The race to go public in the United States has gained a new contender as Marex Group, a UK-based financial services platform, has thrown its hat into the ring by filing for an initial public offering (IPO) of ordinary shares with the Securities and Exchange Commission (SEC).

Marex Group Files for US IPO, Aims to List on Nasdaq

The details of the offering, including the timing, number of shares to be offered, and the price range, have not yet been determined. However, the company aims to list its shares on the Nasdaq stock exchange under the ticker symbol "MRX.”

Furthermore, Barclays, Goldman Sachs & Co. LLC, Jefferies, and Keefe, Bruyette & Woods, a Stifel Company, have been named the joint lead book-running managers for the proposed offering.

Marex Group decided to file for an IPO in the United States after the company dropped plans for a listing in the United Kingdom in 2021. However, the first hints that Marex wanted to become the US publicly-listed company emerged in early December, when it privately submitted a preliminary registration statement to the SEC.

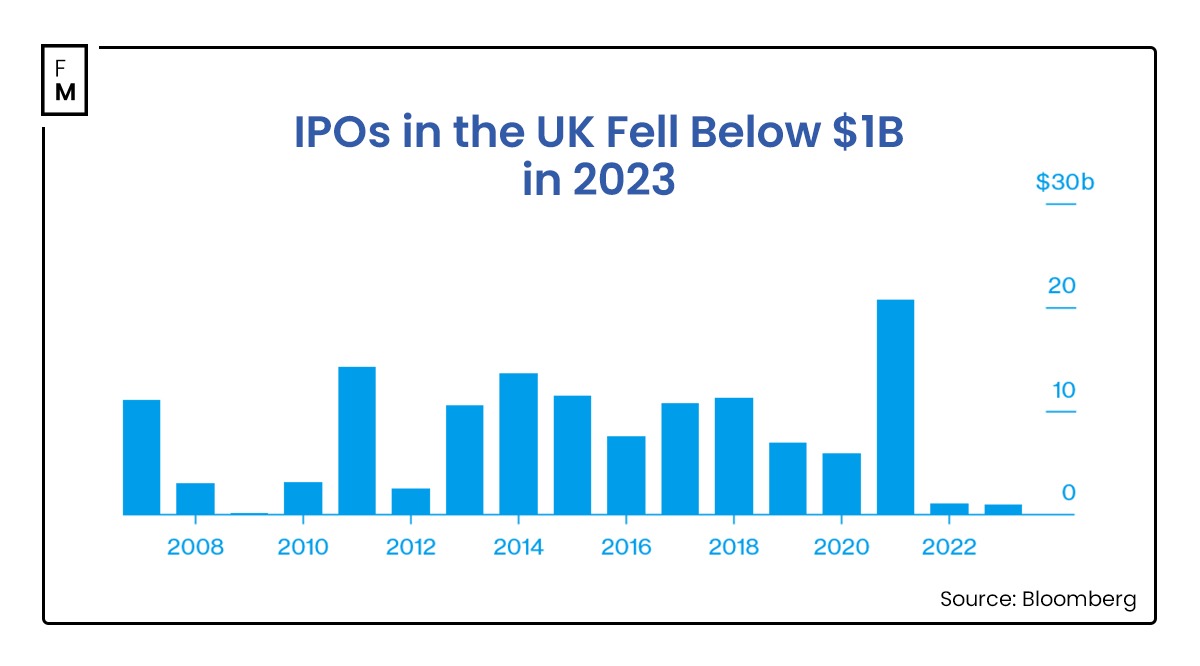

This move has added Marex to the growing list of UK-based firms seeking to go public in the US market. In 2023, the IPO market was dominated by Nasdaq, which attracts the largest number of offerings in the Western world. In London, they fell 36% over the same period.

The IPO information appears two weeks after Marex strengthened its Board by adding John W. Pietrowicz, who serves as a member of the Audit & Compliance Committee and previously worked for the CME Group.

Marex Summarizes the Acquisition of Cowen

Four months ago, the company announced that it had completed the acquisition of Cowen's prime brokerage and outsourced trading business. The transaction was closed two months after its initial announcement.

"Our clients can expect the same high level of service they are accustomed to, with the added benefit of Marex's extensive resources," Jack Seibald, the Director of Marex, commented, expressing optimism about the merger and emphasizing the continuity of service for existing clients.

Last week, Seibald and other Marex representatives explained the benefits the company gained from the acquisition of Cowen. The recording is available here.

Finance Magnates previously reported that Marex strengthened its presence in the Asia-Pacific region by becoming a trading and clearing member of the Singapore Exchange Group (SGX). This strategic move has enabled Marex to provide direct trading and clearing services to SGX clients.