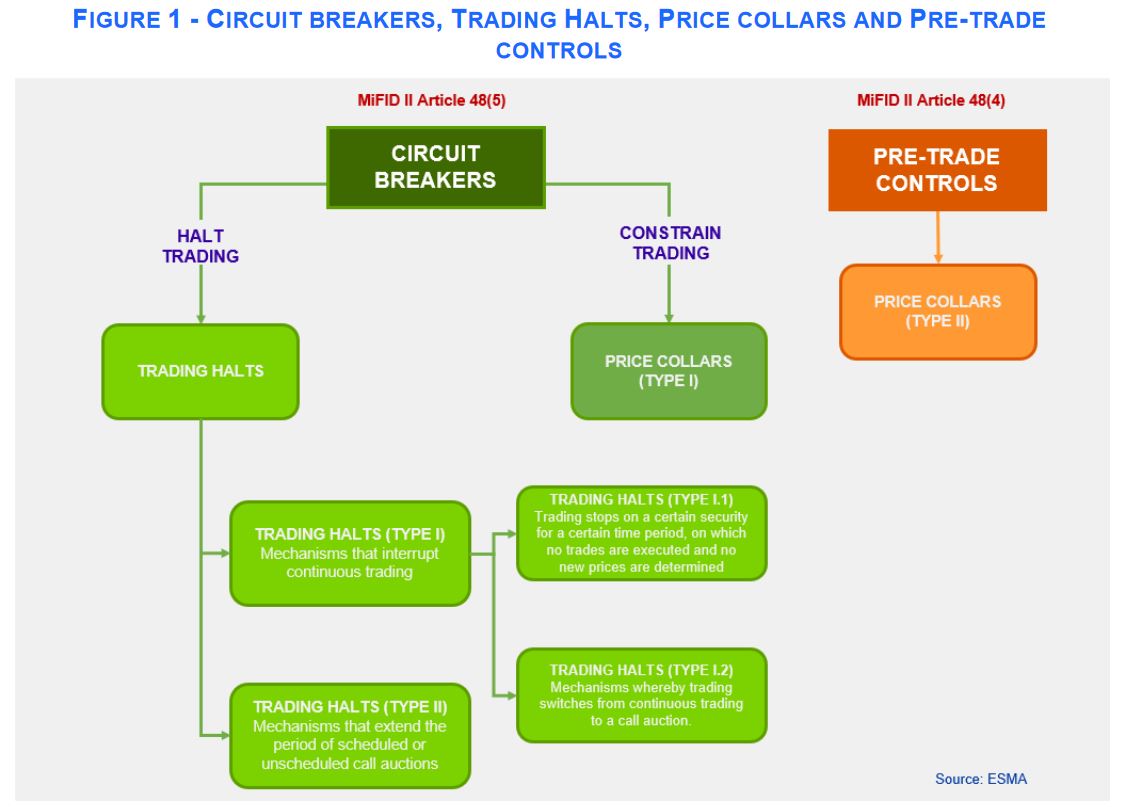

The European Securities and Markets Authority (ESMA) has published new guidance regarding the use of circuit breakers by trading venues to protect markets against excessive volatility. Circuit breakers temporarily halt or restrict trading during periods of significant price movements.

Why Circuit Breakers Are Important

Circuit breakers serve as an essential safeguard during times of high market volatility and stress. By temporarily pausing trading, circuit breakers aim to restore orderly market conditions and give market participants time to reassess valuations and their trading strategies.

Recent events like Russia's invasion of Ukraine and the May 2022 "flash crash" led to extreme volatility in commodity derivatives and equity markets. The presence of well-calibrated circuit breakers can mitigate the impact of such volatility, providing a controlled environment for market participants to navigate through uncertain times.

This makes them an indispensable tool for maintaining the overall health and integrity of financial markets. For this reason, ESMA has presented its expectations for the effective implementation of circuit breakers.

Overview of New ESMA Guidance

The new supervisory briefing from ESMA provides a comprehensive overview of regulatory expectations regarding circuit breaker calibration by trading venues. Key aspects include:

- Outlining principles for effective circuit breaker implementation that national regulators should enforce

- Promoting greater convergence in circuit breaker calibration methods

- Covering static price limits and dynamic price collars

- Applicable across asset classes, especially commodity derivatives

National regulators will inform trading venues in their jurisdiction about the new supervisory expectations. Trading venues are then expected to review and adjust their circuit breaker mechanisms as needed to align with ESMA's guidance

Key implementation steps:

- Assess current circuit breaker calibration

- Make necessary adjustments to align with ESMA principles

- Improve calibration to manage volatility better

- Report updated circuit breakers to national regulators

ESMA aims to enhance the ability to manage volatility across EU financial markets by improving circuit breaker calibration. A few months ago, the institution was already "praising" some European regulators for improving their practices.