Financial reports for 2023 released by two European companies of the Monex financial conglomerate paint a mixed picture of their financial health. Monex Europe Limited and Monex Europe Holdings Limited, both registered in the UK, reported a decrease in trading income. However, their final net results differ significantly.

Monex Summarizes 2023 Performance in Europe

Monex Europe Limited primarily focuses on commercial foreign exchange and payment services. Monex Europe Holdings Limited is the immediate parent company, but according to its report, EU-based clients were serviced by the former entity.

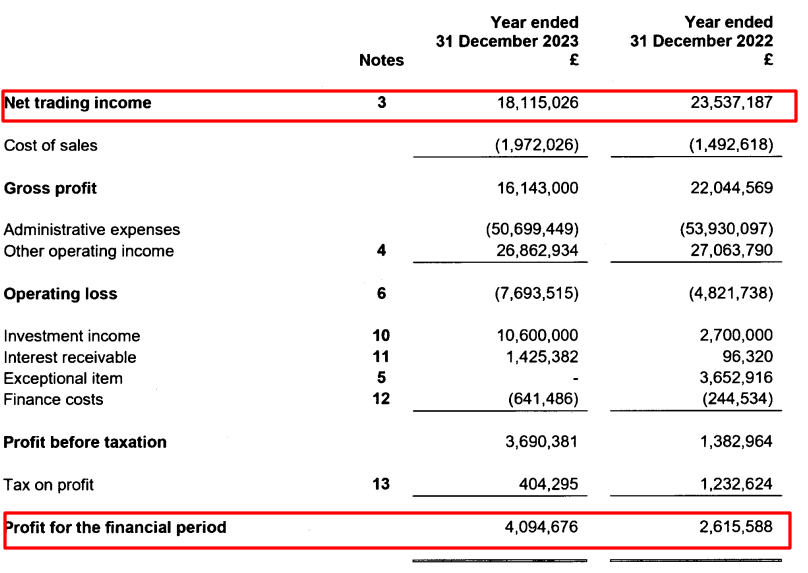

Monex Europe reported a decline in net trading income to £18 million from £23.5 million reported the previous year. Gross profit shrank by 27% to £16.1 million, "which results from unfavorable market conditions that relate to the lack of volatility and prevailing high interest rates."

The company also reported a net operating loss of nearly £7.7 million. However, "investment income" allowed it to achieve a net profit of £4 million for the reported period, compared to £2.6 million reported the previous year.

Monex Europe Holdings Reports Net Loss

As for Monex Europe Holdings, it also recorded a decrease in net trading income and gross profit. The former fell to £73 million, while the latter dropped to £70 million.

The operating profit of nearly £7 million in 2022 turned into a loss of £7.1 million. As a result, the net profit of about £10 million disappeared, and the final net loss amounted to £4.9 million.

"The company intends to consolidate and strengthen its position and continue to review opportunities in the market for trading FX options and FX forward contracts," the report stated. "As a consequence of the more stringent regulatory burdens and a lower appetite for this form of business from dealing and banking counterparties, the directors believe that new entry into this market is becoming increasingly difficult."