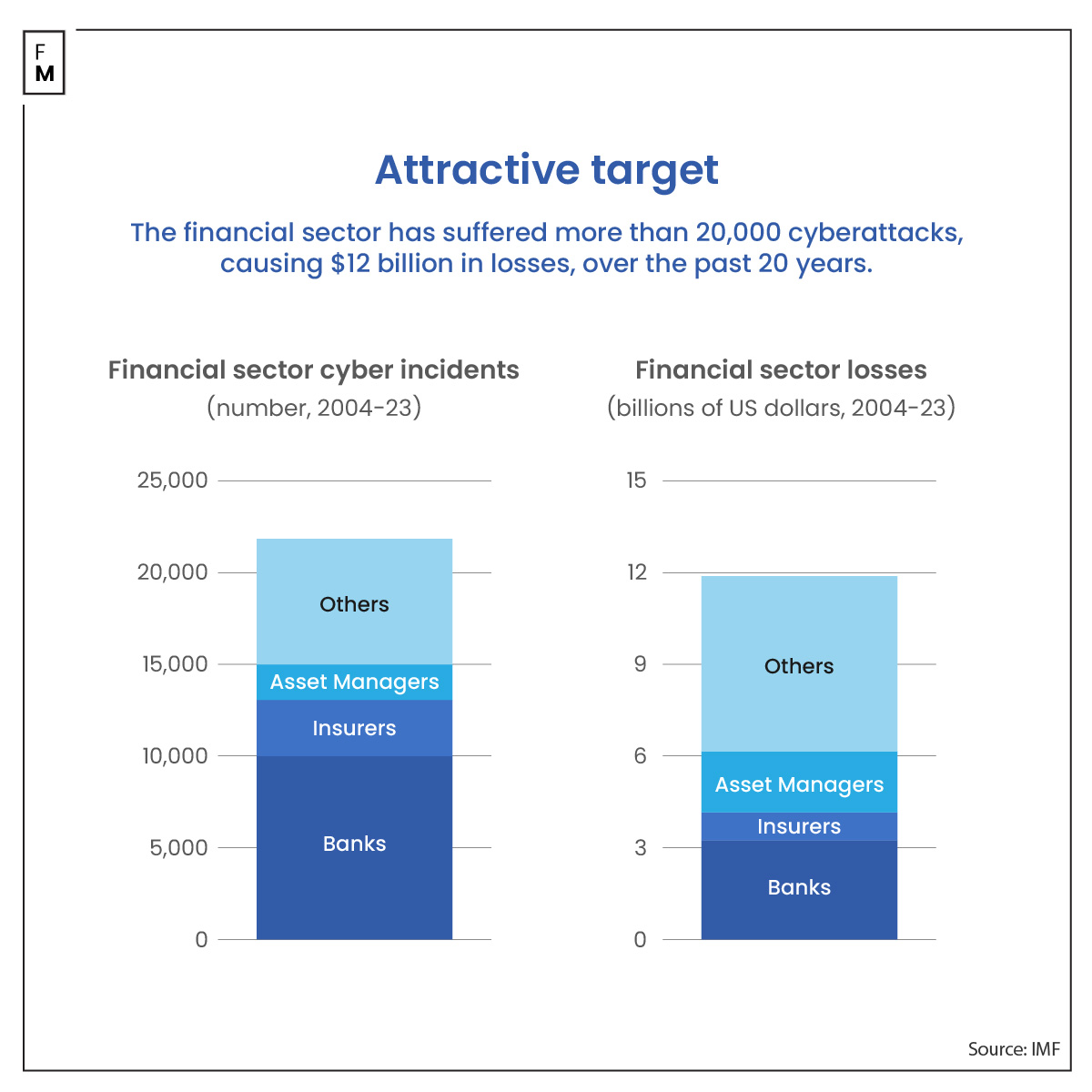

The financial sector has lost $12 billion in the last 20 years as a result of more than 20,000 cases of cyberattacks, according to the latest report by the International Monetary Fund (IMF). This rising trend in cyberattacks is attributed to a surge in digitalization and geopolitical tensions.

Since Covid-19 pandemic began, the incidences of cyberattacks reported by financial firms have doubled. The direct losses incurred by companies in this sector have reportedly increased. In particular, the losses have more than quadrupled since 2017 to $2.5 billion.

Vulnerability in the Financial Sector

Notably, financial institutions are susceptible to the risk of cyberattacks due to the volume of sensitive data and transactions they handle. Banks alone are prime targets, accounting for a significant portion of cyber attacks.

These attacks pose immediate financial threats and have the potential to erode confidence in the financial system, leading to market instability or bank runs. Besides that, the repercussions of cyber security violations could cause economic instability.

“Cyber incidents that disrupt critical services like payment networks could also severely affect economic activity. For example, a December attack at the Central Bank of Lesotho disrupted the national payment system, preventing transactions by domestic bank,” the authors of the report Fabio Natalucci, Mahvash Qureshi, and Felix Suntheim mentioned.

Challenges and Solutions

Addressing cyber risks requires concerted efforts at the national and international levels. While private incentives may fail to mitigate systemic risks, public intervention, effective regulation , and supervision are essential.

To strengthen the resilience of the financial sector, authorities must prioritize the development of comprehensive cybersecurity strategies and regulations. This includes fostering cyber security among financial firms and promoting information sharing.

IMF’s study is corroborated by a recent report by Finance Magnates, which highlighted that the financial services sector in Europe is facing a growing threat from cyberattacks, particularly distributed denial-of-service attacks. These attacks have significantly increased in recent years, posing a serious challenge to the stability and security of financial institutions across the continent.

According to a report by Akamai Technologies, an increase of 119% year-over-year was reported in web application and API attacks towards the end of last year, with the financial sector ranking as the third most targeted industry in the Europe, Middle East, and Africa region.

The banking and insurance sectors are particularly vulnerable due to the sensitive nature of the data they handle, making them attractive targets for cybercriminals seeking to exploit vulnerabilities in their systems.