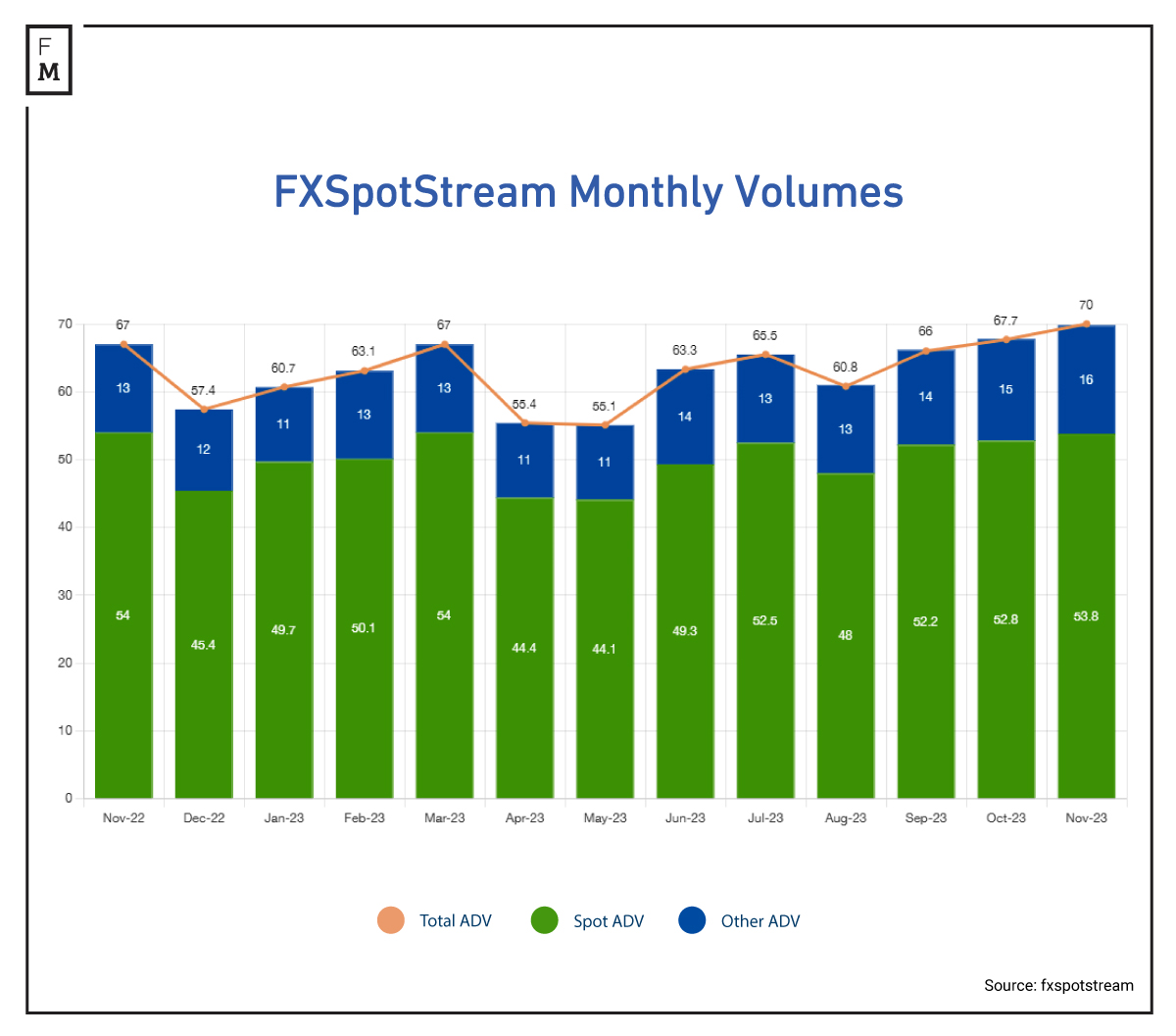

FXSportStream, a provider of FX electronic liquidity distribution, marked the year 2023 with resilient trading performance. Throughout the year, the company demonstrated stability and consistent growth in its Average Daily Volume (ADV), showcasing its ability to navigate through market conditions.

FXSportStream's 2023 Trading Highlights

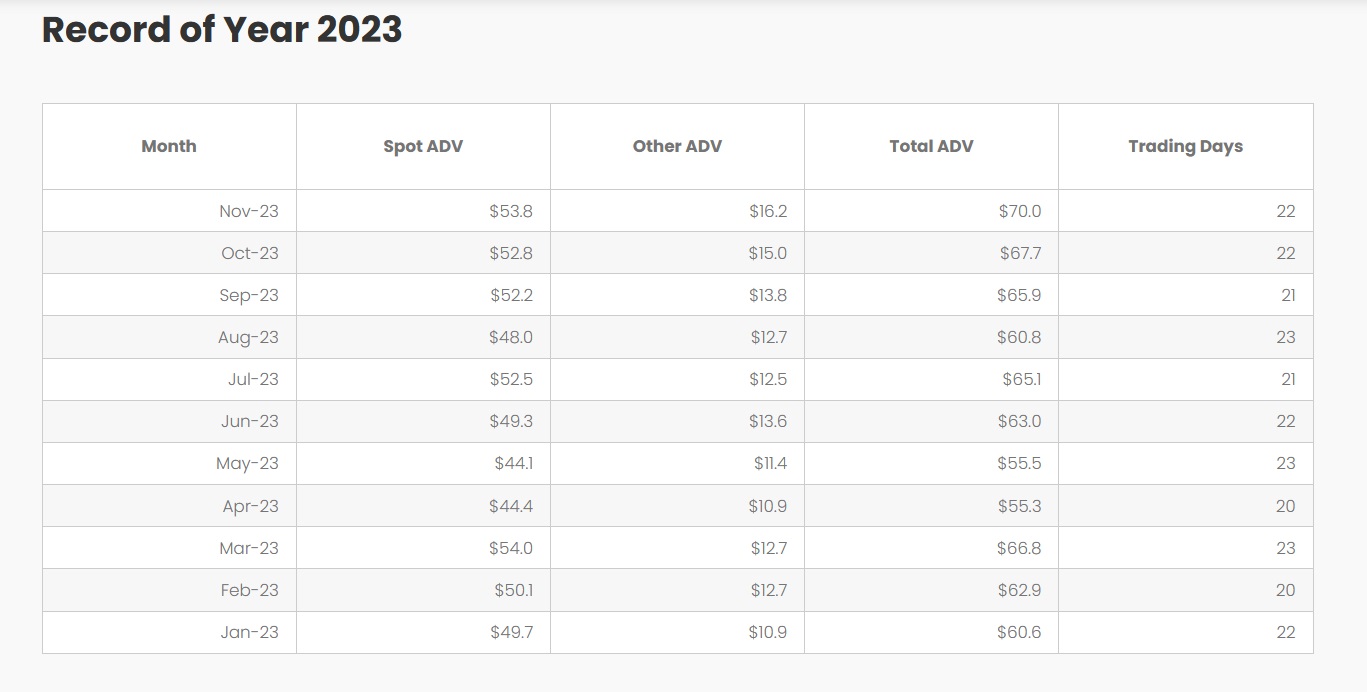

November 2023 witnessed a notable increase in both Spot and Other ADV compared to the previous month, with a Total ADV peaking at $70 billion over 22 trading days. October maintained a sturdy trading performance, with a Total ADV of $67.7 billion. September reflected steady performance, with a Total ADV of $65.9 billion over 21 trading days.

Despite a slight dip in trading activities in August, FXSportStream maintained a solid Total ADV of $60.8 billion over 23 trading days. July marked a rebound in trading, with a surge in both Spot and Other ADV, resulting in a Total ADV of $65.1 billion over 21 trading days.

Throughout the year, FXSportStream demonstrated consistency in its trading performance, with Total ADV consistently ranging between $55.3 billion and $70 billion. The company adeptly navigated through market dynamics, adjusting trading activities based on factors such as economic indicators, geopolitical events, and global market trends.

The variation in trading days across months did not significantly impact overall performance, indicating the utilization of available market opportunities. FXSportStream's trading performance in 2023 showcases an adaptable approach to the financial landscape.

FXSpotStream Integrates FairXchange's Horizon

In an earlier report, Finance Magnates wrote that FXSpotStream had announced the integration of FairXchange's data analytics platform, Horizon. This integration has enhanced real-time analytics for more precise trading execution and analysis. The liquidity management team at FXSpotStream can leverage Horizon to optimize relationships with both price-takers and liquidity-providing banks.

Clients of FXSpotStream gain insights into their execution, optimizing trading and strengthening relationships with liquidity providers. Established in 2011, FXSpotStream is a bank-owned consortium offering services in the institutional spot forex and derivatives markets.

The recent integration followed its expansion into FX Algos and allocations over its API. Antony Brocksom, Head of Sales at FXSpotStream highlighted the value of Horizon in enabling informed decision-making for clients. FairXchange, a United Fintech Portfolio Company, provides microstructural analysis tools for transparent execution performance in the forex market. The collaboration aims to combine FXSpotStream's aggregation services with FairXchange's Horizon platform.