The electronic trading platform MarketAxess Holdings Inc. announced today (Wednesday) its financial results for the fourth quarter (Q4) and the full 2023. The company reported solid revenue growth of almost 11%, along with higher trading volumes across several products and regions.

MarketAxess Reports Solid Growth in Q4 and Full 2023 Results

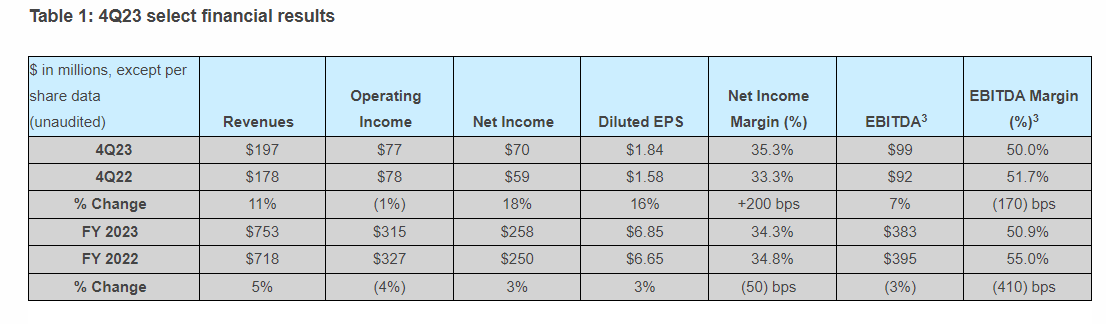

Total revenues for the fourth quarter rose 10.9% year-over-year (YoY) to $197.2 million. This includes revenues from the acquisition of Pragma and a positive impact from foreign currency fluctuations. Net income increased 18% to $69.6 million, while diluted EPS was up 16.5% to $1.84.

For 2023, MarketAxess posted a YoY increase of 5% in total revenues to $753 million. Net income rose 3% to $258 million and diluted EPS grew 3% to $6.85. Also, the results were visibly better than in Q3 2023.

“In 2023, we made significant strides in enhancing our client franchise, increasing client engagement with MarketAxess X-Pro, our new trading platform, and delivering solid growth in ADV across new product areas and regions,” commented Chris Concannon, the CEO of MarketAxess.

The growth was driven by record revenues in information services, an increase of 14.6% in the quarter, as well as post-trade services revenues, that improved 24.1%. MarketAxess benefited from solid volume increases internationally, with average daily trading volume (ADV) from emerging markets and Eurobonds rising 10.8%.

Municipal bonds ADV hit a record high in the quarter, climbing 7.8% YoY. Portfolio trading volumes reached record levels, jumping 35.8% from the prior year. The ADV for the last quarter was significantly boosted by results from November when it reached an all-time high with $303 billion in credit trading volume in a single month. December’s results did not disappoint investors’ expectations.

Future Outlook

In terms of outlook, MarketAxess provided full-year 2024 revenue guidance for the recent acquisition of Pragma in the mid-single digit percentage range compared to Pragma's Q4 2023 revenue base. The company expects total expenses for 2024 between $480 million and $500 million, including Pragma operating expenses estimated at $33-35 million.

“We are entering 2024 with a more favorable backdrop for fixed-income, and our client franchise has never been stronger,” the CEO added. “We are focused on realizing the full potential of the investments we have made to drive continued growth in the quarters ahead.”

Overall, MarketAxess delivered a positive quarter to finish 2023, with higher trading volumes across several products and geographies. The company saw strong adoption of its new trading platform MarketAxess X-Pro and continues working to drive growth from its investments.

In an announcement by MarketAxess in November 2023, the company revealed that Christopher Gerosa, the Chief Financial Officer, will leave his position on 31 January 2024. Gerosa plans to move into a new position at a technology solutions company that serves the commercial banking industry.