The UK forex market is doing well, according to the latest edition of the survey conducted annually by the Bank of England. The average daily reported UK FX turnover (ADV) was $2.928 trillion in October 2023, a visible increase from the $2.844 trillion recorded a year earlier.

FX Turnover Up 3% from April 2023

This week, the Foreign Exchange Joint Standing Committee (FXJSC) released the results of its latest semi-annual survey of turnover in the UK foreign exchange market. The survey, conducted in October 2023, showed continued growth in the UK FX market.

The turnover for October represents an increase of 3% year-over-year (YoY) from October 2022. As is typical for these surveys, the figure for October was lower than the preceding April. This is attributed to seasonal trends in trading activity. In April 2023, the volume reached $3.117 trillion, which is 3% higher.

Although the report aligns with the data from the survey published every three years by the Bank for International Settlements (BIS), there's one thing worth noting. The latest BIS report appeared in October 2022, showing that the ADV of the global FX market is $7.5 trillion.

More importantly, it indicated that the FX market itself was losing some market significance, especially after Brexit, in favor of the USA and Singapore. While London remains the largest player, its transaction share fell from 43% reported in 2019 to 38% in 2022.

Top Currency Pairs Stable

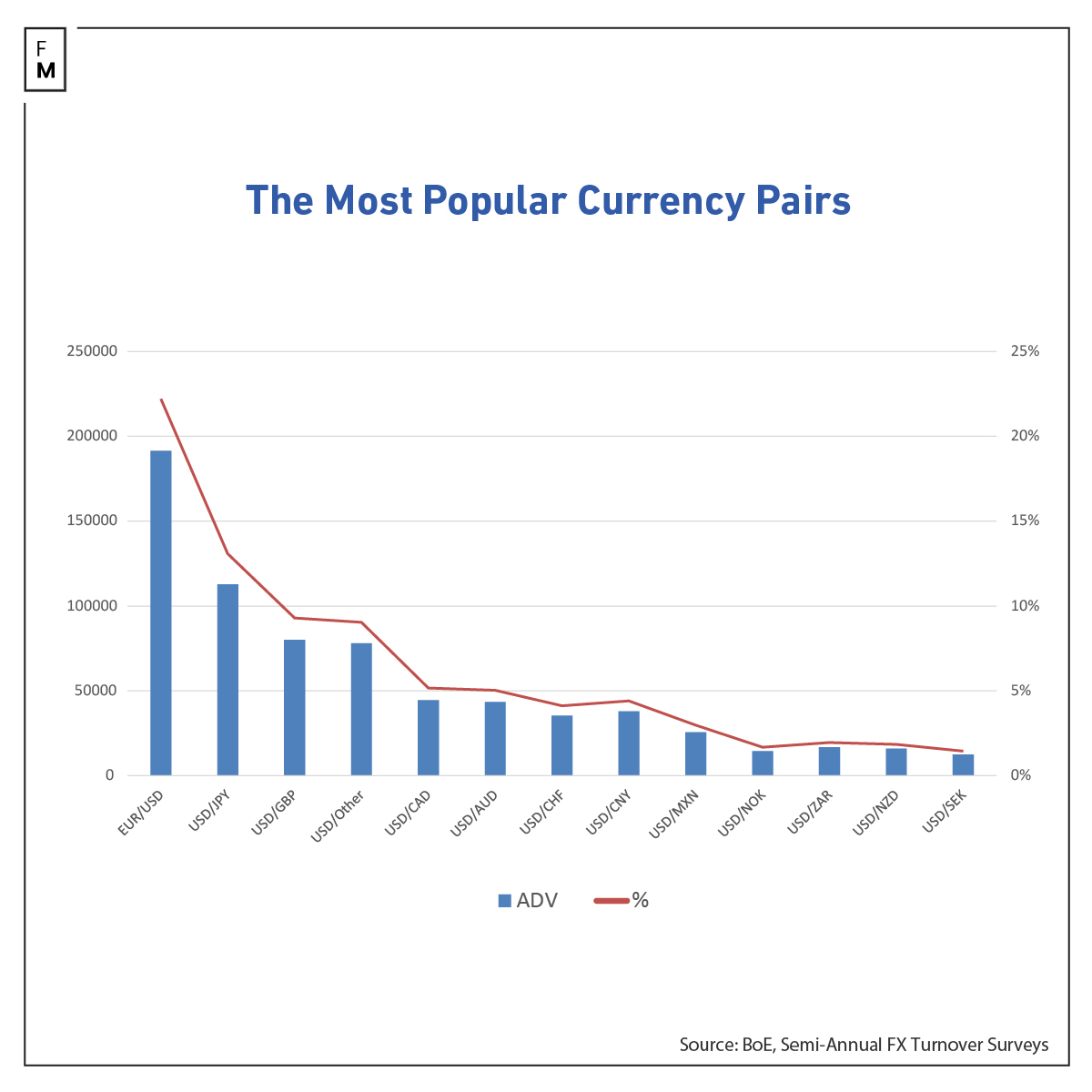

The top three currency pairs by trading volume, EUR/USD, GBP/USD, and USD/JPY, retained their positions from April. These three pairs have held the top spots since the survey began tracking turnover in 2008. The EUR/USD pair remained the most actively traded in London at $738 billion average daily volume, accounting for 25% of total turnover.

Similar FX turnover surveys conducted concurrently in other global financial centers like New York, Tokyo, Singapore, Hong Kong, and Sydney showed comparable results over the last year. This indicates broadly growing activity across FX trading hubs, likely spurred by the same macroeconomic conditions and uncertainty.

Growth Driven by Spot Trading

The growth in turnover was driven primarily by increased spot trading, while FX swaps saw a decrease in share. FX spot trading made up 29% of total turnover in October, an improvement from 27% in April.

Meanwhile, FX swaps accounted for 46% of turnover, dropping from 49% in April. This indicates a shift toward more short-term trading activity. Turnover in other instruments, such as forwards and options, remained steady.

The October 2023 figures show the continuation of a long-term growth trend in UK FX market turnover. Total turnover has elevated 73% from $1.697 trillion in October 2008. Recent turnover growth aligns with greater currency price volatility driven by events like Russia's invasion of Ukraine, rising interest rates, and inflationary pressures. The full impact of these events on trading activity is still developing.

The FXJSC semi-annual turnover survey has been conducted since 1973. It provides a snapshot of activity in the UK wholesale FX market based on volumes reported by participating financial institutions. The October 2023 survey included data from 27 institutions, comprising banks, brokers, infrastructure providers, and public authorities.