Spot currency trading in October 2023 presented mixed data for another consecutive month regarding institutional market operators, including Cboe FX, Deutsche Börse's 360T, Euronext FX, and Click 365. While Cboe managed to achieve growth in volumes both on an annual and monthly basis, the results from Asia and Europe were not as positive.

Cboe FX Reports Higher ADV in October 2023

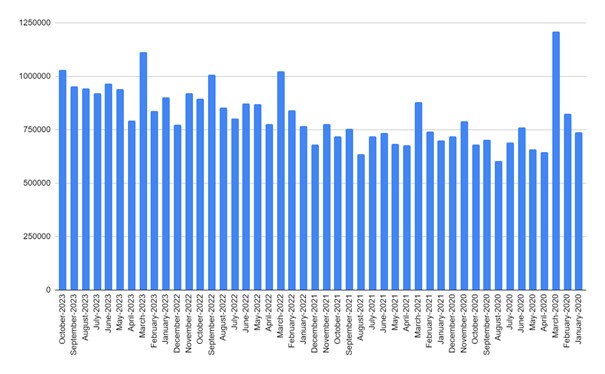

For the US Cboe FX, trading volumes increased for another consecutive month in terms of total values and average daily volumes (ADV). In October, the trading volume was at $1.03 trillion, surpassing $952.01 billion in September and $944.44 billion in August.

Although the number of trading days in October was 22, one more than in August, the ADV still increased to $46.75 billion exceeding the $45.33 billion reported in September.

For Cboe FX, this was the best monthly result since March 2023 when the total volumes were at $1.11 trillion. Generally speaking, volume values exceeding $1 trillion are very rare. Since 2017, this has only occurred five times.

Finance Magnates recently reported that Cboe Digital, a subsidiary of Cboe Global Markets, partnered with Crossover Markets Group, a digital asset market launched last year by two former Jefferies directors.

Mixed Results (Again) in Europe and Asia

In Europe, there were two less trading days in contrast to the United States. 360T Deutsche Börse, a leading European institutional FX trading platform , reported a volume of $567.97 billion in October, marking a decline from September's $585.77 billion. Additionally, the ADV automatically fared worse, standing at $28.4 billion compared to September's figure of $29.29 billion.

Euronext FX, a significant ECN for spot FX and precious metals, experienced a modest rebound from $503 billion to $507.79 billion in October. However, with 22 trading days as opposed to 21, seen in the previous month, the ADV decreased from $23.95 billion to $23.08 billion.

In Asia, particularly with Japan's Click365 operating on the Tokyo Financial Exchange, the decline in volume for another consecutive month was the most pronounced, with an annual decline of 42.8% to 2,067,617 contracts. However, there was nearly a rebound of 8% on a monthly basis from 1,917,266 reported in the previous month.

The currency pair USD/JPY had the largest share in the volumes executed by Click365, accounting for 40% of all transactions. MXN/JPY was in second place, followed by AUD/JPY.