Marex, a global financial services platform, has announced its plans to introduce client clearing services for interest rate swaps. The company is poised to become the first non-bank Futures Commission Merchant (FCM) to offer this service through LCH's SwapClear, pending final approval.

Marex to Launch Client Clearing for Interest Rate Swaps

Marex's initiative comes as a response to the growing demand from clients for increased counterparty risk diversification, enhanced clearing capacity, and improved market connectivity. By stepping in as a non-bank clearing member, Marex aims to fill a gap in the market and provide an alternative to traditional bank-dominated clearing services.

The introduction of Marex's interest rate swap clearing service is expected to boost liquidity, reduce counterparty risk concentration, and expand overall capacity. According to the information e-mailed to Finance Magnates, the launch of the new service is scheduled for July 15, 2024, subject to final regulatory approval.

“Our entry into interest rate swap clearing is a significant move given the size of this market and complements our existing clearing offering,” said Thomas Texier, Head of Clearing at Marex. “Recent consolidation in the interest rate swaps clearing market has heightened the need for new players.”

The decision comes at a time when Marex has strong financial foundations. According to the report published for 2023 and Q1 2024, the company's revenue increased by 75% to $1.245 billion, while pretax profit jumped 44% to $141 million. The group recorded a 12% growth in revenue for the three months ended March 2024 and a surge of 141% month-on-month in pretax profit.

Marex offers an interest rate swap clearing service designed to work independently of any specific broker. Clients can integrate the service with their existing bank relationships, benefiting from Marex's capabilities without needing to change their current trading setup.

“Our clients will be empowered to trade with greater confidence using Marex’s robust balance sheet, comprehensive end-to-end offerings and our consistent delivery on excellent client service.”

Marex Aims to Go Public in the US

Marex Group has also entered the race to go public in the United States by filing an initial public offering (IPO) of ordinary shares with the Securities and Exchange Commission (SEC).

This strategic move follows the company's decision to cancel a planned listing in the United Kingdom back in 2021. Early signals of Marex's intent to list publicly in the US emerged in early December when it confidentially submitted a preliminary registration statement to the SEC.

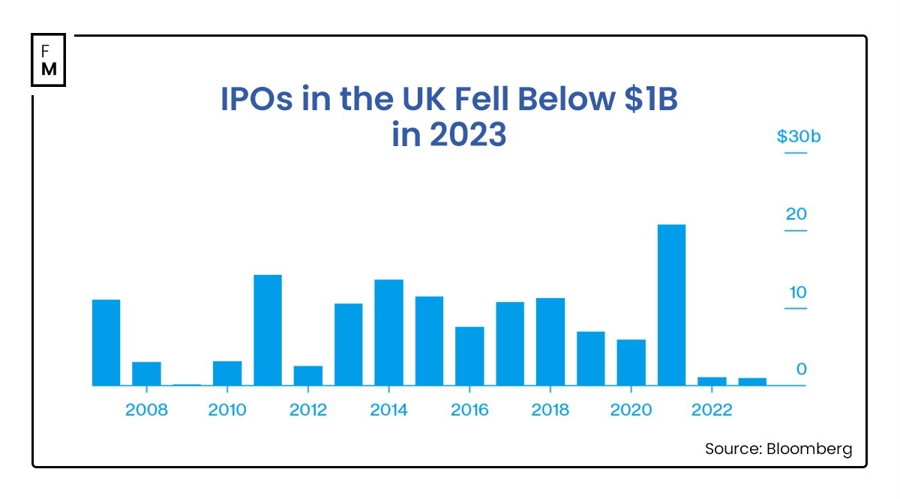

It places Marex among many UK-based companies seeking to enter the US public market. The IPO landscape in 2023 was largely dominated by Nasdaq, which continues to attract the highest volume of public offerings in the Western hemisphere. During the same period, public offerings in London saw a decline of 36%.

Marex also recently enhanced its governance structure by appointing John W. Pietrowicz, a former executive at CME Group, to its Board as an Audit & Compliance Committee member.