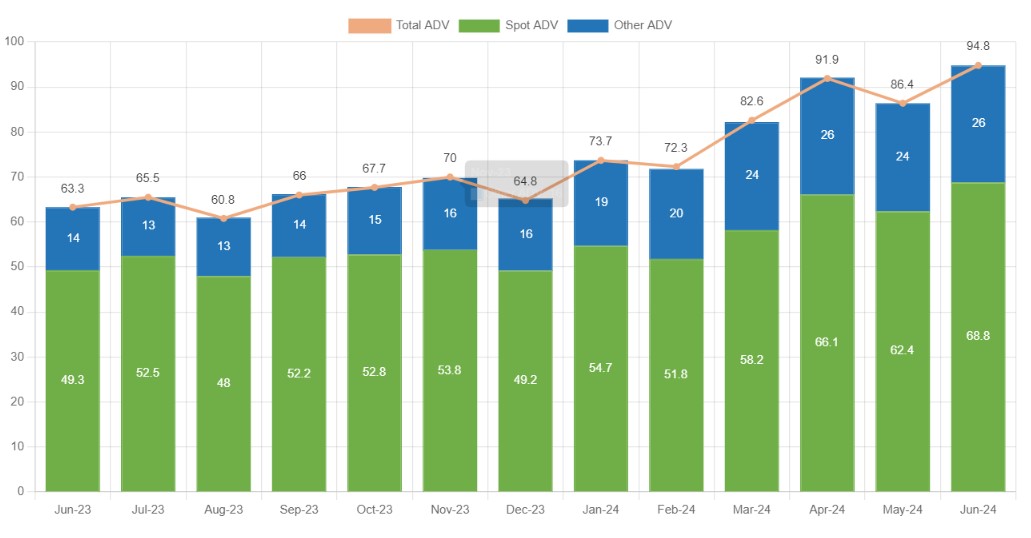

FXSpotStream, the provider of multibank price streaming services to clients supporting FX trading, reported a boost in the average trading volumes (ADV) for the month of June. The spot ADV soared 39% year-over-year, while other ADV skyrocketed 85% YoY from USD $14 billion.

Double-Digit Growth

The spot ADV rose 10% from USD $62.4 billion to USD $68.8 billion in June. Similarly, other ADV jumped 8% from USD $24 billion to USD $26 billion. The platform's total ADV was USD $94.8 billion, a 9.7% increase from USD $86.4 billion in May.

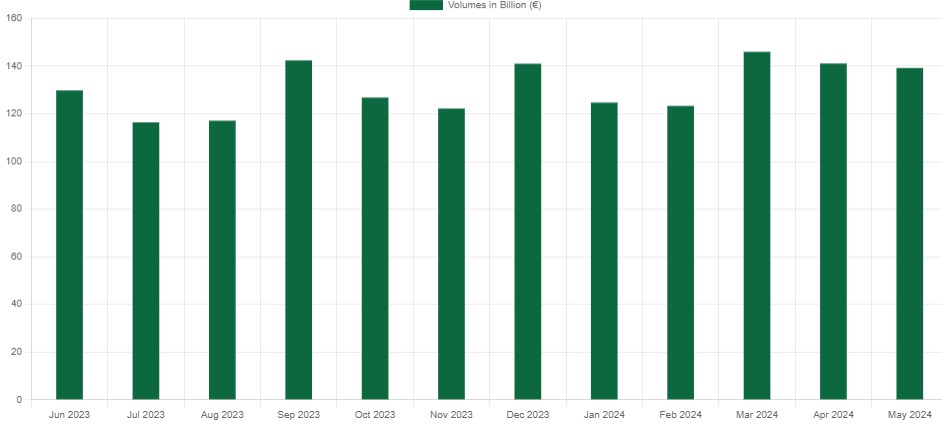

Elsewhere, 360T's daily volumes closed at USD $2,589,269,266.9, a drop from USD $3,209,370,392.22 in the same period of May. However, this decline, which represents a 21% decrease, could partly be attributed to shorter trading days in June.

On the Tokyo Financial Exchange's Click 365, the trading volume was 2,315,198, representing a 4.2% decline from the previous month and a 15.8% decline YoY. The daily average was 115, 760.

Topping the list of the most traded items was the Mexican Peso-Japanese Yen, which had 655,124 in trading volume and 32,756 in the daily average. This amount marked a 24.6% and 23.1% month-on-month and year-over-year increase, respectively.

Cboe ADV for June

Similarly, the numbers were negative on Cboe, where the spot volumes dropped 2% from USD $970,822 to $950,283. In contrast, the average daily volume rose 12% from USD $42,209 to USD $47,514. The trading days for May were 23, while that of June were 20 days.

The demand for forex trading instruments soared in March, as FXSpotStream posted a record ADV for the month at $82.6 billion. The total ADV jumped 14% compared to the previous month, while the yearly increase was more than 23%. The record figures came after the platform experienced USD $73.6 billion and USD $72.3 billion total ADV for January and February, respectively, making it the strongest quarter.